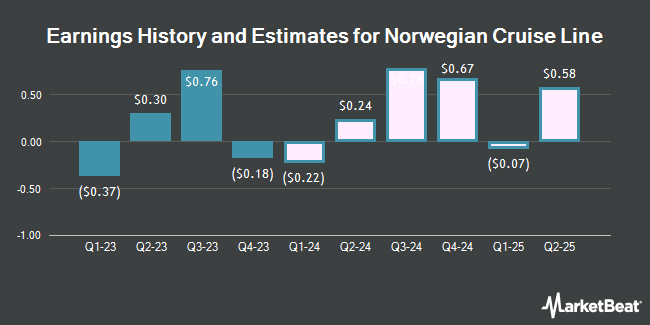

Norwegian Cruise Line Holdings Ltd. (NYSE:NCLH - Free Report) - Research analysts at Zacks Research decreased their Q3 2025 earnings per share estimates for shares of Norwegian Cruise Line in a note issued to investors on Wednesday, May 14th. Zacks Research analyst R. Department now forecasts that the company will post earnings per share of $1.07 for the quarter, down from their prior estimate of $1.11. The consensus estimate for Norwegian Cruise Line's current full-year earnings is $1.48 per share. Zacks Research also issued estimates for Norwegian Cruise Line's FY2025 earnings at $1.78 EPS, Q1 2026 earnings at $0.18 EPS, Q3 2026 earnings at $1.07 EPS, FY2026 earnings at $2.20 EPS, Q1 2027 earnings at $0.23 EPS and FY2027 earnings at $2.61 EPS.

A number of other analysts also recently weighed in on the company. Stifel Nicolaus dropped their target price on Norwegian Cruise Line from $30.00 to $26.00 and set a "buy" rating for the company in a research report on Thursday, May 1st. Morgan Stanley dropped their target price on Norwegian Cruise Line from $21.00 to $20.00 and set an "equal weight" rating for the company in a research report on Tuesday, May 6th. Jefferies Financial Group assumed coverage on Norwegian Cruise Line in a research report on Monday, March 31st. They issued a "buy" rating and a $25.00 target price for the company. Tigress Financial restated a "strong-buy" rating and issued a $36.00 target price on shares of Norwegian Cruise Line in a research report on Tuesday, March 11th. Finally, BNP Paribas assumed coverage on Norwegian Cruise Line in a research note on Thursday, March 27th. They issued a "neutral" rating and a $21.00 price target on the stock. One investment analyst has rated the stock with a sell rating, seven have assigned a hold rating, twelve have assigned a buy rating and two have assigned a strong buy rating to the company. Based on data from MarketBeat.com, the company has an average rating of "Moderate Buy" and a consensus target price of $25.63.

Check Out Our Latest Stock Analysis on NCLH

Norwegian Cruise Line Price Performance

NYSE:NCLH traded down $0.10 during mid-day trading on Monday, reaching $17.35. The stock had a trading volume of 7,415,932 shares, compared to its average volume of 12,551,910. The firm has a 50 day moving average price of $17.80 and a two-hundred day moving average price of $22.97. The stock has a market capitalization of $7.75 billion, a P/E ratio of 15.91, a P/E/G ratio of 0.24 and a beta of 2.09. Norwegian Cruise Line has a one year low of $14.21 and a one year high of $29.29. The company has a debt-to-equity ratio of 10.35, a quick ratio of 0.17 and a current ratio of 0.20.

Norwegian Cruise Line (NYSE:NCLH - Get Free Report) last issued its quarterly earnings results on Wednesday, April 30th. The company reported $0.07 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.09 by ($0.02). The business had revenue of $2.13 billion for the quarter, compared to the consensus estimate of $2.15 billion. Norwegian Cruise Line had a net margin of 5.87% and a return on equity of 99.31%. The business's revenue was down 2.9% compared to the same quarter last year. During the same quarter last year, the business posted $0.16 EPS.

Hedge Funds Weigh In On Norwegian Cruise Line

Hedge funds have recently made changes to their positions in the business. Hopwood Financial Services Inc. purchased a new position in shares of Norwegian Cruise Line during the fourth quarter valued at approximately $26,000. Kestra Investment Management LLC purchased a new position in shares of Norwegian Cruise Line during the fourth quarter valued at approximately $27,000. Stonebridge Financial Group LLC purchased a new position in shares of Norwegian Cruise Line during the fourth quarter valued at approximately $27,000. Rakuten Securities Inc. increased its stake in shares of Norwegian Cruise Line by 176.0% during the fourth quarter. Rakuten Securities Inc. now owns 1,159 shares of the company's stock valued at $30,000 after buying an additional 739 shares during the period. Finally, R Squared Ltd purchased a new position in shares of Norwegian Cruise Line during the fourth quarter valued at approximately $31,000. 69.58% of the stock is owned by hedge funds and other institutional investors.

Norwegian Cruise Line Company Profile

(

Get Free Report)

Norwegian Cruise Line Holdings Ltd., together with its subsidiaries, operates as a cruise company in North America, Europe, the Asia-Pacific, and internationally. The company operates through the Norwegian Cruise Line, Oceania Cruises, and Regent Seven Seas Cruises brands. It offers itineraries ranging from three days to a 180-days calling on various ports, including Scandinavia, Northern Europe, the Mediterranean, the Greek Isles, Alaska, Canada and New England, Hawaii, Asia, Tahiti and the South Pacific, Australia and New Zealand, Africa, India, South America, the Panama Canal, and the Caribbean.

Further Reading

Before you consider Norwegian Cruise Line, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Norwegian Cruise Line wasn't on the list.

While Norwegian Cruise Line currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.