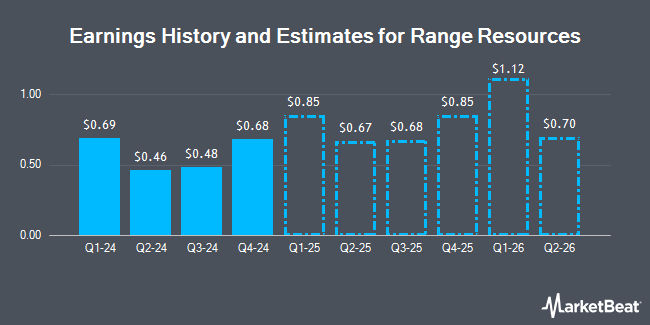

Range Resources Corporation (NYSE:RRC - Free Report) - Equities researchers at Zacks Research upped their Q2 2025 earnings estimates for Range Resources in a note issued to investors on Monday, June 23rd. Zacks Research analyst R. Department now anticipates that the oil and gas exploration company will post earnings of $0.56 per share for the quarter, up from their previous forecast of $0.51. The consensus estimate for Range Resources' current full-year earnings is $2.02 per share. Zacks Research also issued estimates for Range Resources' Q3 2025 earnings at $0.65 EPS, FY2025 earnings at $3.00 EPS, Q2 2026 earnings at $0.78 EPS and Q4 2026 earnings at $1.06 EPS.

A number of other analysts have also weighed in on the stock. Morgan Stanley set a $41.00 target price on shares of Range Resources in a report on Tuesday, April 15th. Bank of America upped their target price on shares of Range Resources from $45.00 to $47.00 and gave the stock a "buy" rating in a report on Friday, May 23rd. JPMorgan Chase & Co. raised shares of Range Resources from an "underweight" rating to a "neutral" rating and boosted their price target for the stock from $43.00 to $45.00 in a research note on Thursday, March 13th. Mizuho boosted their price target on shares of Range Resources from $45.00 to $46.00 and gave the stock an "outperform" rating in a research note on Tuesday, May 13th. Finally, Williams Trading set a $40.00 price target on shares of Range Resources in a research note on Wednesday, March 5th. Two equities research analysts have rated the stock with a sell rating, twelve have assigned a hold rating, seven have issued a buy rating and one has given a strong buy rating to the company. Based on data from MarketBeat.com, Range Resources currently has a consensus rating of "Hold" and an average price target of $41.95.

View Our Latest Stock Report on Range Resources

Range Resources Price Performance

Range Resources stock traded up $0.31 during midday trading on Thursday, reaching $41.22. 2,275,365 shares of the stock were exchanged, compared to its average volume of 2,501,236. The company's fifty day moving average is $38.50 and its 200-day moving average is $37.68. The company has a debt-to-equity ratio of 0.28, a quick ratio of 0.56 and a current ratio of 0.56. The firm has a market cap of $9.85 billion, a PE ratio of 36.80, a PEG ratio of 0.32 and a beta of 0.63. Range Resources has a 52 week low of $27.29 and a 52 week high of $43.50.

Institutional Inflows and Outflows

Several institutional investors have recently added to or reduced their stakes in RRC. Sanctuary Advisors LLC raised its holdings in Range Resources by 169.1% in the 4th quarter. Sanctuary Advisors LLC now owns 17,944 shares of the oil and gas exploration company's stock worth $674,000 after purchasing an additional 11,276 shares in the last quarter. Lingotto Investment Management LLP increased its stake in shares of Range Resources by 2.5% in the 4th quarter. Lingotto Investment Management LLP now owns 6,864,038 shares of the oil and gas exploration company's stock worth $246,968,000 after acquiring an additional 165,242 shares in the last quarter. Oppenheimer Asset Management Inc. bought a new stake in Range Resources during the 4th quarter valued at about $380,000. Oppenheimer & Co. Inc. bought a new stake in Range Resources during the 4th quarter valued at about $986,000. Finally, Proficio Capital Partners LLC bought a new stake in Range Resources during the 4th quarter valued at about $1,192,000. 98.93% of the stock is currently owned by institutional investors.

Insiders Place Their Bets

In other Range Resources news, CEO Dennis Degner sold 35,850 shares of the company's stock in a transaction on Wednesday, May 14th. The shares were sold at an average price of $40.42, for a total value of $1,449,057.00. Following the completion of the transaction, the chief executive officer now directly owns 58,431 shares in the company, valued at approximately $2,361,781.02. This represents a 38.02% decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, Director James M. Funk sold 13,582 shares of the company's stock in a transaction on Tuesday, May 6th. The stock was sold at an average price of $35.03, for a total transaction of $475,777.46. Following the completion of the transaction, the director now owns 54,394 shares of the company's stock, valued at $1,905,421.82. This trade represents a 19.98% decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last ninety days, insiders sold 76,080 shares of company stock worth $2,984,479. 1.00% of the stock is currently owned by corporate insiders.

Range Resources Announces Dividend

The company also recently declared a quarterly dividend, which was paid on Friday, June 27th. Shareholders of record on Friday, June 13th were given a dividend of $0.09 per share. The ex-dividend date was Friday, June 13th. This represents a $0.36 annualized dividend and a yield of 0.87%. Range Resources's payout ratio is currently 32.14%.

Range Resources Company Profile

(

Get Free Report)

Range Resources Corporation operates as an independent natural gas, natural gas liquids (NGLs), crude oil, and condensate company in the United States. The company engages in the exploration, development, and acquisition of natural gas and crude oil properties located in the Appalachian region. It sells natural gas to utilities, marketing and midstream companies, and industrial users; NGLs to petrochemical end users, marketers/traders, and natural gas processors; and oil and condensate to crude oil processors, transporters, and refining and marketing companies.

Further Reading

Before you consider Range Resources, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Range Resources wasn't on the list.

While Range Resources currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.