Texas Roadhouse Today

$188.48 +0.39 (+0.21%) As of 04:00 PM Eastern

- 52-Week Range

- $148.73

▼

$206.04 - Dividend Yield

- 1.44%

- P/E Ratio

- 29.09

- Price Target

- $194.09

Restaurant-goers have developed a bit of a Goldilocks attitude lately, demanding high-quality food, prompt service, and a price point that warrants repeat visits.

It’s hard to blame a cash-strapped consumer for demanding top-notch food and excellent service, especially when cooking at home remains a more affordable option.

Still, these shifting trends have given rise to fast-casual establishments like Raising Cane’s and Shake Shack, where hungry people can get quick and satisfying meals at affordable prices.

Fast-casual demand is a real impulse, and Texas Roadhouse NASDAQ: TXRH has put itself in a good position to ride these shifting tides.

Texas Roadhouse Is Adapting to Fast Casual Dining Trends

The restaurant sector is a lot like the NFL: you need a quarterback like Patrick Mahomes one year and a running back like Saquon Barkley the next. Diners today are less interested in popular 90s-style chains and quick-service fast food. Budget-conscious consumers are instead flocking to fast-casual restaurants, and Texas Roadhouse is embracing these new preferences through a series of innovative measures.

The company has purposely underpriced some of its food options to combat inflation, using a barbell method where affordable options like burgers and chicken are paired with premium cuts of beef. The personable wait staff is also well-trained in upselling, recommending toppings and sides for entrees and drinks to pair with different meals. Beverage Innovation is another new company pillar, as younger crowds drift away from alcohol but still want premium, zero-proof drinks. Texas Roadhouse is experimenting with a variety of new non-alcoholic beverages, combining different flavors in non-typical fashions such as salty and sweet (swalty) and sweet and spicy (swicy). Yes, these are real terms.

Digital innovation and portfolio diversification are two additional strategic initiatives the company is employing to enhance speed and profitability. More than 200 kitchens are planned for conversion to a Digital Kitchen System, which will reduce the amount of labor required to service a busy restaurant while creating a less stressful environment for staff. More than 60% of these conversions have already been completed, and the company has reported reduced cook times in the restaurants using the system.

Texas Roadhouse is also expanding its offerings into different markets with Bubba’s 33, a sports bar focused on wings and burgers, and Jaggers, a traditional fast-casual restaurant to compete directly with established players like Shake Shack, Five Guys, and Raising Cane’s. As of April 2025, the company has opened 50 Bubba’s 33 and 14 Jaggers locations, with 33 more Bubba’s expected in the next 12 months. Bubba’s 33, in particular, has reported exceptional revenue growth, with sales up more than 20% last year.

EPS Expected to Rise as Inflation Eases

Texas Roadhouse MarketRank™ Stock Analysis

- Overall MarketRank™

- 83rd Percentile

- Analyst Rating

- Moderate Buy

- Upside/Downside

- 3.0% Upside

- Short Interest Level

- Healthy

- Dividend Strength

- Strong

- Environmental Score

- N/A

- News Sentiment

- 1.18

- Insider Trading

- Selling Shares

- Proj. Earnings Growth

- 14.52%

See Full AnalysisTexas Roadhouse missed earnings expectations during its Q1 2025 release on May 8, posting EPS of $1.70 compared to analyst projections of $1.75. However, a closer look under the hood reveals why this figure could be misleading. The company’s underpricing plan to attract fast-casual diners has resulted in a deliberate but temporary reduction in profit. However, revenue growth remains strong, and EPS numbers are expected to rebound as inflation continues to moderate.

The company’s Q1 2025 revenue of $1.45 billion slightly surpassed the expected $1.44 billion, but the figure represented year-over-year (YOY) growth of nearly 12% during a time period when consumers were cautious and pulling back from discretionary spending. Same-store sales were up 3.5% for the quarter, and all three of the company’s brands reported all-time high sales weeks during the period.

Rising beef prices will weigh on the company’s performance moving forward, but that hasn’t stopped analysts from Truist Financial and Guggenheim from boosting their price targets this month, to $212 and $210, respectively. Both these updated targets indicate upside of more than 11% from current levels. The company’s Q2 report is scheduled for July 24.

Bullish Signals on the Chart Point to More Upside

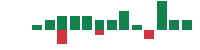

The TXRH daily stock chart also shows some bullish momentum, and if history is any guide, this could precede an outsized gain. At the end of September 2023, the 50-day moving average dipped under the 200-day moving average, and shares declined to a multi-year low. Investors didn’t need to stress for long, though; a Golden Cross formed shortly before the calendar flipped, and 2024 proved to be a banner year for the stock.

And now, what do we have here—a brief decline that caused the 50-day moving average to dip below the 200-day, followed by a quick rebound where a Golden Cross formed. Even though TXRH shares haven’t made a new all-time high since last November, bullish momentum is beginning to boil, and the stock has been tap-dancing on the 50-day MA for more than a month. If the company’s growth initiatives continue to produce results, Texas Roadhouse should remain a compelling investment.

Before you consider Texas Roadhouse, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Texas Roadhouse wasn't on the list.

While Texas Roadhouse currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Summer 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.