Ovata Capital Management Ltd increased its holdings in shares of TETRA Technologies, Inc. (NYSE:TTI - Free Report) by 33.3% during the fourth quarter, according to the company in its most recent Form 13F filing with the SEC. The firm owned 1,000,000 shares of the oil and gas company's stock after acquiring an additional 250,000 shares during the quarter. TETRA Technologies comprises about 1.4% of Ovata Capital Management Ltd's investment portfolio, making the stock its 19th largest holding. Ovata Capital Management Ltd owned approximately 0.76% of TETRA Technologies worth $3,580,000 at the end of the most recent quarter.

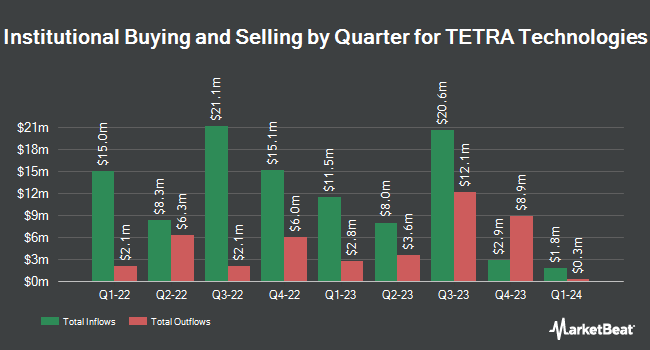

A number of other institutional investors have also recently bought and sold shares of the business. Townsquare Capital LLC bought a new stake in shares of TETRA Technologies in the third quarter valued at approximately $36,000. KLCM Advisors Inc. bought a new stake in shares of TETRA Technologies during the 4th quarter valued at $36,000. HighTower Advisors LLC bought a new stake in TETRA Technologies during the fourth quarter worth about $39,000. Cibc World Markets Corp bought a new stake in shares of TETRA Technologies during the 4th quarter worth approximately $42,000. Finally, M&T Bank Corp acquired a new stake in shares of TETRA Technologies in the 4th quarter valued at $53,000. Institutional investors own 70.19% of the company's stock.

Analyst Ratings Changes

Separately, D. Boral Capital restated a "buy" rating and set a $5.50 price target on shares of TETRA Technologies in a report on Wednesday, March 26th.

View Our Latest Stock Analysis on TETRA Technologies

TETRA Technologies Trading Down 2.4 %

TTI stock traded down $0.06 during mid-day trading on Thursday, reaching $2.29. The company's stock had a trading volume of 778,540 shares, compared to its average volume of 1,196,892. The business's 50 day moving average price is $3.62 and its 200 day moving average price is $3.68. The company has a market cap of $302.52 million, a price-to-earnings ratio of 112.81 and a beta of 1.54. The company has a current ratio of 2.33, a quick ratio of 1.51 and a debt-to-equity ratio of 1.16. TETRA Technologies, Inc. has a 12 month low of $2.03 and a 12 month high of $5.12.

TETRA Technologies (NYSE:TTI - Get Free Report) last released its quarterly earnings data on Tuesday, February 25th. The oil and gas company reported $0.03 earnings per share (EPS) for the quarter, hitting analysts' consensus estimates of $0.03. TETRA Technologies had a net margin of 0.27% and a return on equity of 14.53%. The company had revenue of $134.50 million for the quarter, compared to analysts' expectations of $138.96 million. On average, equities research analysts predict that TETRA Technologies, Inc. will post 0.15 EPS for the current year.

TETRA Technologies Company Profile

(

Free Report)

TETRA Technologies, Inc, together with its subsidiaries, operates as an energy services and solutions company. It operates through two segments, Completion Fluids & Products Division and Water & Flowback Services. The Completion Fluids & Products segment manufactures and markets clear brine fluids, additives, and associated products and services to the oil and gas industry for use in well drilling, completion, and workover operations in the United States, as well as in Latin America, Europe, Asia, the Middle East, and Africa.

Featured Articles

Before you consider TETRA Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TETRA Technologies wasn't on the list.

While TETRA Technologies currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.