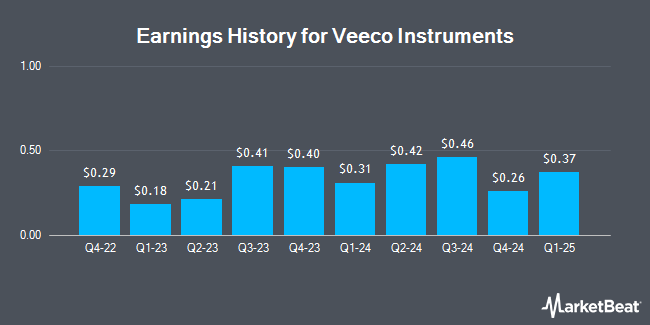

Veeco Instruments (NASDAQ:VECO - Get Free Report) is expected to be posting its Q1 2025 quarterly earnings results after the market closes on Wednesday, May 7th. Analysts expect the company to announce earnings of $0.32 per share and revenue of $166.00 million for the quarter. Veeco Instruments has set its Q1 2025 guidance at 0.260-0.360 EPS.

Veeco Instruments (NASDAQ:VECO - Get Free Report) last posted its earnings results on Wednesday, February 12th. The semiconductor company reported $0.26 EPS for the quarter, missing analysts' consensus estimates of $0.40 by ($0.14). Veeco Instruments had a net margin of 10.28% and a return on equity of 9.38%. On average, analysts expect Veeco Instruments to post $1 EPS for the current fiscal year and $1 EPS for the next fiscal year.

Veeco Instruments Price Performance

Veeco Instruments stock traded down $0.19 during mid-day trading on Monday, reaching $19.48. 173,023 shares of the company's stock traded hands, compared to its average volume of 733,541. Veeco Instruments has a 12-month low of $16.92 and a 12-month high of $49.25. The company has a quick ratio of 2.69, a current ratio of 3.98 and a debt-to-equity ratio of 0.32. The stock has a 50 day moving average of $20.00 and a two-hundred day moving average of $24.64. The company has a market cap of $1.13 billion, a price-to-earnings ratio of 15.74 and a beta of 1.13.

Insider Transactions at Veeco Instruments

In other Veeco Instruments news, CFO John P. Kiernan sold 2,500 shares of the business's stock in a transaction dated Monday, February 10th. The shares were sold at an average price of $24.51, for a total value of $61,275.00. Following the completion of the sale, the chief financial officer now directly owns 72,642 shares of the company's stock, valued at $1,780,455.42. The trade was a 3.33 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available at this hyperlink. Company insiders own 2.40% of the company's stock.

Wall Street Analysts Forecast Growth

Several research analysts recently commented on VECO shares. Oppenheimer reiterated an "outperform" rating and issued a $35.00 price target (down previously from $40.00) on shares of Veeco Instruments in a research report on Friday, February 7th. StockNews.com upgraded Veeco Instruments from a "sell" rating to a "hold" rating in a report on Friday, February 28th. Barclays lowered their price target on Veeco Instruments from $25.00 to $22.00 and set an "equal weight" rating for the company in a research report on Tuesday, April 22nd. Citigroup cut their price objective on shares of Veeco Instruments from $33.00 to $30.00 and set a "buy" rating on the stock in a research report on Thursday, February 13th. Finally, Needham & Company LLC reduced their target price on shares of Veeco Instruments from $35.00 to $29.00 and set a "buy" rating on the stock in a research note on Thursday, February 13th. Three equities research analysts have rated the stock with a hold rating and five have given a buy rating to the stock. According to data from MarketBeat, the company currently has an average rating of "Moderate Buy" and an average price target of $32.00.

Get Our Latest Stock Analysis on VECO

About Veeco Instruments

(

Get Free Report)

Veeco Instruments Inc, together with its subsidiaries, develops, manufactures, sells, and supports semiconductor and thin film process equipment primarily to make electronic devices in the United States, Europe, the Middle East, and Africa, China, Rest of the Asia-Pacific, and internationally. The company offers laser annealing, ion beam deposition and etch, metal organic chemical vapor deposition, single wafer wet processing and surface preparation, molecular beam epitaxy, advanced packaging lithography, atomic layer deposition, and other deposition systems.

Further Reading

Before you consider Veeco Instruments, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Veeco Instruments wasn't on the list.

While Veeco Instruments currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.