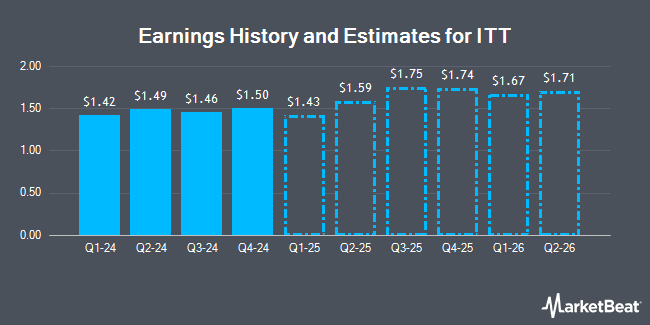

ITT Inc. (NYSE:ITT - Free Report) - Equities research analysts at Zacks Research lowered their Q2 2027 earnings per share estimates for ITT in a report released on Tuesday, July 1st. Zacks Research analyst R. Department now anticipates that the conglomerate will earn $1.82 per share for the quarter, down from their prior estimate of $1.83. The consensus estimate for ITT's current full-year earnings is $6.51 per share. Zacks Research also issued estimates for ITT's FY2027 earnings at $7.67 EPS.

Other research analysts have also issued research reports about the company. KeyCorp increased their price objective on ITT from $150.00 to $160.00 and gave the company an "overweight" rating in a report on Friday, May 2nd. Wall Street Zen raised ITT from a "hold" rating to a "buy" rating in a research report on Wednesday, May 7th. Bank of America lifted their price target on shares of ITT from $145.00 to $170.00 and gave the company a "buy" rating in a research report on Wednesday, May 21st. Stifel Nicolaus boosted their price objective on shares of ITT from $161.00 to $171.00 and gave the stock a "buy" rating in a research note on Friday, May 16th. Finally, The Goldman Sachs Group raised their target price on shares of ITT from $160.00 to $177.00 and gave the company a "buy" rating in a research note on Monday, May 19th. One research analyst has rated the stock with a hold rating and nine have given a buy rating to the stock. According to MarketBeat.com, ITT presently has an average rating of "Moderate Buy" and an average target price of $165.50.

Check Out Our Latest Report on ITT

ITT Trading Up 0.8%

ITT stock traded up $1.22 during mid-day trading on Thursday, hitting $161.39. 265,401 shares of the company's stock were exchanged, compared to its average volume of 454,043. ITT has a 1-year low of $105.64 and a 1-year high of $161.52. The stock has a 50 day moving average of $149.14 and a two-hundred day moving average of $142.60. The stock has a market cap of $12.70 billion, a P/E ratio of 25.66, a P/E/G ratio of 2.09 and a beta of 1.35.

ITT (NYSE:ITT - Get Free Report) last announced its quarterly earnings results on Thursday, May 1st. The conglomerate reported $1.45 EPS for the quarter, topping the consensus estimate of $1.44 by $0.01. The company had revenue of $913.00 million for the quarter, compared to analyst estimates of $901.22 million. ITT had a net margin of 14.19% and a return on equity of 17.75%. ITT's quarterly revenue was up .3% on a year-over-year basis. During the same quarter in the prior year, the business posted $1.42 EPS.

ITT Dividend Announcement

The business also recently announced a quarterly dividend, which was paid on Monday, June 30th. Investors of record on Monday, June 2nd were paid a dividend of $0.351 per share. This represents a $1.40 annualized dividend and a yield of 0.87%. The ex-dividend date was Monday, June 2nd. ITT's payout ratio is currently 22.26%.

Institutional Trading of ITT

Several hedge funds and other institutional investors have recently bought and sold shares of the stock. Voya Investment Management LLC raised its stake in shares of ITT by 4.7% in the 1st quarter. Voya Investment Management LLC now owns 12,792 shares of the conglomerate's stock valued at $1,652,000 after buying an additional 573 shares in the last quarter. Strs Ohio bought a new stake in ITT in the first quarter valued at about $1,539,000. Geneos Wealth Management Inc. raised its position in ITT by 341.1% in the first quarter. Geneos Wealth Management Inc. now owns 913 shares of the conglomerate's stock worth $118,000 after purchasing an additional 706 shares in the last quarter. Intech Investment Management LLC lifted its stake in ITT by 25.4% during the first quarter. Intech Investment Management LLC now owns 17,623 shares of the conglomerate's stock worth $2,276,000 after purchasing an additional 3,572 shares during the period. Finally, Focus Partners Wealth boosted its holdings in ITT by 80.7% during the first quarter. Focus Partners Wealth now owns 7,871 shares of the conglomerate's stock valued at $1,017,000 after purchasing an additional 3,515 shares in the last quarter. 91.59% of the stock is currently owned by institutional investors and hedge funds.

About ITT

(

Get Free Report)

ITT Inc, together with its subsidiaries, manufactures and sells engineered critical components and customized technology solutions for the transportation, industrial, and energy markets in the United States and internationally. The Motion Technologies segment manufactures brake pads, shims, shock absorbers, and energy absorption components; and sealing technologies primarily for the transportation industry, including passenger cars, trucks, light- and heavy-duty commercial and military vehicles, buses, and trains.

Read More

Before you consider ITT, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ITT wasn't on the list.

While ITT currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for July 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.