BlackRock NYSE: BLK is set to report its first-quarter earnings on Thursday; the largest asset manager in the world launched two new Environmental, Social, and Governance (ESG) ETFs on Thursday, showing where its focus lies ahead of the earnings release.

The asset manager wasn’t always on the cutting edge of sustainable investing. In the 2010s, BlackRock was under pressure from climate activists for its fossil fuel holdings. In January 2020, BlackRock responded by announcing it would no longer invest in companies that generate more than a quarter of their revenues from thermal coal. On top of that, the company unveiled plans to double its offerings of ESG funds to 150 over the next few years.

Here’s the deal:

Regardless of BlackRock management’s personal convictions on sustainable investing, this was a sound business decision. The company only had to exit $500 million in investments to satisfy its thermal coal requirements; that is a mere 0.006% of BlackRock’s $8.7 trillion of assets under management (AUM). The asset manager was able to satisfy its critics without hurting its bottom line. A win-win.

As for the ESG ETFs themselves, they are becoming a consequential part of BlackRock’s business. On the fourth-quarter earnings call, BlackRock CEO Larry Fink noted, “BlackRock generated $68 billion of net inflows in sustainable strategies in 2020, representing over 60% organic growth.”

That growth may become the norm in years to come; BlackRock believes that the market for sustainable investments could grow nearly sixfold to $1.2 trillion by 2030.

BlackRock Had an Outstanding 2020

In the stock market, 2020 was the year of the haves and the have-nots. BlackRock was in the former category. The company’s $8.7 trillion in AUM as of December 31, 2020 was up nearly 17% from December 31, 2019.

A large percentage of that increase can be attributed to a surging stock market – the S&P 500 was up 16.3% over the same period – but BlackRock also generated $391 billion in net inflows in 2020. The net inflows worked out to 5% organic asset growth and 7% organic base fee growth.

Blackrock closed out 2020 on a high note, generating $127 billion in net inflows in the fourth quarter – that would have put the asset manager on a $504 billion pace over a full year. Its fourth-quarter operating margin of 41.3% was up 260 basis points over the year-ago period.

All to say that BlackRock looks primed to expand its lead over the other asset managers.

It Has an Attractive Valuation and Dividend

BlackRock shares are changing hands at 22.1x forward earnings. Clearly, there are growth expectations baked into the share price, but we’re talking about a company that could potentially grow its top and bottom lines by a low double-digit CAGR over the next 3+ years. At that type of growth rate, shares would quickly become a bargain.

The dividend is equally attractive. BlackRock isn’t anywhere close to becoming a Dividend King, but it has increased its dividend for each of the last 12 years. Those increases have been substantial, particularly in recent years. In January, the company increased its dividend by 13.8% to $4.13 per share. The dividend is now 80.3% higher than it was five years ago. The forward yield of 2.20% is solid in our current low-yield environment.

How Should You Play BlackRock?

BlackRock looks like an excellent long-term play, but it’s hard to say what will happen after the asset manager reports its earnings on Thursday.

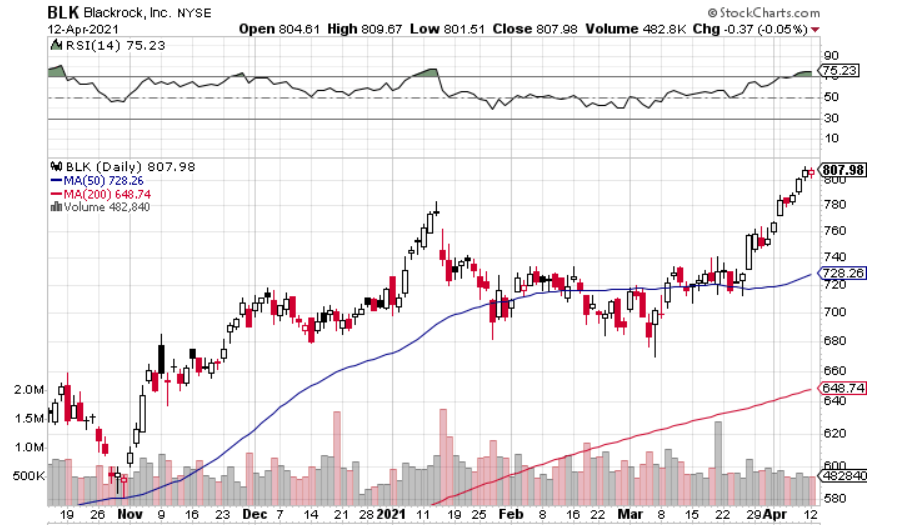

The bearish argument is that shares are in overbought territory on the RSI after a six-week rally. On top of that, the social media influenced trading and cryptocurrency booms certainly took potential inflows away from BlackRock in the first quarter.

The bullish argument is that BlackRock’s business has a lot of momentum and those retail traders aren’t enough to impact a behemoth like BlackRock. Also, even if the stimulus check money does move the needle, some of that money surely flowed into index funds and ETFs.

So, what is an investor to do?

It may be best to look for a post-earnings dip. BlackRock will likely post solid numbers, but there’s a decent chance we see some profit-taking.

Before you consider BlackRock, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BlackRock wasn't on the list.

While BlackRock currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.