FirstEnergy (NYSE:FE - Get Free Report) received a $44.00 price target from research analysts at UBS Group in a research report issued to clients and investors on Tuesday, MarketBeat.com reports. The firm presently has a "neutral" rating on the utilities provider's stock. UBS Group's price objective suggests a potential upside of 10.57% from the company's previous close.

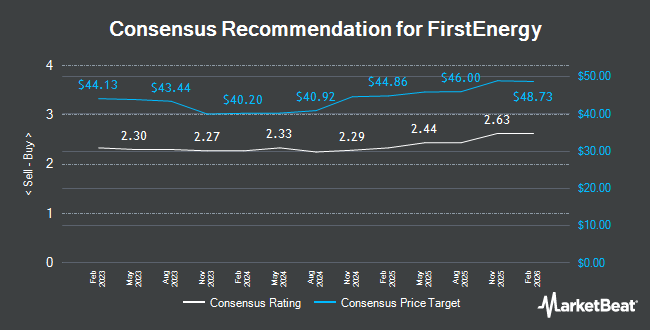

Several other brokerages have also recently issued reports on FE. Wells Fargo & Company boosted their price target on FirstEnergy from $41.00 to $44.00 and gave the company an "equal weight" rating in a research note on Friday, April 25th. Scotiabank reissued an "outperform" rating on shares of FirstEnergy in a report on Friday, April 25th. Mizuho set a $43.00 price objective on shares of FirstEnergy in a research note on Monday, April 28th. Evercore ISI lifted their price target on FirstEnergy from $41.00 to $47.00 and gave the company an "outperform" rating in a research note on Monday, April 28th. Finally, Guggenheim lifted their target price on FirstEnergy from $45.00 to $47.00 and gave the company a "buy" rating in a research report on Monday, April 7th. Eight equities research analysts have rated the stock with a hold rating and six have assigned a buy rating to the company's stock. Based on data from MarketBeat.com, the stock has a consensus rating of "Hold" and an average target price of $46.00.

Check Out Our Latest Stock Report on FirstEnergy

FirstEnergy Stock Performance

NYSE:FE traded down $0.14 during mid-day trading on Tuesday, hitting $39.80. 2,598,229 shares of the stock were exchanged, compared to its average volume of 3,926,467. The firm's 50-day simple moving average is $41.56 and its 200 day simple moving average is $40.45. The stock has a market capitalization of $22.97 billion, a price-to-earnings ratio of 21.16, a price-to-earnings-growth ratio of 2.45 and a beta of 0.40. FirstEnergy has a fifty-two week low of $37.58 and a fifty-two week high of $44.97. The company has a debt-to-equity ratio of 1.53, a quick ratio of 0.34 and a current ratio of 0.42.

FirstEnergy (NYSE:FE - Get Free Report) last posted its earnings results on Wednesday, April 23rd. The utilities provider reported $0.67 earnings per share for the quarter, topping analysts' consensus estimates of $0.60 by $0.07. FirstEnergy had a return on equity of 11.49% and a net margin of 7.78%. The company had revenue of $3.80 billion during the quarter, compared to the consensus estimate of $3.68 billion. During the same quarter last year, the firm earned $0.55 earnings per share. The company's revenue was up 14.5% on a year-over-year basis. As a group, equities analysts anticipate that FirstEnergy will post 2.66 EPS for the current fiscal year.

Insider Buying and Selling at FirstEnergy

In other news, CAO Jason Lisowski sold 12,000 shares of the stock in a transaction on Thursday, May 22nd. The stock was sold at an average price of $41.97, for a total transaction of $503,640.00. Following the completion of the transaction, the chief accounting officer now owns 183 shares in the company, valued at approximately $7,680.51. This represents a 98.50% decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. 0.17% of the stock is owned by corporate insiders.

Institutional Investors Weigh In On FirstEnergy

A number of hedge funds and other institutional investors have recently added to or reduced their stakes in the company. Covestor Ltd grew its stake in FirstEnergy by 69.3% in the 4th quarter. Covestor Ltd now owns 623 shares of the utilities provider's stock valued at $25,000 after buying an additional 255 shares in the last quarter. Lee Danner & Bass Inc. bought a new stake in FirstEnergy during the fourth quarter valued at approximately $26,000. N.E.W. Advisory Services LLC purchased a new stake in shares of FirstEnergy during the 1st quarter valued at $27,000. TruNorth Capital Management LLC lifted its holdings in shares of FirstEnergy by 226.9% during the 1st quarter. TruNorth Capital Management LLC now owns 706 shares of the utilities provider's stock worth $29,000 after acquiring an additional 490 shares during the last quarter. Finally, Bernard Wealth Management Corp. purchased a new position in FirstEnergy in the fourth quarter worth $31,000. 89.41% of the stock is currently owned by institutional investors.

About FirstEnergy

(

Get Free Report)

FirstEnergy Corp., through its subsidiaries, generates, transmits, and distributes electricity in the United States. It operates through Regulated Distribution and Regulated Transmission segments. The company owns and operates coal-fired, nuclear, hydroelectric, wind, and solar power generating facilities.

Featured Stories

Before you consider FirstEnergy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and FirstEnergy wasn't on the list.

While FirstEnergy currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.