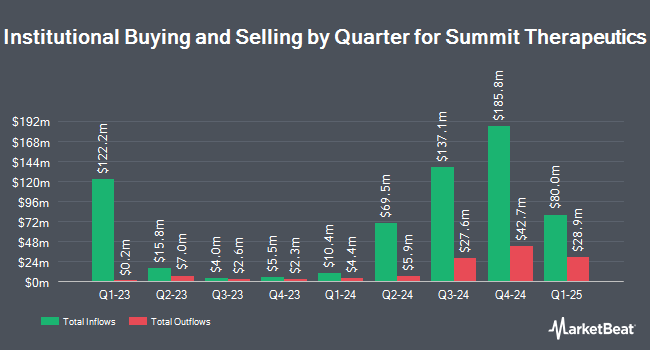

Wells Fargo & Company MN increased its position in shares of Summit Therapeutics Inc. (NASDAQ:SMMT - Free Report) by 79.2% during the 4th quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 95,265 shares of the company's stock after purchasing an additional 42,090 shares during the period. Wells Fargo & Company MN's holdings in Summit Therapeutics were worth $1,700,000 at the end of the most recent quarter.

A number of other institutional investors have also recently added to or reduced their stakes in the company. Griffin Asset Management Inc. boosted its holdings in shares of Summit Therapeutics by 63.3% in the fourth quarter. Griffin Asset Management Inc. now owns 110,660 shares of the company's stock worth $1,975,000 after buying an additional 42,900 shares during the period. SeaCrest Wealth Management LLC purchased a new stake in shares of Summit Therapeutics in the fourth quarter valued at $444,000. China Universal Asset Management Co. Ltd. lifted its holdings in shares of Summit Therapeutics by 12.2% in the fourth quarter. China Universal Asset Management Co. Ltd. now owns 156,366 shares of the company's stock valued at $2,790,000 after purchasing an additional 17,014 shares in the last quarter. Principal Financial Group Inc. boosted its position in shares of Summit Therapeutics by 252.8% in the fourth quarter. Principal Financial Group Inc. now owns 205,150 shares of the company's stock worth $3,661,000 after buying an additional 147,003 shares during the period. Finally, Franklin Resources Inc. purchased a new position in shares of Summit Therapeutics during the third quarter valued at $2,091,000. 4.61% of the stock is currently owned by institutional investors and hedge funds.

Summit Therapeutics Stock Performance

Summit Therapeutics stock traded up $0.74 during trading hours on Thursday, hitting $24.86. 684,601 shares of the stock were exchanged, compared to its average volume of 3,828,778. The stock has a market capitalization of $18.34 billion, a P/E ratio of -87.96 and a beta of -0.46. The business's 50-day moving average is $21.05 and its two-hundred day moving average is $20.23. Summit Therapeutics Inc. has a 12 month low of $2.10 and a 12 month high of $36.91.

Summit Therapeutics (NASDAQ:SMMT - Get Free Report) last released its quarterly earnings results on Monday, February 24th. The company reported ($0.08) earnings per share for the quarter, meeting analysts' consensus estimates of ($0.08). The business had revenue of $0.20 million for the quarter. On average, equities analysts predict that Summit Therapeutics Inc. will post -0.3 earnings per share for the current fiscal year.

Analyst Upgrades and Downgrades

SMMT has been the subject of several research reports. HC Wainwright restated a "buy" rating and set a $44.00 price target on shares of Summit Therapeutics in a report on Monday. JMP Securities reissued a "market outperform" rating and issued a $40.00 target price on shares of Summit Therapeutics in a research report on Monday. Evercore ISI initiated coverage on Summit Therapeutics in a research note on Wednesday, March 12th. They issued an "outperform" rating and a $30.00 price objective on the stock. StockNews.com upgraded shares of Summit Therapeutics from a "sell" rating to a "hold" rating in a report on Wednesday, March 5th. Finally, Truist Financial assumed coverage on Summit Therapeutics in a research note on Wednesday, January 8th. They issued a "buy" rating and a $35.00 price objective on the stock. One investment analyst has rated the stock with a hold rating and ten have issued a buy rating to the company's stock. According to MarketBeat, the company presently has an average rating of "Moderate Buy" and a consensus price target of $37.50.

Read Our Latest Analysis on Summit Therapeutics

Summit Therapeutics Company Profile

(

Free Report)

Summit Therapeutics Inc, a biopharmaceutical company, focuses on discovery, development, and commercialization of patient, physician, caregiver, and societal friendly medicinal therapies in the United States, and the United Kingdom. The company's lead development candidate is Ivonescimab, a bispecific antibody for immunotherapy through blockade of PD-1 with the anti-angiogenesis; and anti-infectives portfolio includes SMT-738, a novel class of precision antibiotics for the treatment of multidrug resistant infections, which primarily includes carbapenem-resistant Enterobacteriaceae infections.

Further Reading

Before you consider Summit Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Summit Therapeutics wasn't on the list.

While Summit Therapeutics currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.