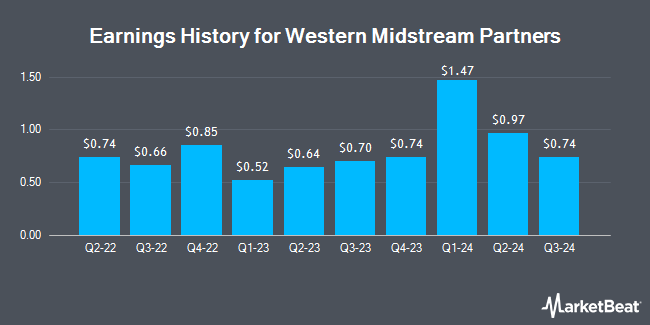

Western Midstream Partners (NYSE:WES - Get Free Report) is expected to issue its Q1 2025 quarterly earnings data after the market closes on Wednesday, May 7th. Analysts expect the company to announce earnings of $0.83 per share and revenue of $926.55 million for the quarter.

Western Midstream Partners Trading Down 1.3 %

Shares of NYSE WES traded down $0.46 during mid-day trading on Monday, reaching $35.87. The company had a trading volume of 761,858 shares, compared to its average volume of 1,253,744. The stock has a market cap of $13.68 billion, a price-to-earnings ratio of 9.16, a price-to-earnings-growth ratio of 1.40 and a beta of 1.12. Western Midstream Partners has a 52 week low of $33.60 and a 52 week high of $43.33. The business's 50-day moving average is $39.02 and its 200-day moving average is $39.33. The company has a current ratio of 1.11, a quick ratio of 1.11 and a debt-to-equity ratio of 2.05.

Western Midstream Partners Increases Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Thursday, May 15th. Investors of record on Friday, May 2nd will be paid a $0.91 dividend. The ex-dividend date is Friday, May 2nd. This represents a $3.64 annualized dividend and a yield of 10.15%. This is a boost from Western Midstream Partners's previous quarterly dividend of $0.88. Western Midstream Partners's dividend payout ratio is 90.32%.

Analysts Set New Price Targets

Separately, StockNews.com raised shares of Western Midstream Partners from a "hold" rating to a "buy" rating in a research report on Saturday, March 8th. Two investment analysts have rated the stock with a sell rating, four have assigned a hold rating and two have issued a buy rating to the company's stock. According to MarketBeat.com, Western Midstream Partners currently has a consensus rating of "Hold" and an average price target of $38.43.

Get Our Latest Report on Western Midstream Partners

About Western Midstream Partners

(

Get Free Report)

Western Midstream Partners, LP, together with its subsidiaries, operates as a midstream energy company primarily in the United States. It is involved in gathering, compressing, treating, processing, and transporting natural gas; gathering, stabilizing, and transporting condensate, natural gas liquids (NGLs), and crude oil; and gathering and disposing produced water.

Featured Articles

Before you consider Western Midstream Partners, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Western Midstream Partners wasn't on the list.

While Western Midstream Partners currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.