OMERS ADMINISTRATION Corp lowered its stake in shares of UDR, Inc. (NYSE:UDR - Free Report) by 8.1% during the 4th quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 246,672 shares of the real estate investment trust's stock after selling 21,791 shares during the quarter. OMERS ADMINISTRATION Corp owned about 0.07% of UDR worth $10,708,000 as of its most recent SEC filing.

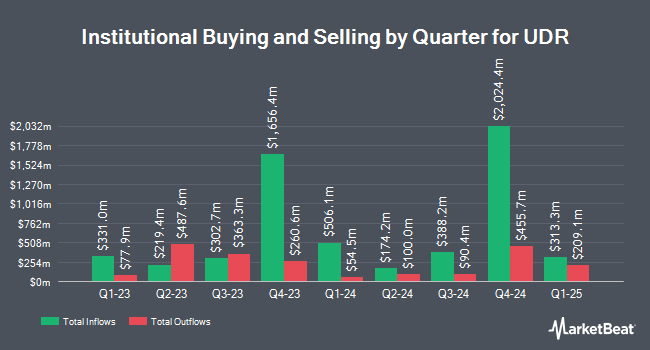

Other hedge funds have also recently modified their holdings of the company. JPMorgan Chase & Co. boosted its position in UDR by 5.0% in the third quarter. JPMorgan Chase & Co. now owns 7,774,541 shares of the real estate investment trust's stock valued at $352,498,000 after buying an additional 368,087 shares during the last quarter. Czech National Bank boosted its position in UDR by 6.5% in the fourth quarter. Czech National Bank now owns 65,104 shares of the real estate investment trust's stock valued at $2,826,000 after buying an additional 3,963 shares during the last quarter. Salem Investment Counselors Inc. boosted its position in UDR by 62.7% in the fourth quarter. Salem Investment Counselors Inc. now owns 1,349 shares of the real estate investment trust's stock valued at $59,000 after buying an additional 520 shares during the last quarter. Eastern Bank purchased a new stake in UDR in the fourth quarter valued at approximately $68,000. Finally, Oak Thistle LLC purchased a new stake in UDR in the fourth quarter valued at approximately $559,000. Institutional investors and hedge funds own 97.84% of the company's stock.

Insider Activity at UDR

In other UDR news, CEO Thomas W. Toomey sold 25,000 shares of the firm's stock in a transaction on Thursday, February 20th. The stock was sold at an average price of $42.75, for a total value of $1,068,750.00. Following the completion of the sale, the chief executive officer now directly owns 824,716 shares of the company's stock, valued at $35,256,609. This trade represents a 2.94% decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available through this hyperlink. 3.39% of the stock is owned by corporate insiders.

Analyst Upgrades and Downgrades

A number of equities research analysts recently commented on the company. Barclays upped their target price on UDR from $48.00 to $51.00 and gave the company an "overweight" rating in a research report on Friday, May 9th. StockNews.com upgraded UDR from a "sell" rating to a "hold" rating in a research report on Thursday, February 6th. Scotiabank upped their price objective on UDR from $48.00 to $49.00 and gave the stock a "sector perform" rating in a research report on Friday, February 14th. Zelman & Associates restated a "neutral" rating on shares of UDR in a research report on Thursday, February 13th. Finally, Royal Bank of Canada upped their price objective on UDR from $43.00 to $44.00 and gave the stock a "sector perform" rating in a research report on Thursday, May 8th. One research analyst has rated the stock with a sell rating, ten have issued a hold rating and seven have assigned a buy rating to the company. According to data from MarketBeat.com, the stock has a consensus rating of "Hold" and an average target price of $46.69.

Get Our Latest Analysis on UDR

UDR Price Performance

Shares of UDR stock traded up $0.53 during trading hours on Friday, hitting $42.43. 2,270,450 shares of the company's stock were exchanged, compared to its average volume of 2,142,845. The company has a quick ratio of 5.91, a current ratio of 5.61 and a debt-to-equity ratio of 1.71. The firm has a market cap of $14.06 billion, a P/E ratio of 169.72, a P/E/G ratio of 8.67 and a beta of 0.84. The firm has a 50 day moving average of $42.21 and a two-hundred day moving average of $42.93. UDR, Inc. has a fifty-two week low of $36.61 and a fifty-two week high of $47.55.

UDR (NYSE:UDR - Get Free Report) last posted its quarterly earnings data on Wednesday, April 30th. The real estate investment trust reported $0.61 EPS for the quarter, meeting the consensus estimate of $0.61. UDR had a return on equity of 2.65% and a net margin of 5.36%. The firm had revenue of $419.84 million during the quarter, compared to the consensus estimate of $421.23 million. During the same period in the prior year, the company earned $0.61 EPS. The firm's revenue was up 2.0% compared to the same quarter last year. Sell-side analysts forecast that UDR, Inc. will post 2.51 EPS for the current year.

UDR Increases Dividend

The company also recently disclosed a quarterly dividend, which was paid on Wednesday, April 30th. Investors of record on Thursday, April 10th were paid a $0.43 dividend. This is an increase from UDR's previous quarterly dividend of $0.43. This represents a $1.72 annualized dividend and a yield of 4.05%. The ex-dividend date was Thursday, April 10th. UDR's dividend payout ratio is currently 491.43%.

UDR Company Profile

(

Free Report)

UDR, Inc NYSE: UDR, an S&P 500 company, is a leading multifamily real estate investment trust with a demonstrated performance history of delivering superior and dependable returns by successfully managing, buying, selling, developing and redeveloping attractive real estate communities in targeted U.S.

See Also

Before you consider UDR, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and UDR wasn't on the list.

While UDR currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.