Tribune Investment Group LP purchased a new position in shares of TC Energy Co. (NYSE:TRP - Free Report) TSE: TRP during the fourth quarter, according to its most recent 13F filing with the SEC. The institutional investor purchased 92,000 shares of the pipeline company's stock, valued at approximately $4,281,000. TC Energy comprises approximately 2.4% of Tribune Investment Group LP's portfolio, making the stock its 20th largest position.

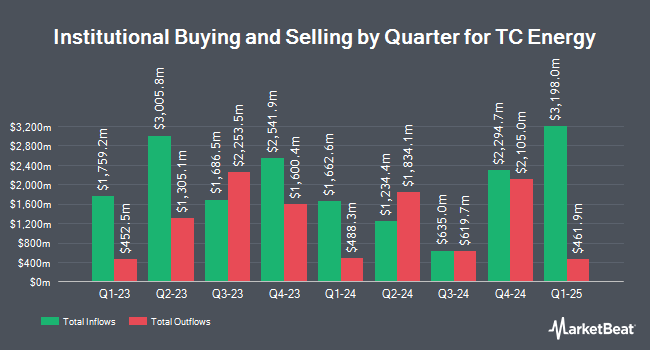

A number of other hedge funds and other institutional investors have also recently bought and sold shares of TRP. SBI Securities Co. Ltd. acquired a new stake in shares of TC Energy in the fourth quarter valued at $31,000. Versant Capital Management Inc bought a new stake in TC Energy during the 4th quarter worth about $33,000. Synergy Investment Management LLC acquired a new stake in TC Energy in the 4th quarter valued at about $36,000. Millstone Evans Group LLC bought a new position in shares of TC Energy in the fourth quarter worth about $41,000. Finally, First Command Advisory Services Inc. acquired a new position in shares of TC Energy during the fourth quarter worth approximately $46,000. 83.13% of the stock is owned by institutional investors and hedge funds.

TC Energy Trading Up 1.1 %

NYSE:TRP traded up $0.54 on Friday, reaching $49.44. The company's stock had a trading volume of 3,376,859 shares, compared to its average volume of 2,611,607. TC Energy Co. has a 1-year low of $35.30 and a 1-year high of $50.37. The company has a debt-to-equity ratio of 1.56, a quick ratio of 1.23 and a current ratio of 0.55. The firm has a market cap of $51.39 billion, a PE ratio of 15.26, a PEG ratio of 4.34 and a beta of 0.74. The business's 50-day moving average price is $46.78 and its two-hundred day moving average price is $46.99.

TC Energy (NYSE:TRP - Get Free Report) TSE: TRP last issued its quarterly earnings results on Friday, February 14th. The pipeline company reported $1.05 EPS for the quarter, beating analysts' consensus estimates of $0.51 by $0.54. TC Energy had a return on equity of 12.12% and a net margin of 29.40%. The company had revenue of $2.56 billion for the quarter, compared to analyst estimates of $2.42 billion. During the same period in the previous year, the company posted $1.35 earnings per share. Equities research analysts anticipate that TC Energy Co. will post 2.63 earnings per share for the current fiscal year.

TC Energy Increases Dividend

The firm also recently declared a quarterly dividend, which will be paid on Wednesday, April 30th. Shareholders of record on Monday, March 31st will be paid a $0.85 dividend. This is a positive change from TC Energy's previous quarterly dividend of $0.82. This represents a $3.40 annualized dividend and a yield of 6.88%. The ex-dividend date is Monday, March 31st. TC Energy's payout ratio is presently 72.84%.

Wall Street Analysts Forecast Growth

Several research firms recently weighed in on TRP. US Capital Advisors upgraded shares of TC Energy from a "hold" rating to a "moderate buy" rating in a research report on Monday, February 3rd. TD Securities began coverage on TC Energy in a research note on Wednesday, January 15th. They set a "buy" rating on the stock. Royal Bank of Canada lifted their price objective on TC Energy from $71.00 to $74.00 and gave the stock an "outperform" rating in a research report on Tuesday, February 18th. Veritas upgraded shares of TC Energy from a "strong sell" rating to a "strong-buy" rating in a research report on Tuesday, February 18th. Finally, Citigroup assumed coverage on shares of TC Energy in a report on Friday, April 4th. They set a "neutral" rating for the company. One research analyst has rated the stock with a sell rating, three have issued a hold rating, six have issued a buy rating and one has issued a strong buy rating to the company. According to data from MarketBeat.com, the stock currently has an average rating of "Moderate Buy" and a consensus target price of $62.00.

Get Our Latest Report on TC Energy

TC Energy Company Profile

(

Free Report)

TC Energy Corporation operates as an energy infrastructure company in North America. It operates through five segments: Canadian Natural Gas Pipelines; U.S. Natural Gas Pipelines; Mexico Natural Gas Pipelines; Liquids Pipelines; and Power and Energy Solutions. The company builds and operates a network of 93,600 kilometers of natural gas pipelines, which transports natural gas from supply basins to local distribution companies, power generation plants, industrial facilities, interconnecting pipelines, LNG export terminals, and other businesses.

Featured Articles

Before you consider TC Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TC Energy wasn't on the list.

While TC Energy currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Like this article? Share it with a colleague.

Link copied to clipboard.