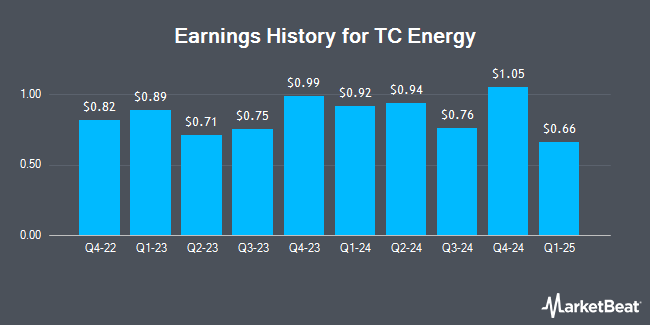

TC Energy (NYSE:TRP - Get Free Report) TSE: TRP announced its quarterly earnings data on Thursday. The pipeline company reported $0.66 earnings per share for the quarter, missing analysts' consensus estimates of $0.70 by ($0.04), Zacks reports. TC Energy had a net margin of 29.40% and a return on equity of 12.12%. The business had revenue of $1.78 billion during the quarter, compared to analyst estimates of $2.57 billion. During the same quarter last year, the firm posted $1.02 EPS.

TC Energy Stock Up 1.9 %

Shares of NYSE:TRP traded up $0.94 during trading on Friday, hitting $50.95. 2,091,960 shares of the company were exchanged, compared to its average volume of 2,552,287. The firm's 50 day moving average price is $47.57 and its 200-day moving average price is $47.30. TC Energy has a 12-month low of $37.05 and a 12-month high of $51.25. The company has a debt-to-equity ratio of 1.56, a current ratio of 0.55 and a quick ratio of 1.23. The stock has a market capitalization of $52.97 billion, a P/E ratio of 15.73, a PEG ratio of 4.34 and a beta of 0.74.

TC Energy Cuts Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Thursday, July 31st. Shareholders of record on Monday, June 30th will be issued a dividend of $0.6142 per share. The ex-dividend date is Monday, June 30th. This represents a $2.46 dividend on an annualized basis and a yield of 4.82%. TC Energy's payout ratio is currently 72.84%.

Analyst Ratings Changes

TRP has been the subject of several research reports. Veritas upgraded shares of TC Energy from a "strong sell" rating to a "strong-buy" rating in a research note on Tuesday, February 18th. CIBC raised TC Energy from a "neutral" rating to a "sector outperform" rating in a research note on Friday. TD Securities initiated coverage on TC Energy in a research report on Wednesday, January 15th. They issued a "buy" rating on the stock. US Capital Advisors upgraded TC Energy from a "hold" rating to a "moderate buy" rating in a research note on Monday, February 3rd. Finally, StockNews.com lowered shares of TC Energy from a "buy" rating to a "hold" rating in a research note on Thursday, March 6th. One research analyst has rated the stock with a sell rating, three have given a hold rating, seven have issued a buy rating and two have issued a strong buy rating to the company's stock. Based on data from MarketBeat, TC Energy currently has an average rating of "Moderate Buy" and an average target price of $62.00.

Check Out Our Latest Report on TC Energy

About TC Energy

(

Get Free Report)

TC Energy Corporation operates as an energy infrastructure company in North America. It operates through five segments: Canadian Natural Gas Pipelines; U.S. Natural Gas Pipelines; Mexico Natural Gas Pipelines; Liquids Pipelines; and Power and Energy Solutions. The company builds and operates a network of 93,600 kilometers of natural gas pipelines, which transports natural gas from supply basins to local distribution companies, power generation plants, industrial facilities, interconnecting pipelines, LNG export terminals, and other businesses.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider TC Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TC Energy wasn't on the list.

While TC Energy currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.