Susquehanna Fundamental Investments LLC acquired a new stake in shares of Avista Co. (NYSE:AVA - Free Report) in the fourth quarter, according to the company in its most recent 13F filing with the SEC. The fund acquired 56,403 shares of the utilities provider's stock, valued at approximately $2,066,000. Susquehanna Fundamental Investments LLC owned 0.07% of Avista as of its most recent SEC filing.

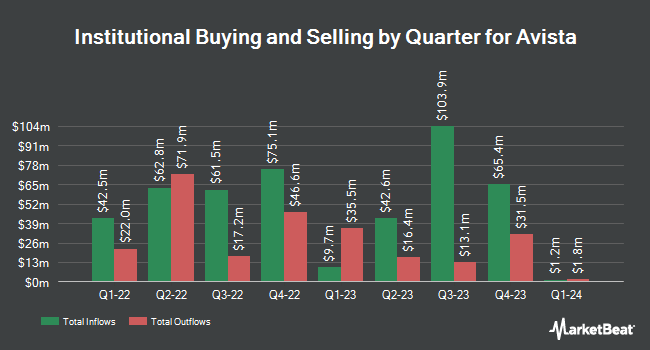

Other hedge funds and other institutional investors have also bought and sold shares of the company. Vanguard Group Inc. grew its holdings in Avista by 3.3% during the fourth quarter. Vanguard Group Inc. now owns 10,260,857 shares of the utilities provider's stock worth $375,855,000 after acquiring an additional 327,535 shares during the period. Invesco Ltd. grew its stake in Avista by 27.2% during the 4th quarter. Invesco Ltd. now owns 1,283,532 shares of the utilities provider's stock valued at $47,016,000 after acquiring an additional 274,270 shares in the last quarter. Charles Schwab Investment Management Inc. boosted its holdings in shares of Avista by 2.0% during the 4th quarter. Charles Schwab Investment Management Inc. now owns 1,253,280 shares of the utilities provider's stock worth $45,908,000 after purchasing an additional 24,981 shares during the last quarter. Bank of New York Mellon Corp lifted its position in Avista by 16.6% during the fourth quarter. Bank of New York Mellon Corp now owns 1,184,838 shares of the utilities provider's stock worth $43,401,000 after buying an additional 168,648 shares in the last quarter. Finally, Prudential Financial Inc. grew its holdings in shares of Avista by 10.2% in the fourth quarter. Prudential Financial Inc. now owns 1,019,177 shares of the utilities provider's stock valued at $37,332,000 after purchasing an additional 94,460 shares during the period. Hedge funds and other institutional investors own 85.24% of the company's stock.

Insider Buying and Selling

In other news, VP Scott J. Kinney sold 2,298 shares of the stock in a transaction dated Thursday, March 6th. The shares were sold at an average price of $38.75, for a total value of $89,047.50. Following the completion of the transaction, the vice president now owns 12,539 shares in the company, valued at $485,886.25. This trade represents a 15.49 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is available through this hyperlink. 0.96% of the stock is currently owned by corporate insiders.

Wall Street Analysts Forecast Growth

Separately, Jefferies Financial Group lowered their price target on Avista from $40.00 to $39.00 and set a "hold" rating for the company in a report on Tuesday, January 28th.

Check Out Our Latest Stock Analysis on AVA

Avista Stock Performance

Shares of AVA stock traded down $0.00 during mid-day trading on Tuesday, hitting $41.95. 66,305 shares of the stock were exchanged, compared to its average volume of 573,771. The stock has a market capitalization of $3.37 billion, a price-to-earnings ratio of 16.73, a P/E/G ratio of 2.56 and a beta of 0.42. Avista Co. has a 12-month low of $33.45 and a 12-month high of $43.09. The stock's fifty day simple moving average is $40.54 and its two-hundred day simple moving average is $38.36. The company has a debt-to-equity ratio of 1.05, a quick ratio of 0.48 and a current ratio of 0.75.

Avista (NYSE:AVA - Get Free Report) last announced its earnings results on Wednesday, February 26th. The utilities provider reported $0.84 earnings per share for the quarter, missing the consensus estimate of $0.86 by ($0.02). The company had revenue of $517.00 million during the quarter, compared to analysts' expectations of $487.48 million. Avista had a net margin of 10.24% and a return on equity of 7.83%. On average, analysts forecast that Avista Co. will post 2.3 EPS for the current year.

Avista Announces Dividend

The firm also recently declared a quarterly dividend, which will be paid on Friday, June 13th. Investors of record on Tuesday, May 13th will be paid a $0.49 dividend. The ex-dividend date is Tuesday, May 13th. This represents a $1.96 dividend on an annualized basis and a dividend yield of 4.67%. Avista's dividend payout ratio (DPR) is presently 86.34%.

Avista Company Profile

(

Free Report)

Avista Corporation, together with its subsidiaries, operates as an electric and natural gas utility company. It operates in two segments, Avista Utilities and AEL&P. The Avista Utilities segment provides electric distribution and transmission, and natural gas distribution services in parts of eastern Washington and northern Idaho; and natural gas distribution services in parts of northeastern and southwestern Oregon, as well as generates electricity in Washington, Idaho, Oregon, and Montana.

Read More

Before you consider Avista, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Avista wasn't on the list.

While Avista currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.