Rehmann Capital Advisory Group raised its stake in Visa Inc. (NYSE:V - Free Report) by 31.6% in the 4th quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The institutional investor owned 14,907 shares of the credit-card processor's stock after buying an additional 3,582 shares during the quarter. Rehmann Capital Advisory Group's holdings in Visa were worth $4,711,000 at the end of the most recent quarter.

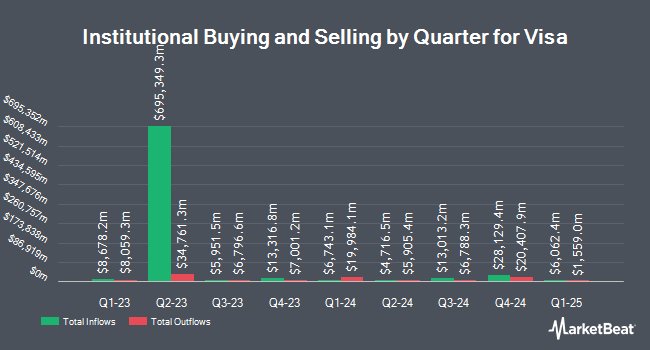

Other hedge funds and other institutional investors have also modified their holdings of the company. Howard Capital Management Group LLC grew its holdings in shares of Visa by 0.6% during the 3rd quarter. Howard Capital Management Group LLC now owns 106,355 shares of the credit-card processor's stock worth $29,242,000 after purchasing an additional 610 shares during the period. Principal Financial Group Inc. lifted its position in Visa by 7.7% in the third quarter. Principal Financial Group Inc. now owns 5,733,284 shares of the credit-card processor's stock valued at $1,576,366,000 after buying an additional 411,210 shares during the last quarter. Morse Asset Management Inc purchased a new position in Visa during the third quarter worth about $69,000. Passumpsic Savings Bank increased its position in shares of Visa by 2.0% during the third quarter. Passumpsic Savings Bank now owns 9,137 shares of the credit-card processor's stock valued at $2,512,000 after acquiring an additional 179 shares during the last quarter. Finally, Virtu Financial LLC raised its stake in shares of Visa by 101.5% in the 3rd quarter. Virtu Financial LLC now owns 44,984 shares of the credit-card processor's stock valued at $12,368,000 after acquiring an additional 22,658 shares during the period. 82.15% of the stock is owned by institutional investors and hedge funds.

Insider Activity at Visa

In related news, insider Tullier Kelly Mahon sold 33,741 shares of the company's stock in a transaction on Friday, February 7th. The stock was sold at an average price of $349.77, for a total transaction of $11,801,589.57. Following the transaction, the insider now owns 36,566 shares of the company's stock, valued at $12,789,689.82. This represents a 47.99 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is available at this link. Also, insider Paul D. Fabara sold 39,350 shares of the firm's stock in a transaction on Friday, March 14th. The shares were sold at an average price of $327.20, for a total value of $12,875,320.00. Following the completion of the sale, the insider now directly owns 26,413 shares of the company's stock, valued at approximately $8,642,333.60. This trade represents a 59.84 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold a total of 143,205 shares of company stock worth $48,842,490 in the last three months. Insiders own 0.13% of the company's stock.

Visa Stock Performance

Shares of V stock opened at $341.46 on Wednesday. Visa Inc. has a 1 year low of $252.70 and a 1 year high of $366.54. The company has a debt-to-equity ratio of 0.45, a quick ratio of 1.12 and a current ratio of 1.12. The firm has a market cap of $634.36 billion, a price-to-earnings ratio of 34.42, a PEG ratio of 2.33 and a beta of 0.94. The stock's 50-day moving average is $337.89 and its two-hundred day moving average is $323.52.

Visa (NYSE:V - Get Free Report) last released its quarterly earnings results on Tuesday, April 29th. The credit-card processor reported $2.76 EPS for the quarter, topping the consensus estimate of $2.68 by $0.08. The company had revenue of $9.59 billion for the quarter, compared to analyst estimates of $9.57 billion. Visa had a return on equity of 54.79% and a net margin of 54.27%. The firm's revenue was up 9.3% compared to the same quarter last year. During the same quarter in the previous year, the company posted $2.51 earnings per share. Analysts predict that Visa Inc. will post 11.3 earnings per share for the current year.

Visa Announces Dividend

The firm also recently announced a quarterly dividend, which was paid on Monday, March 3rd. Stockholders of record on Tuesday, February 11th were paid a dividend of $0.59 per share. The ex-dividend date of this dividend was Tuesday, February 11th. This represents a $2.36 annualized dividend and a dividend yield of 0.69%. Visa's dividend payout ratio (DPR) is 23.79%.

Analysts Set New Price Targets

A number of equities analysts recently weighed in on the stock. Bank of America increased their price objective on shares of Visa from $331.00 to $363.00 and gave the stock a "neutral" rating in a research report on Friday, January 31st. Oppenheimer reaffirmed an "outperform" rating on shares of Visa in a research note on Thursday, February 13th. William Blair reissued an "outperform" rating on shares of Visa in a research note on Friday, January 31st. Evercore ISI assumed coverage on Visa in a research report on Wednesday, April 9th. They issued an "in-line" rating and a $330.00 target price for the company. Finally, Wells Fargo & Company increased their price target on shares of Visa from $360.00 to $395.00 and gave the stock an "overweight" rating in a research report on Friday, January 31st. Seven analysts have rated the stock with a hold rating, twenty have assigned a buy rating and one has issued a strong buy rating to the company. Based on data from MarketBeat, the company has a consensus rating of "Moderate Buy" and an average target price of $358.17.

Check Out Our Latest Stock Analysis on V

Visa Company Profile

(

Free Report)

Visa Inc operates as a payment technology company in the United States and internationally. The company operates VisaNet, a transaction processing network that enables authorization, clearing, and settlement of payment transactions. It also offers credit, debit, and prepaid card products; tap to pay, tokenization, and click to pay services; Visa Direct, a solution that facilitates the delivery of funds to eligible cards, deposit accounts, and digital wallets; Visa B2B Connect, a multilateral business-to-business cross-border payments network; Visa Cross-Border Solution, a cross-border consumer payments solution; and Visa DPS that provides a range of value-added services, including fraud mitigation, dispute management, data analytics, campaign management, a suite of digital solutions, and contact center services.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Visa, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Visa wasn't on the list.

While Visa currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report