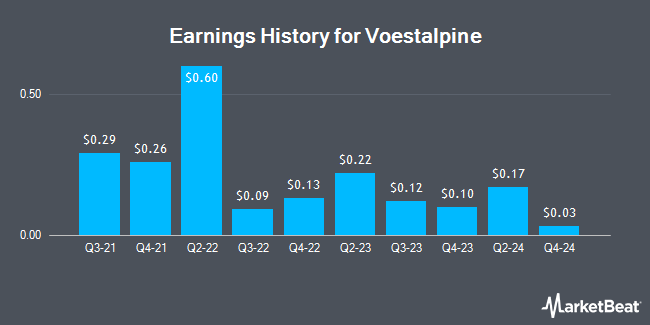

Voestalpine (OTCMKTS:VLPNY - Get Free Report) posted its earnings results on Wednesday. The company reported ($0.04) EPS for the quarter, Zacks reports. Voestalpine had a negative net margin of 0.41% and a negative return on equity of 0.53%. The firm had revenue of $4.21 billion during the quarter.

Voestalpine Stock Performance

Shares of VLPNY stock remained flat at $5.28 during trading on Friday. The company had a trading volume of 124 shares, compared to its average volume of 1,202. The company has a current ratio of 1.39, a quick ratio of 0.43 and a debt-to-equity ratio of 0.19. The stock's 50 day simple moving average is $4.82 and its 200-day simple moving average is $4.38. Voestalpine has a fifty-two week low of $3.34 and a fifty-two week high of $5.69.

Voestalpine Company Profile

(

Get Free Report)

Voestalpine AG processes, develops, manufactures, and sells steel products in Austria, European Union, and internationally. The company operates through five segments: Steel, High Performance Metals, Metal Engineering, Metal Forming, and Other. The Steel division produces hot and cold-rolled steel strips, as well as electrogalvanized, hot-dip galvanized, and organically coated steel strips; and heavy plates for the energy sector, as well as turbine casings for automotive, white goods/consumer goods, building/construction, energy, mechanical engineering, and others.

Recommended Stories

Before you consider Voestalpine, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Voestalpine wasn't on the list.

While Voestalpine currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Today, we are inviting you to take a free peek at our proprietary, exclusive, and up-to-the-minute list of 20 stocks that Wall Street's top analysts hate.

Many of these appear to have good fundamentals and might seem like okay investments, but something is wrong. Analysts smell something seriously rotten about these companies. These are true "Strong Sell" stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.