American International Group (NYSE:AIG - Get Free Report) had its price objective raised by investment analysts at Wells Fargo & Company from $81.00 to $82.00 in a research report issued on Tuesday,Benzinga reports. The brokerage currently has an "equal weight" rating on the insurance provider's stock. Wells Fargo & Company's target price points to a potential downside of 0.65% from the company's current price.

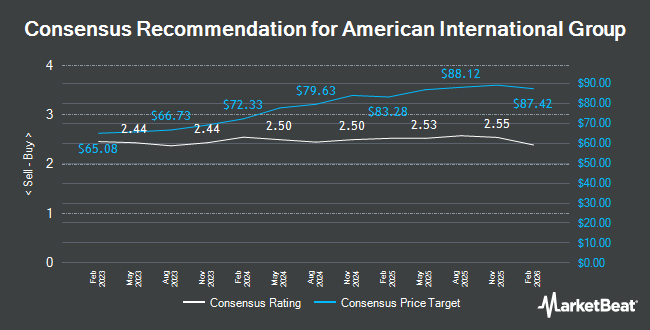

Several other research firms have also commented on AIG. The Goldman Sachs Group raised their target price on shares of American International Group from $79.00 to $87.00 and gave the company a "neutral" rating in a report on Tuesday, April 1st. UBS Group reduced their target price on shares of American International Group from $88.00 to $86.00 and set a "buy" rating on the stock in a report on Tuesday, February 18th. BMO Capital Markets lifted their price objective on American International Group from $75.00 to $83.00 and gave the stock a "market perform" rating in a research note on Thursday, March 13th. Keefe, Bruyette & Woods lowered their target price on American International Group from $98.00 to $94.00 and set an "outperform" rating for the company in a report on Wednesday, April 9th. Finally, JPMorgan Chase & Co. reissued a "neutral" rating and set a $91.00 target price (up from $83.00) on shares of American International Group in a research report on Tuesday, April 8th. Nine research analysts have rated the stock with a hold rating, nine have given a buy rating and one has given a strong buy rating to the company's stock. According to data from MarketBeat.com, American International Group currently has an average rating of "Moderate Buy" and an average price target of $87.76.

Get Our Latest Analysis on American International Group

American International Group Stock Performance

NYSE:AIG opened at $82.54 on Tuesday. American International Group has a 12-month low of $69.00 and a 12-month high of $88.07. The company has a quick ratio of 0.67, a current ratio of 0.67 and a debt-to-equity ratio of 0.21. The firm has a 50-day moving average price of $82.23 and a 200 day moving average price of $77.38. The firm has a market capitalization of $49.15 billion, a PE ratio of -39.64, a price-to-earnings-growth ratio of 1.01 and a beta of 0.69.

American International Group (NYSE:AIG - Get Free Report) last released its quarterly earnings data on Thursday, May 1st. The insurance provider reported $1.17 earnings per share for the quarter, topping the consensus estimate of $1.04 by $0.13. American International Group had a negative net margin of 4.25% and a positive return on equity of 8.01%. The business had revenue of $6.77 billion for the quarter, compared to analyst estimates of $6.89 billion. During the same quarter last year, the firm earned $1.25 EPS. Research analysts anticipate that American International Group will post 6.24 earnings per share for the current fiscal year.

Insiders Place Their Bets

In related news, Director John G. Rice acquired 10,000 shares of American International Group stock in a transaction that occurred on Thursday, February 13th. The stock was acquired at an average price of $77.00 per share, with a total value of $770,000.00. Following the completion of the acquisition, the director now directly owns 10,000 shares of the company's stock, valued at $770,000. This trade represents a ∞ increase in their position. The acquisition was disclosed in a legal filing with the Securities & Exchange Commission, which is available through this hyperlink. 0.50% of the stock is currently owned by insiders.

Institutional Inflows and Outflows

Several hedge funds and other institutional investors have recently made changes to their positions in the company. Duncker Streett & Co. Inc. acquired a new stake in American International Group in the 4th quarter valued at approximately $25,000. Asset Planning Inc acquired a new position in American International Group during the fourth quarter valued at approximately $26,000. Ameriflex Group Inc. bought a new position in shares of American International Group in the fourth quarter valued at about $29,000. Sachetta LLC lifted its holdings in shares of American International Group by 194.5% during the first quarter. Sachetta LLC now owns 377 shares of the insurance provider's stock worth $33,000 after buying an additional 249 shares in the last quarter. Finally, BankPlus Trust Department bought a new position in American International Group during the 4th quarter worth $36,000. 90.60% of the stock is currently owned by institutional investors and hedge funds.

American International Group Company Profile

(

Get Free Report)

American International Group, Inc offers insurance products for commercial, institutional, and individual customers in North America and internationally. It operates through three segments: General Insurance, Life and Retirement, and Other Operations. The General Insurance segment provides commercial and industrial property insurance, including business interruption and package insurance that cover exposure to made and natural disasters; general liability, environmental, commercial automobile liability, workers' compensation, excess casualty, and crisis management insurance products; and professional liability insurance.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider American International Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and American International Group wasn't on the list.

While American International Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.