Hedge funds, university endowments, pension funds, and sovereign wealth funds have been pouring money into an elite group of 13 stocks.

Institutional investors don’t get easily swayed by the hot stocks of the day that are popular with retail investors. They are disciplined. They don’t take dumb losses. When institutions start to pour money into a company, it’s because they have done extensive analysis and believe a company is undervalued compared to the broader market. On this list, you will find real companies that are backed by real earnings and real fundamentals. These stocks have solid future growth prospects. If they didn’t, institutional investors wouldn’t be writing them a check.

You might ask, where did this proprietary list of companies even come from? No, it wasn’t stolen from a trading desk at a major bank. MarketBeat has combed through more than 5,000 SEC 13D and 13F filings issued with the SEC in the last quarter to see where institutional money is flowing. The 13 stocks on this list stick out like a sore thumb – big money investors are pouring hundreds of millions of dollars into these companies.

- Net Inflows of from Institutional Investors in Dollars

- $138,267,747,932.00

- Net Inflows of from Institutional Investors in Shares

- 663,918,892

- Number of Institutional Transactions in the Last 90 Days

- 5,320

Broadcom Inc designs, develops, and supplies various semiconductor devices with a focus on complex digital and mixed signal complementary metal oxide semiconductor based devices and analog III-V based products worldwide. The company operates in two segments, Semiconductor Solutions and Infrastructure Software.

More about Broadcom

- Net Inflows of from Institutional Investors in Dollars

- $86,501,318,136.00

- Net Inflows of from Institutional Investors in Shares

- 197,162,990

- Number of Institutional Transactions in the Last 90 Days

- 8,316

Microsoft Corporation develops and supports software, services, devices and solutions worldwide. The Productivity and Business Processes segment offers office, exchange, SharePoint, Microsoft Teams, office 365 Security and Compliance, Microsoft viva, and Microsoft 365 copilot; and office consumer services, such as Microsoft 365 consumer subscriptions, Office licensed on-premises, and other office services.

More about Microsoft

- Net Inflows of from Institutional Investors in Dollars

- $75,177,178,364.00

- Net Inflows of from Institutional Investors in Shares

- 644,467,886

- Number of Institutional Transactions in the Last 90 Days

- 7,432

NVIDIA Corporation provides graphics and compute and networking solutions in the United States, Taiwan, China, Hong Kong, and internationally. The Graphics segment offers GeForce GPUs for gaming and PCs, the GeForce NOW game streaming service and related infrastructure, and solutions for gaming platforms; Quadro/NVIDIA RTX GPUs for enterprise workstation graphics; virtual GPU or vGPU software for cloud-based visual and virtual computing; automotive platforms for infotainment systems; and Omniverse software for building and operating metaverse and 3D internet applications.

More about NVIDIA

- Net Inflows of from Institutional Investors in Dollars

- $62,903,282,254.00

- Net Inflows of from Institutional Investors in Shares

- 325,822,454

- Number of Institutional Transactions in the Last 90 Days

- 7,608

Amazon.com, Inc engages in the retail sale of consumer products, advertising, and subscriptions service through online and physical stores in North America and internationally. The company operates through three segments: North America, International, and Amazon Web Services (AWS). It also manufactures and sells electronic devices, including Kindle, Fire tablets, Fire TVs, Echo, Ring, Blink, and eero; and develops and produces media content.

More about Amazon.com

#5 - Eli Lilly and Company (NYSE:LLY)

- Net Inflows of from Institutional Investors in Dollars

- $61,952,326,548.00

- Net Inflows of from Institutional Investors in Shares

- 84,150,347

- Number of Institutional Transactions in the Last 90 Days

- 5,131

Eli Lilly and Company discovers, develops, and markets human pharmaceuticals worldwide. The company offers Basaglar, Humalog, Humalog Mix 75/25, Humalog U-100, Humalog U-200, Humalog Mix 50/50, insulin lispro, insulin lispro protamine, insulin lispro mix 75/25, Humulin, Humulin 70/30, Humulin N, Humulin R, and Humulin U-500 for diabetes; Jardiance, Mounjaro, and Trulicity for type 2 diabetes; and Zepbound for obesity.

More about Eli Lilly and Company

- Net Inflows of from Institutional Investors in Dollars

- $59,935,151,419.00

- Net Inflows of from Institutional Investors in Shares

- 201,090,931

- Number of Institutional Transactions in the Last 90 Days

- 5,226

Tesla, Inc designs, develops, manufactures, leases, and sells electric vehicles, and energy generation and storage systems in the United States, China, and internationally. The company operates in two segments, Automotive, and Energy Generation and Storage. The Automotive segment offers electric vehicles, as well as sells automotive regulatory credits; and non-warranty after-sales vehicle, used vehicles, body shop and parts, supercharging, retail merchandise, and vehicle insurance services.

More about Tesla

- Net Inflows of from Institutional Investors in Dollars

- $57,866,293,830.00

- Net Inflows of from Institutional Investors in Shares

- 291,473,800

- Number of Institutional Transactions in the Last 90 Days

- 8,290

Apple Inc designs, manufactures, and markets smartphones, personal computers, tablets, wearables, and accessories worldwide. The company offers iPhone, a line of smartphones; Mac, a line of personal computers; iPad, a line of multi-purpose tablets; and wearables, home, and accessories comprising AirPods, Apple TV, Apple Watch, Beats products, and HomePod.

