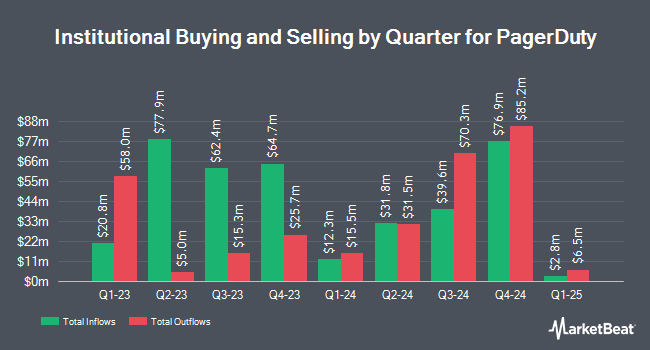

Voya Investment Management LLC grew its position in PagerDuty, Inc. (NYSE:PD - Free Report) by 437.4% in the fourth quarter, according to its most recent filing with the SEC. The fund owned 157,960 shares of the company's stock after acquiring an additional 128,567 shares during the period. Voya Investment Management LLC owned 0.18% of PagerDuty worth $2,884,000 as of its most recent filing with the SEC.

A number of other institutional investors also recently modified their holdings of the stock. Venturi Wealth Management LLC bought a new position in shares of PagerDuty during the 4th quarter valued at approximately $43,000. Picton Mahoney Asset Management purchased a new stake in PagerDuty in the 4th quarter valued at about $58,000. Vinva Investment Management Ltd purchased a new stake in shares of PagerDuty during the 4th quarter worth $139,000. PNC Financial Services Group Inc. lifted its holdings in shares of PagerDuty by 24.3% during the fourth quarter. PNC Financial Services Group Inc. now owns 10,061 shares of the company's stock worth $184,000 after purchasing an additional 1,965 shares during the period. Finally, Skandinaviska Enskilda Banken AB publ increased its position in PagerDuty by 22.3% during the 4th quarter. Skandinaviska Enskilda Banken AB publ now owns 13,700 shares of the company's stock worth $247,000 after purchasing an additional 2,500 shares in the last quarter. Institutional investors and hedge funds own 97.26% of the company's stock.

Analyst Upgrades and Downgrades

A number of research analysts have recently weighed in on the company. Canaccord Genuity Group lowered their price target on PagerDuty from $24.00 to $23.00 and set a "buy" rating on the stock in a report on Friday, March 14th. Bank of America cut PagerDuty from a "buy" rating to an "underperform" rating and cut their price target for the company from $23.00 to $18.00 in a research note on Thursday, January 30th. Royal Bank of Canada decreased their price target on PagerDuty from $24.00 to $22.00 and set an "outperform" rating for the company in a report on Friday, March 14th. The Goldman Sachs Group lowered their target price on shares of PagerDuty from $21.00 to $18.00 and set a "neutral" rating on the stock in a report on Friday, March 14th. Finally, Truist Financial dropped their price objective on PagerDuty from $30.00 to $26.00 and set a "buy" rating for the company in a report on Friday, March 14th. Two research analysts have rated the stock with a sell rating, five have issued a hold rating and four have assigned a buy rating to the company's stock. According to data from MarketBeat.com, the stock presently has a consensus rating of "Hold" and an average price target of $20.55.

View Our Latest Stock Analysis on PD

PagerDuty Price Performance

Shares of NYSE PD traded up $0.40 during mid-day trading on Thursday, reaching $15.71. The company's stock had a trading volume of 160,732 shares, compared to its average volume of 1,077,108. The stock has a 50-day moving average of $16.61 and a two-hundred day moving average of $18.19. PagerDuty, Inc. has a 1-year low of $14.30 and a 1-year high of $23.12. The stock has a market capitalization of $1.43 billion, a P/E ratio of -19.64 and a beta of 0.99. The company has a debt-to-equity ratio of 3.52, a quick ratio of 1.97 and a current ratio of 1.97.

PagerDuty (NYSE:PD - Get Free Report) last posted its quarterly earnings results on Thursday, March 13th. The company reported $0.22 earnings per share for the quarter, topping analysts' consensus estimates of $0.16 by $0.06. The company had revenue of $121.45 million for the quarter, compared to the consensus estimate of $119.53 million. PagerDuty had a negative net margin of 16.29% and a negative return on equity of 22.02%. PagerDuty's revenue was up 9.3% on a year-over-year basis. During the same quarter last year, the firm posted $0.17 earnings per share. On average, equities research analysts anticipate that PagerDuty, Inc. will post -0.27 EPS for the current fiscal year.

PagerDuty announced that its Board of Directors has authorized a stock repurchase program on Thursday, March 13th that permits the company to repurchase $150.00 million in shares. This repurchase authorization permits the company to reacquire up to 10.7% of its shares through open market purchases. Shares repurchase programs are often an indication that the company's board believes its stock is undervalued.

About PagerDuty

(

Free Report)

PagerDuty, Inc engages in the operation of a digital operations management platform in the United States and internationally. The company's digital operations management platform collects data and digital signals from virtually any software-enabled system or device and leverage machine learning to correlate, process, and predict opportunities and issues.

Recommended Stories

Before you consider PagerDuty, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and PagerDuty wasn't on the list.

While PagerDuty currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.