Deutsche Bank AG raised its position in Vera Therapeutics, Inc. (NASDAQ:VERA - Free Report) by 5.7% in the fourth quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The fund owned 810,376 shares of the company's stock after acquiring an additional 43,832 shares during the quarter. Deutsche Bank AG owned approximately 1.28% of Vera Therapeutics worth $34,271,000 at the end of the most recent reporting period.

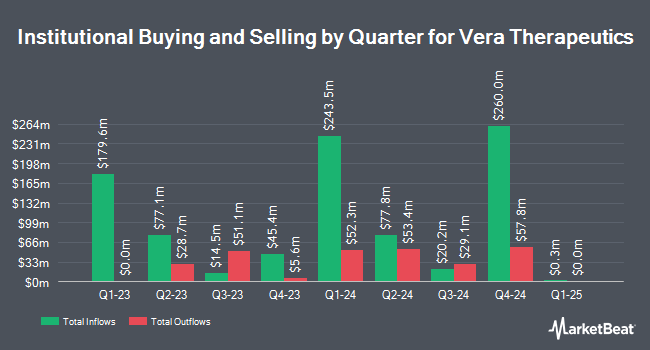

A number of other large investors have also recently added to or reduced their stakes in VERA. Avoro Capital Advisors LLC lifted its stake in Vera Therapeutics by 30.2% in the fourth quarter. Avoro Capital Advisors LLC now owns 5,610,000 shares of the company's stock valued at $237,247,000 after acquiring an additional 1,300,410 shares during the last quarter. Lord Abbett & CO. LLC lifted its stake in Vera Therapeutics by 170.8% in the fourth quarter. Lord Abbett & CO. LLC now owns 1,153,670 shares of the company's stock valued at $48,788,000 after acquiring an additional 727,656 shares during the last quarter. Federated Hermes Inc. lifted its stake in Vera Therapeutics by 162.2% in the fourth quarter. Federated Hermes Inc. now owns 1,085,986 shares of the company's stock valued at $45,926,000 after acquiring an additional 671,881 shares during the last quarter. Voya Investment Management LLC lifted its stake in Vera Therapeutics by 572.2% in the fourth quarter. Voya Investment Management LLC now owns 695,091 shares of the company's stock valued at $29,395,000 after acquiring an additional 591,682 shares during the last quarter. Finally, First Light Asset Management LLC lifted its stake in shares of Vera Therapeutics by 78.8% during the 4th quarter. First Light Asset Management LLC now owns 1,261,246 shares of the company's stock worth $53,338,000 after buying an additional 556,012 shares during the last quarter. Institutional investors and hedge funds own 99.21% of the company's stock.

Analyst Upgrades and Downgrades

A number of research firms have recently issued reports on VERA. Cantor Fitzgerald cut their target price on shares of Vera Therapeutics from $107.00 to $100.00 and set an "overweight" rating for the company in a research note on Wednesday, May 7th. Wedbush dropped their price objective on shares of Vera Therapeutics from $34.00 to $26.00 and set a "neutral" rating for the company in a research note on Wednesday, May 7th. The Goldman Sachs Group started coverage on shares of Vera Therapeutics in a research note on Tuesday, January 28th. They issued a "buy" rating and a $58.00 price objective for the company. Guggenheim lifted their price objective on shares of Vera Therapeutics from $59.00 to $61.00 and gave the stock a "buy" rating in a research note on Thursday, February 27th. Finally, Wolfe Research started coverage on shares of Vera Therapeutics in a research note on Tuesday, February 4th. They issued an "outperform" rating and a $49.00 price objective for the company. One investment analyst has rated the stock with a hold rating, seven have issued a buy rating and two have assigned a strong buy rating to the company. According to MarketBeat.com, the company presently has a consensus rating of "Buy" and an average price target of $63.33.

Read Our Latest Stock Analysis on Vera Therapeutics

Vera Therapeutics Price Performance

Vera Therapeutics stock traded down $0.08 during mid-day trading on Friday, reaching $21.25. The company had a trading volume of 955,320 shares, compared to its average volume of 780,251. The business has a fifty day simple moving average of $23.49 and a 200 day simple moving average of $34.01. The company has a market cap of $1.35 billion, a P/E ratio of -8.14 and a beta of 1.28. Vera Therapeutics, Inc. has a fifty-two week low of $18.53 and a fifty-two week high of $51.61. The company has a current ratio of 13.76, a quick ratio of 13.76 and a debt-to-equity ratio of 0.17.

Vera Therapeutics (NASDAQ:VERA - Get Free Report) last posted its earnings results on Thursday, May 8th. The company reported ($0.81) earnings per share for the quarter, missing analysts' consensus estimates of ($0.75) by ($0.06). During the same period in the previous year, the company earned ($0.56) EPS. On average, equities research analysts predict that Vera Therapeutics, Inc. will post -2.89 earnings per share for the current year.

About Vera Therapeutics

(

Free Report)

Vera Therapeutics, Inc, a clinical stage biotechnology company, focuses on developing and commercializing treatments for patients with serious immunological diseases. Its lead product candidate is atacicept, a fusion protein self-administered as a subcutaneous injection that is in Phase III clinical trial for patients with immunoglobulin A nephropathy; and for treatment of lupus nephritis that is in Phase II clinical trial.

Featured Articles

Before you consider Vera Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Vera Therapeutics wasn't on the list.

While Vera Therapeutics currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.