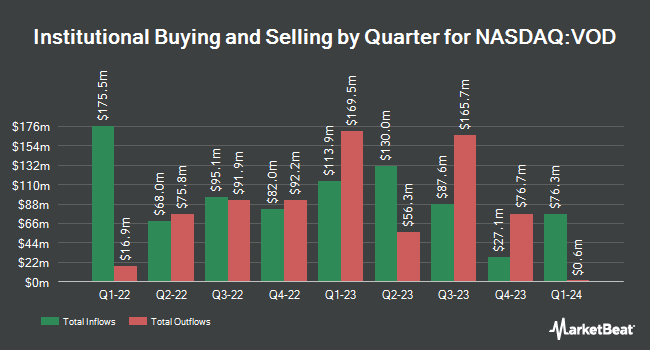

Wellington Management Group LLP purchased a new stake in shares of Vodafone Group Public Limited (NASDAQ:VOD - Free Report) in the fourth quarter, according to the company in its most recent disclosure with the SEC. The institutional investor purchased 114,300 shares of the cell phone carrier's stock, valued at approximately $970,000.

A number of other institutional investors also recently bought and sold shares of the stock. ABC Arbitrage SA purchased a new position in shares of Vodafone Group Public in the fourth quarter worth $22,646,000. JPMorgan Chase & Co. lifted its stake in Vodafone Group Public by 177.1% during the 3rd quarter. JPMorgan Chase & Co. now owns 3,356,455 shares of the cell phone carrier's stock valued at $33,632,000 after acquiring an additional 2,145,085 shares during the period. Proficio Capital Partners LLC boosted its holdings in shares of Vodafone Group Public by 749.7% during the 4th quarter. Proficio Capital Partners LLC now owns 2,151,935 shares of the cell phone carrier's stock valued at $18,270,000 after acquiring an additional 1,898,663 shares during the last quarter. Raymond James Financial Inc. bought a new stake in shares of Vodafone Group Public in the fourth quarter worth approximately $10,583,000. Finally, Virtu Financial LLC bought a new position in Vodafone Group Public during the fourth quarter valued at approximately $2,638,000. 7.84% of the stock is owned by institutional investors.

Analyst Ratings Changes

Several equities analysts have recently weighed in on the company. DZ Bank raised Vodafone Group Public from a "hold" rating to a "buy" rating in a report on Friday, March 7th. StockNews.com raised Vodafone Group Public from a "hold" rating to a "buy" rating in a research report on Friday. Finally, Bank of America lowered shares of Vodafone Group Public from a "buy" rating to a "neutral" rating in a research report on Monday, March 24th. Three analysts have rated the stock with a hold rating, three have given a buy rating and one has assigned a strong buy rating to the company's stock. According to data from MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy".

Get Our Latest Analysis on VOD

Vodafone Group Public Stock Performance

Shares of VOD stock traded up $0.14 during trading hours on Friday, reaching $9.31. 10,189,894 shares of the company traded hands, compared to its average volume of 7,072,665. The firm has a 50-day moving average price of $8.98 and a 200 day moving average price of $8.91. The company has a market cap of $22.05 billion, a P/E ratio of 8.17, a P/E/G ratio of 0.66 and a beta of 0.58. Vodafone Group Public Limited has a 12-month low of $8.00 and a 12-month high of $10.39. The company has a debt-to-equity ratio of 0.78, a current ratio of 1.37 and a quick ratio of 1.34.

Vodafone Group Public Company Profile

(

Free Report)

Vodafone Group Public Limited Company provides telecommunication services in Europe and internationally. It offers mobile connectivity services comprising end-to-end services for mobile voice and data, messaging, device management, BYOx, and telecoms management, as well as professional and consulting services; and fixed line connectivity, such as fixed voice and data, broadband, software-defined networks, managed WAN, LAN, ethernet, and satellite; and financial services, as well as business and merchant services.

See Also

Before you consider Vodafone Group Public, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Vodafone Group Public wasn't on the list.

While Vodafone Group Public currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.