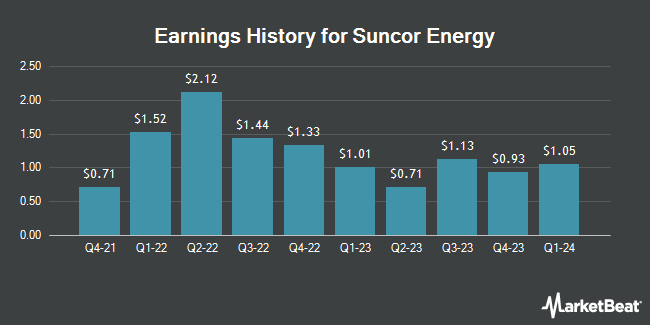

Suncor Energy (NYSE:SU - Get Free Report) TSE: SU is projected to post its Q1 2025 quarterly earnings results after the market closes on Tuesday, May 6th. Analysts expect the company to announce earnings of $0.95 per share and revenue of $13.39 billion for the quarter.

Suncor Energy (NYSE:SU - Get Free Report) TSE: SU last released its quarterly earnings results on Wednesday, February 5th. The oil and gas producer reported $0.89 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.82 by $0.07. Suncor Energy had a return on equity of 15.37% and a net margin of 11.80%. On average, analysts expect Suncor Energy to post $3 EPS for the current fiscal year and $4 EPS for the next fiscal year.

Suncor Energy Stock Performance

Shares of SU traded up $0.33 during trading hours on Friday, hitting $36.03. The stock had a trading volume of 4,664,783 shares, compared to its average volume of 4,490,169. Suncor Energy has a 12 month low of $30.79 and a 12 month high of $41.95. The stock has a fifty day moving average price of $35.85 and a 200 day moving average price of $37.56. The company has a debt-to-equity ratio of 0.21, a current ratio of 1.33 and a quick ratio of 0.86. The firm has a market capitalization of $44.43 billion, a PE ratio of 10.44, a PEG ratio of 2.94 and a beta of 0.79.

Suncor Energy Cuts Dividend

The company also recently declared a quarterly dividend, which was paid on Tuesday, March 25th. Shareholders of record on Tuesday, March 4th were paid a dividend of $0.399 per share. The ex-dividend date was Tuesday, March 4th. This represents a $1.60 dividend on an annualized basis and a dividend yield of 4.43%. Suncor Energy's dividend payout ratio is currently 45.51%.

Analyst Ratings Changes

Several brokerages recently issued reports on SU. Cibc World Mkts upgraded shares of Suncor Energy from a "hold" rating to a "strong-buy" rating in a research report on Tuesday, February 11th. Bank of America initiated coverage on shares of Suncor Energy in a research report on Wednesday, February 26th. They set a "neutral" rating for the company. StockNews.com cut Suncor Energy from a "buy" rating to a "hold" rating in a report on Thursday, April 17th. Royal Bank of Canada reissued an "outperform" rating and set a $66.00 price target on shares of Suncor Energy in a report on Tuesday, January 7th. Finally, Tudor, Pickering, Holt & Co. raised Suncor Energy from a "hold" rating to a "buy" rating in a research note on Monday, February 10th. Five investment analysts have rated the stock with a hold rating, seven have assigned a buy rating and two have given a strong buy rating to the company's stock. According to MarketBeat, the stock has a consensus rating of "Moderate Buy" and an average target price of $59.20.

Get Our Latest Research Report on Suncor Energy

Suncor Energy Company Profile

(

Get Free Report)

Suncor Energy Inc operates as an integrated energy company in Canada, the United States, and internationally. It operates through Oil Sands; Exploration and Production; and Refining and Marketing segments. The Oil Sands segment explores, develops, and produces bitumen, synthetic crude oil, and related products.

Further Reading

Before you consider Suncor Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Suncor Energy wasn't on the list.

While Suncor Energy currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.