Stifel Financial (NYSE:SF - Get Free Report) was downgraded by Wall Street Zen from a "hold" rating to a "sell" rating in a note issued to investors on Saturday.

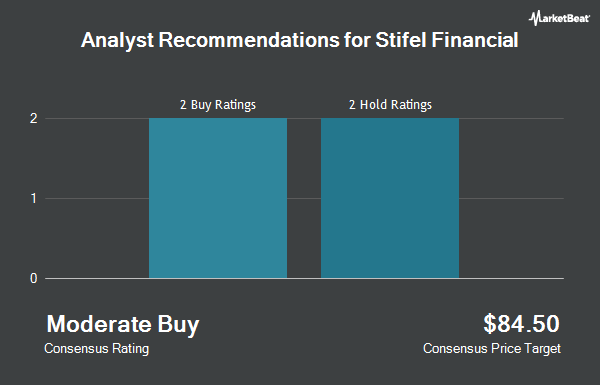

A number of other equities analysts have also weighed in on the company. Citigroup decreased their price target on Stifel Financial from $125.00 to $105.00 and set a "neutral" rating for the company in a research report on Wednesday, April 2nd. Wolfe Research upgraded Stifel Financial from a "peer perform" rating to an "outperform" rating and set a $108.00 price target for the company in a research report on Thursday, April 24th. JMP Securities decreased their price target on Stifel Financial from $135.00 to $120.00 and set a "market outperform" rating for the company in a research report on Tuesday, April 8th. Wells Fargo & Company decreased their price target on Stifel Financial from $106.00 to $102.00 and set an "overweight" rating for the company in a research report on Thursday, April 24th. Finally, JPMorgan Chase & Co. decreased their price target on Stifel Financial from $123.00 to $100.00 and set a "neutral" rating for the company in a research report on Friday, April 11th. One equities research analyst has rated the stock with a sell rating, five have issued a hold rating and three have given a buy rating to the stock. According to MarketBeat.com, Stifel Financial presently has a consensus rating of "Hold" and a consensus price target of $105.50.

View Our Latest Stock Report on Stifel Financial

Stifel Financial Price Performance

NYSE:SF traded up $1.85 during mid-day trading on Friday, reaching $109.20. 466,965 shares of the stock were exchanged, compared to its average volume of 685,576. The business has a fifty day moving average price of $96.22 and a 200 day moving average price of $99.45. The firm has a market capitalization of $11.22 billion, a PE ratio of 20.88 and a beta of 1.09. Stifel Financial has a 1-year low of $73.27 and a 1-year high of $120.64. The company has a current ratio of 0.81, a quick ratio of 0.77 and a debt-to-equity ratio of 0.28.

Stifel Financial (NYSE:SF - Get Free Report) last released its earnings results on Wednesday, April 23rd. The financial services provider reported $0.49 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $1.64 by ($1.15). The firm had revenue of $1.26 billion for the quarter, compared to analyst estimates of $1.32 billion. Stifel Financial had a return on equity of 13.88% and a net margin of 12.26%. Stifel Financial's revenue was up 7.9% on a year-over-year basis. During the same period in the previous year, the firm earned $1.49 earnings per share. Research analysts expect that Stifel Financial will post 8.26 earnings per share for the current fiscal year.

Insider Buying and Selling

In other Stifel Financial news, Director Michael J. Zimmerman sold 10,000 shares of the firm's stock in a transaction dated Friday, June 6th. The stock was sold at an average price of $96.69, for a total transaction of $966,900.00. Following the completion of the sale, the director directly owned 45,833 shares in the company, valued at approximately $4,431,592.77. This trade represents a 17.91% decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available through this hyperlink. Insiders own 3.28% of the company's stock.

Institutional Investors Weigh In On Stifel Financial

Institutional investors have recently bought and sold shares of the business. GAMMA Investing LLC boosted its position in Stifel Financial by 401.0% during the 1st quarter. GAMMA Investing LLC now owns 4,509 shares of the financial services provider's stock worth $425,000 after acquiring an additional 3,609 shares during the period. TT International Asset Management LTD lifted its holdings in shares of Stifel Financial by 46.5% during the 1st quarter. TT International Asset Management LTD now owns 38,126 shares of the financial services provider's stock valued at $3,594,000 after buying an additional 12,108 shares during the last quarter. Sowell Financial Services LLC acquired a new stake in shares of Stifel Financial during the 1st quarter valued at about $312,000. Wealth Enhancement Advisory Services LLC lifted its holdings in shares of Stifel Financial by 263.2% during the 1st quarter. Wealth Enhancement Advisory Services LLC now owns 19,711 shares of the financial services provider's stock valued at $1,858,000 after buying an additional 14,284 shares during the last quarter. Finally, Asset Management One Co. Ltd. acquired a new stake in shares of Stifel Financial during the 1st quarter valued at about $1,165,000. 82.01% of the stock is currently owned by institutional investors and hedge funds.

Stifel Financial Company Profile

(

Get Free Report)

Stifel Financial Corp., a financial services and bank holding company, provides retail and institutional wealth management, and investment banking services to individual investors, corporations, municipalities, and institutions in the United States and internationally. It operates in three segments: Global Wealth Management, Institutional Group, and Other.

Further Reading

Before you consider Stifel Financial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Stifel Financial wasn't on the list.

While Stifel Financial currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.