TD Waterhouse Canada Inc. raised its holdings in Enovis Co. (NYSE:ENOV - Free Report) by 8,111.2% during the 4th quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The firm owned 33,009 shares of the company's stock after purchasing an additional 32,607 shares during the period. TD Waterhouse Canada Inc. owned about 0.06% of Enovis worth $1,446,000 at the end of the most recent quarter.

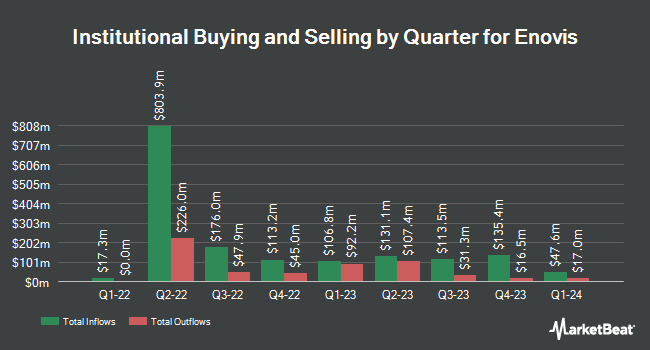

A number of other institutional investors and hedge funds have also made changes to their positions in ENOV. Barclays PLC raised its stake in Enovis by 16.1% in the 3rd quarter. Barclays PLC now owns 368,488 shares of the company's stock valued at $15,864,000 after purchasing an additional 51,151 shares during the last quarter. Retirement Systems of Alabama increased its stake in Enovis by 10.1% during the third quarter. Retirement Systems of Alabama now owns 67,846 shares of the company's stock worth $2,921,000 after acquiring an additional 6,239 shares during the last quarter. Confluence Investment Management LLC purchased a new stake in Enovis in the 4th quarter valued at about $3,494,000. Fiduciary Financial Group LLC purchased a new stake in shares of Enovis in the 4th quarter valued at approximately $268,000. Finally, Oak Thistle LLC acquired a new position in shares of Enovis in the 4th quarter worth approximately $324,000. 98.45% of the stock is currently owned by hedge funds and other institutional investors.

Enovis Stock Down 2.0 %

NYSE:ENOV traded down $0.70 during midday trading on Wednesday, reaching $34.21. The company had a trading volume of 102,461 shares, compared to its average volume of 752,363. The stock's fifty day simple moving average is $36.32 and its 200-day simple moving average is $41.96. The company has a current ratio of 2.27, a quick ratio of 1.12 and a debt-to-equity ratio of 0.40. Enovis Co. has a 12-month low of $29.32 and a 12-month high of $56.43. The firm has a market capitalization of $1.95 billion, a price-to-earnings ratio of -15.59 and a beta of 1.86.

Enovis (NYSE:ENOV - Get Free Report) last released its earnings results on Wednesday, February 26th. The company reported $0.98 earnings per share for the quarter, topping analysts' consensus estimates of $0.92 by $0.06. Enovis had a negative net margin of 5.95% and a positive return on equity of 4.39%. The firm had revenue of $560.98 million for the quarter, compared to analyst estimates of $555.14 million. On average, sell-side analysts anticipate that Enovis Co. will post 2.79 earnings per share for the current fiscal year.

Analyst Upgrades and Downgrades

Separately, Needham & Company LLC reissued a "buy" rating and issued a $64.00 target price on shares of Enovis in a research report on Wednesday, April 9th.

Get Our Latest Research Report on Enovis

Enovis Profile

(

Free Report)

Enovis Corporation operates as a medical technology company focus on developing clinically differentiated solutions worldwide. It also manufactures and distributes medical devices which are used for reconstructive surgery, rehabilitation, pain management, and physical therapy. The company operates through Prevention and Recovery, and Reconstructive segments.

Featured Stories

Before you consider Enovis, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Enovis wasn't on the list.

While Enovis currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.