Voya Investment Management LLC lessened its position in shares of Sensata Technologies Holding plc (NYSE:ST - Free Report) by 73.0% in the fourth quarter, according to the company in its most recent Form 13F filing with the SEC. The fund owned 18,148 shares of the scientific and technical instruments company's stock after selling 49,085 shares during the quarter. Voya Investment Management LLC's holdings in Sensata Technologies were worth $497,000 at the end of the most recent reporting period.

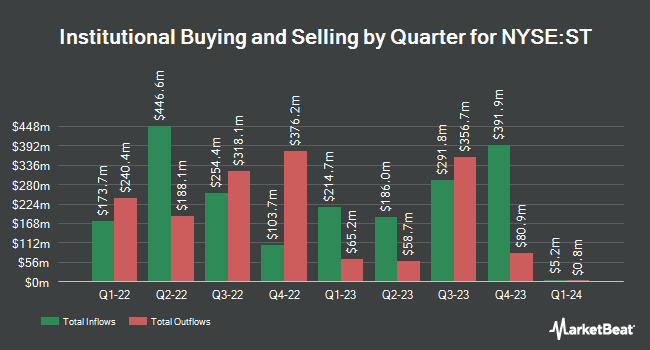

Other institutional investors also recently bought and sold shares of the company. Blue Trust Inc. raised its holdings in Sensata Technologies by 738.7% in the 4th quarter. Blue Trust Inc. now owns 931 shares of the scientific and technical instruments company's stock worth $26,000 after purchasing an additional 820 shares during the period. Brown Brothers Harriman & Co. purchased a new position in shares of Sensata Technologies during the 4th quarter valued at about $27,000. Venturi Wealth Management LLC increased its holdings in Sensata Technologies by 67.6% in the 4th quarter. Venturi Wealth Management LLC now owns 2,026 shares of the scientific and technical instruments company's stock worth $56,000 after acquiring an additional 817 shares in the last quarter. Parkside Financial Bank & Trust raised its stake in Sensata Technologies by 48.2% during the 4th quarter. Parkside Financial Bank & Trust now owns 2,523 shares of the scientific and technical instruments company's stock worth $69,000 after acquiring an additional 820 shares during the period. Finally, Headlands Technologies LLC lifted its holdings in Sensata Technologies by 524.8% during the fourth quarter. Headlands Technologies LLC now owns 2,768 shares of the scientific and technical instruments company's stock valued at $76,000 after purchasing an additional 2,325 shares in the last quarter. Institutional investors own 99.42% of the company's stock.

Sensata Technologies Trading Down 1.3%

Shares of NYSE ST traded down $0.35 during trading hours on Thursday, hitting $27.44. 371,681 shares of the company traded hands, compared to its average volume of 1,701,789. The company's 50 day moving average price is $23.19 and its 200 day moving average price is $27.37. Sensata Technologies Holding plc has a 12 month low of $17.32 and a 12 month high of $43.14. The stock has a market capitalization of $4.01 billion, a price-to-earnings ratio of 32.58, a price-to-earnings-growth ratio of 1.25 and a beta of 1.02. The company has a current ratio of 2.85, a quick ratio of 1.99 and a debt-to-equity ratio of 1.11.

Sensata Technologies (NYSE:ST - Get Free Report) last posted its quarterly earnings data on Thursday, May 8th. The scientific and technical instruments company reported $0.78 earnings per share for the quarter, beating analysts' consensus estimates of $0.72 by $0.06. Sensata Technologies had a net margin of 3.27% and a return on equity of 17.54%. The business had revenue of $911.26 million for the quarter, compared to analysts' expectations of $878.39 million. During the same quarter in the previous year, the business posted $0.89 earnings per share. The business's revenue was down 9.5% compared to the same quarter last year. On average, equities research analysts anticipate that Sensata Technologies Holding plc will post 3.21 earnings per share for the current fiscal year.

Sensata Technologies Dividend Announcement

The firm also recently announced a quarterly dividend, which will be paid on Wednesday, May 28th. Shareholders of record on Wednesday, May 14th will be given a dividend of $0.12 per share. The ex-dividend date of this dividend is Wednesday, May 14th. This represents a $0.48 annualized dividend and a dividend yield of 1.75%. Sensata Technologies's dividend payout ratio (DPR) is presently 59.26%.

Wall Street Analyst Weigh In

Several research analysts recently weighed in on the stock. Oppenheimer dropped their target price on shares of Sensata Technologies from $44.00 to $40.00 and set an "outperform" rating for the company in a report on Thursday, February 13th. The Goldman Sachs Group boosted their price target on shares of Sensata Technologies from $27.00 to $30.00 and gave the stock a "buy" rating in a research note on Friday, May 9th. Wells Fargo & Company began coverage on Sensata Technologies in a research report on Friday, April 25th. They set an "equal weight" rating and a $20.00 price objective for the company. Evercore ISI downgraded Sensata Technologies from an "outperform" rating to an "inline" rating and decreased their target price for the stock from $40.00 to $27.00 in a research report on Thursday, April 3rd. Finally, JPMorgan Chase & Co. dropped their price target on Sensata Technologies from $27.00 to $21.00 and set an "underweight" rating for the company in a research note on Thursday, April 17th. One equities research analyst has rated the stock with a sell rating, six have given a hold rating and five have issued a buy rating to the stock. According to data from MarketBeat, the stock presently has an average rating of "Hold" and a consensus target price of $33.58.

Check Out Our Latest Analysis on ST

Sensata Technologies Company Profile

(

Free Report)

Sensata Technologies Holding plc develops, manufactures, and sells sensors and sensor-rich solutions, electrical protection components and systems, and other products used in mission-critical systems and applications in the United States and internationally. It operates in two segments, Performance Sensing and Sensing Solutions.

Featured Stories

Before you consider Sensata Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sensata Technologies wasn't on the list.

While Sensata Technologies currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know? MarketBeat just compiled its list of the twelve stocks that corporate insiders are abandoning. Complete the form below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.