Hydroponics supplier Hydrofarm Holdings NASDAQ: HYFM stock has been a rollercoaster since it public on Dec. 20, 2020. The nation’s largest and oldest independent wholesaler and manufacturer of hydroponics equipment and grow lights faces powerful tailwinds as the marijuana legalization wave continues to gain momentum. In the cannabis sector, Hydrofarm is an infrastructure play enabling professional and amateur end users to produce and harvest products. Hydrofarm is a wholesaler and manufacturer operating 15 brands distributing through front-end retailers including GrowGeneration NASDAQ: GRWG stores. This takes some of the risks off the table since the Company doesn’t partake in selling marijuana end-products but the infrastructure for cannabis cultivation. However, legalization equates to a tidal wave of demand for its products ranging from pumps, soils, fertilizers to lighting, ventilation, and climate control systems for cultivating the crop. The Company has been generating revenues since 1977, so it’s not a start-up. It’s positioned in the right time and the right place to capitalize on the legalization wave. The big question is what multiples will be applied by the markets as the Company reveals more information on the business. Risk-tolerant investors looking for exposure in the cannabis sector with less inherent regulatory risk can watch shares of Hydroponics for opportunistic pullback levels.

S-1 Financials For Nine Months Ended September 2020

Hydrofarm’s S-1 provided impressive preliminary financials based on the nine-month period ended September 2020. Net sales rose 40.5% year-over-year (YoY) to $254.76 million for the nine-months ended September 2020. This was attributed to the 33.8% increase in volume of products sold and 6.7% increase in price of products sold. Gross profits rose 120.7% YoY, increasing by $26 million to $47.6 million. The continued state-by-state legalization of marijuana drove sales through the prior periods. The Company notes that COVID-19 may have accelerated sales due to higher consumption of end-products.

Lock-Up Period

According to the FORM S-1, Hydrofarm insiders have a 180-day lock-up period as of the date of the Prospectus, December 9, 2021. The Company is set to report its first earnings report as a publicly-traded company shortly. This will provide more color on the business and post-COVID trends. As with all IPOs, the markets tend to take some time for price discovery. Risk-tolerant investors are monitor prices for opportunistic pullback levels pre and/or post-earnings reaction and monitor GRWG price action as these two move closely together.

HYFM Opportunistic Pullback Levels

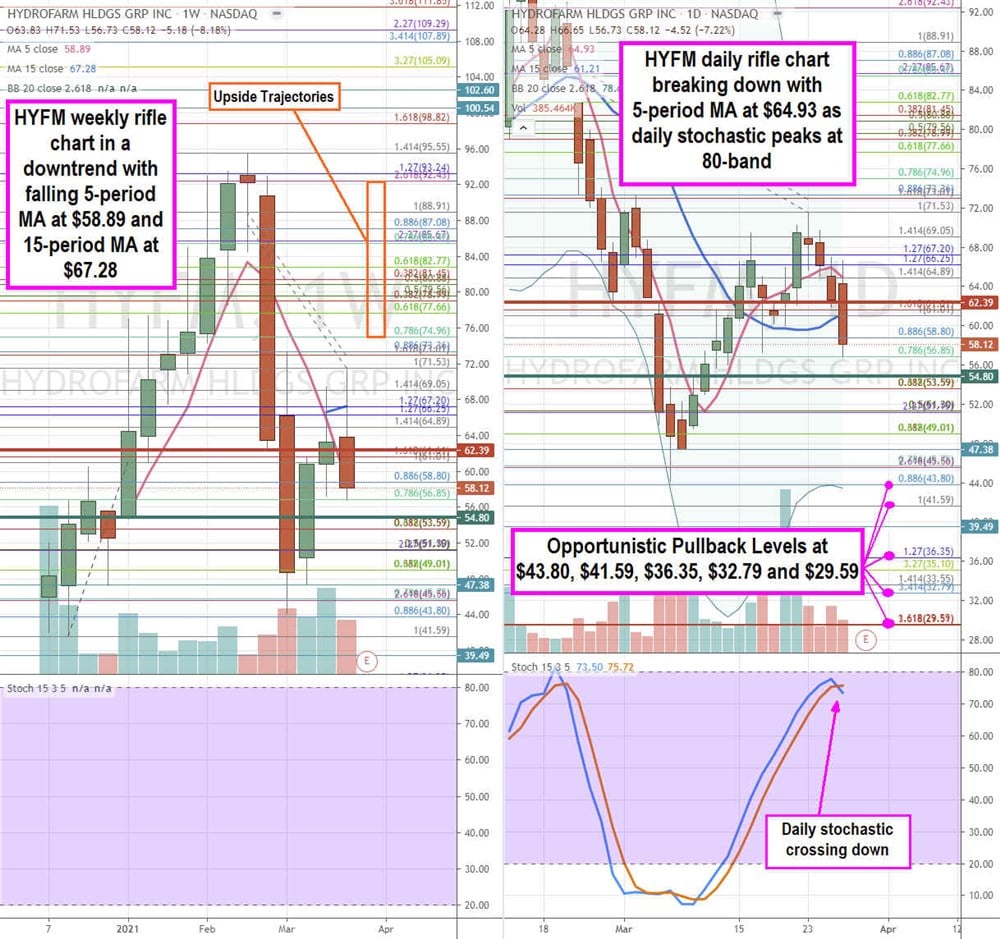

Using the rifle charts on the weekly and daily time frame provides a more precision near-term perspective of the landscape for HYFM stock. Since the stock recently IPO-ed, the weekly stochastic is still materializing. The weekly rifle chart shows an initial downtrend with a falling 5-period moving average (MA) at $58.89 and flat 15-period MA at $67.28. Shares peaked at the $95.55 Fibonacci (fib) level. The daily rifle chart formed a market structure low (MSL) buy trigger above $54.80 but also formed an opposite weekly market structure high (MSH) sell trigger when $62.39 broke down. The daily rifle chart indicates a potential breakdown as the falling 5-period MA at $64.93 closes the channel with the daily 15-period MA at $61.21. The daily stochastic completed a full oscillation to peak out near the 80-band to set up a potential oscillation back down. The upcoming earnings report reaction will impact the rifle charts so it’s prudent to consider waiting out the results. Risk-tolerant investors can watch for deep opportunistic pullback price levels at the $43.80 fib, $41.59 fib, $36.35 fib, $32.79 fib, and the $29.59 fib. Upside trajectories range from the $74.96 fib up to the $92.45 fib. Keep an eye on GRWG as a price action peer as shares move together.

Before you consider Hydrofarm Holdings Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hydrofarm Holdings Group wasn't on the list.

While Hydrofarm Holdings Group currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.