Kinder Morgan Today

KMI

Kinder Morgan

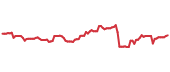

$27.12 -0.77 (-2.74%) As of 03:58 PM Eastern

This is a fair market value price provided by Polygon.io. Learn more. - 52-Week Range

- $19.68

▼

$31.48 - Dividend Yield

- 4.31%

- P/E Ratio

- 23.43

- Price Target

- $31.00

Kinder Morgan NYSE: KMI is poised to grow robustly over the coming years, at a steady and reliable pace that income investors can appreciate. Growth will be driven by the combination of its expanding natural gas pipeline network and capacity, compounded by increasing demand for these resources.

Demand growth, forecast by KMI at 20% through the decade’s end, is tied to decarbonization and the rapid expansion of natural gas infrastructure, including numerous projects coming online globally this year and next.

“With historic growing natural gas demand forecasts, a positive federal regulatory environment, and highly supportive federal permitting agencies, the future for our company is very bright,” said Executive Chairman Richard D. Kinder.

The steady and reliable growth pace fuels a steadily improving cash flow, ample profits, and the ability to self-fund expansion while paying its substantial dividend and maintaining a healthy balance sheet.

The dividend is a critical factor for this investment, as it pays more than 4.2% as of mid-July, and the distribution is expected to increase over time.

Kinder Morgan’s dividend payment is safe and reliable, despite its eye-popping, nearly 100% payout ratio. While a red flag, this company’s business model includes long-term contracts that provide clear revenue and earnings visibility, allowing it to pay dividends from its distributable cash flow, which is superior and sufficient, providing a payout ratio of 65% in FQ2 2025.

At the quarter’s end, balance sheet highlights include mildly increased liability offset by steady cash, increased total assets, and rising equity. Leverage also remains low, with long-term debt running at approximately one times the equity, and credit costs declining due to recent improvements in credit ratings.

Two of the major rating agencies lifted their outlook to positive, indicating potential for an upgrade, while the other affirmed its BBB rating and stable outlook.

Kinder Morgan Delivers Results for Investors: Guidance is Improved

Kinder Morgan had a solid Q2 with revenue of $4.04 billion, growing by 13.2% and outpacing MarketBeat’s reported consensus. The outperformance is substantial, topping the consensus forecast by 550 basis points, driven by strength in the natural gas and LNG export segments.

Margin news is also favorable, with natural gas margins realigning with long-term trends as projects come online. The only bad news is that analysts had expected a little more; the $0.28 in adjusted earnings is as expected despite the top-line strength.

The guidance serves as a catalyst for a long-term increase in share price. It was improved, with management expecting to exceed its forecast by at least the contribution of its recent acquisition. That forecast puts full-year net income growth well above the 8% originally forecasted and is supported by the growing backlog.

The company’s project backlog increased to $9.3 billion, a 6% net increase, with new projects outpacing those put into service by nearly 2-to-1 on a dollar basis.

Analysts Provide Support for KMI Stock in H2 2025

Kinder Morgan Stock Forecast Today

12-Month Stock Price Forecast:$31.0014.33% UpsideModerate BuyBased on 15 Analyst Ratings | Current Price | $27.12 |

|---|

| High Forecast | $38.00 |

|---|

| Average Forecast | $31.00 |

|---|

| Low Forecast | $27.00 |

|---|

Kinder Morgan Stock Forecast DetailsThe analysts' trends for KMI stock in the early second half of 2023 are positive and provide a lift for the market.

Not only is the coverage increasing, but positive price target revisions support the firm's Moderate Buy rating.

The consensus in mid-July is for a 10% upside while the trend leads to the high-end range, which tops out at $38. The $38 target represents a 38% upside in addition to the 4.2% dividend yield. The institutional group similarly supports KMI stock.

They own more than 60% of the shares, their activity ramped to a multi-year high in 2025, and they are buying on balance, netting nearly $2 in shares for every $1 sold through mid-July.

Before you consider Kinder Morgan, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kinder Morgan wasn't on the list.

While Kinder Morgan currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.