More about Apple

- Net Inflows of from Institutional Investors in Dollars

- $48,444,063,653.00

- Net Inflows of from Institutional Investors in Shares

- 642,238,690

- Number of Institutional Transactions in the Last 90 Days

- 2,178

Lam Research Corporation designs, manufactures, markets, refurbishes, and services semiconductor processing equipment used in the fabrication of integrated circuits. The company offers ALTUS systems to deposit conformal films for tungsten metallization applications; SABRE electrochemical deposition products for copper interconnect transition that offers copper damascene manufacturing; SOLA ultraviolet thermal processing products for film treatments; and VECTOR plasma-enhanced CVD ALD products.

More about Lam Research

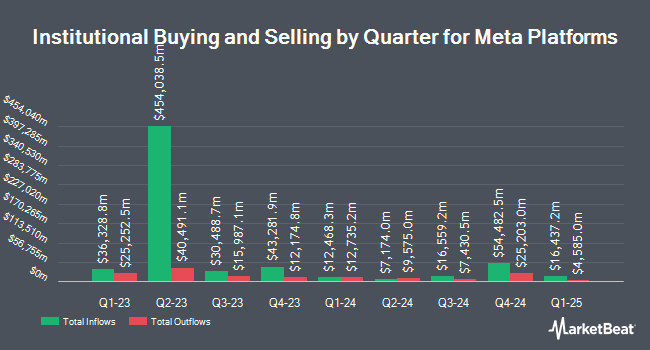

- Net Inflows of from Institutional Investors in Dollars

- $41,873,399,354.00

- Net Inflows of from Institutional Investors in Shares

- 70,673,598

- Number of Institutional Transactions in the Last 90 Days

- 6,096

Meta Platforms, Inc engages in the development of products that enable people to connect and share with friends and family through mobile devices, personal computers, virtual reality headsets, and wearables worldwide. It operates in two segments, Family of Apps and Reality Labs. The Family of Apps segment offers Facebook, which enables people to share, discuss, discover, and connect with interests; Instagram, a community for sharing photos, videos, and private messages, as well as feed, stories, reels, video, live, and shops; Messenger, a messaging application for people to connect with friends, family, communities, and businesses across platforms and devices through text, audio, and video calls; and WhatsApp, a messaging application that is used by people and businesses to communicate and transact privately.

More about Meta Platforms

- Net Inflows of from Institutional Investors in Dollars

- $40,833,700,425.00

- Net Inflows of from Institutional Investors in Shares

- 83,667,044

- Number of Institutional Transactions in the Last 90 Days

- 4,555

PowerShares QQQ Trust, Series 1 is a unit investment trust that issues securities called Nasdaq-100 Index Tracking Stock. The Trust's investment objective is to provide investment results that generally correspond to the price and yield performance of the Nasdaq-100 Index. The Trust provides investors with the opportunity to purchase units of beneficial interest in the Trust representing proportionate undivided interests in the portfolio of securities held by the Trust, which consists of substantially all of the securities, in substantially the same weighting, as the component securities of the Nasdaq-100 Index.

More about Invesco QQQ

#11 - Arista Networks (NYSE:ANET)

- Net Inflows of from Institutional Investors in Dollars

- $40,768,773,896.00

- Net Inflows of from Institutional Investors in Shares

- 473,230,117

- Number of Institutional Transactions in the Last 90 Days

- 2,141

Arista Networks, Inc engages in the development, marketing, and sale of data-driven, client to cloud networking solutions for data center, campus, and routing environments in the Americas, Europe, the Middle East, Africa, and the Asia-Pacific. Its cloud networking solutions consist of Extensible Operating System (EOS), a publish-subscribe state-sharing networking operating system offered in combination with a set of network applications.

More about Arista Networks

#12 - Take-Two Interactive Software (NASDAQ:TTWO)

- Net Inflows of from Institutional Investors in Dollars

- $33,296,646,584.00

- Net Inflows of from Institutional Investors in Shares

- 147,167,499

- Number of Institutional Transactions in the Last 90 Days

- 861

Take-Two Interactive Software, Inc develops, publishes, and markets interactive entertainment solutions for consumers worldwide. It develops and publishes action/adventure products under the Grand Theft Auto, LA Noire, Max Payne, Midnight Club, and Red Dead Redemption names, as well as other franchises.

More about Take-Two Interactive Software

#13 - Palo Alto Networks (NASDAQ:PANW)

- Net Inflows of from Institutional Investors in Dollars

- $18,452,036,276.00

- Net Inflows of from Institutional Investors in Shares

- 98,710,947

- Number of Institutional Transactions in the Last 90 Days

- 3,115

Palo Alto Networks, Inc provides cybersecurity solutions worldwide. The company offers firewall appliances and software; and Panorama, a security management solution for the global control of network security platform as a virtual or a physical appliance. It also provides subscription services covering the areas of threat prevention, malware and persistent threat, URL filtering, laptop and mobile device protection, DNS security, Internet of Things security, SaaS security API, and SaaS security inline, as well as threat intelligence, and data loss prevention.

More about Palo Alto Networks

More Investing Slideshows: