Dividing your limited investment capital between multiple types of investments is referred to as "asset allocation," but what is asset allocation?

It's an essential skill to learn when creating a diversified portfolio and planning for future financial needs like retirement.

Read on to learn more about asset allocation and how you can adjust your asset allocation as your needs change.

What is Asset Allocation and Why is it Important?

What is meant by asset allocation?

No single investor has unlimited capital to invest in every interesting company and project on the market. Asset allocation is a fundamental principle in investing that involves dividing your funds among different asset classes, such as stocks, bonds, cash and real estate. By employing this strategy, you aim to enhance your long-term investment success.

The concept of asset allocation is relatively straightforward. Its purpose is to mitigate the risk associated with investing by ensuring that your money consistently distributes across various asset classes. As different assets tend to perform differently, the strategy takes advantage of market dynamics. Some investors refer to strategic portfolio allocations as "portfolio diversification" because it involves investing in diverse asset classes.

Even when multiple assets move in the same direction, they rarely do so at the same pace or percentage. By diversifying your investments among different asset classes, you increase the likelihood that at least one of your holdings will experience growth or remain stable. This diversification helps to reduce the overall risk exposure of your portfolio.

The primary rationale behind asset allocation recognizes that market conditions fluctuate and individual assets have varying risk and return potential levels. By allocating your funds across different asset classes, you can achieve a balance that aligns with your investment goals and risk tolerance. You can also reassess and reallocate your funds over time to fit your changing investment needs and goals.

How Does Asset Allocation Work?

Asset allocation works by dividing your investment income between multiple types of assets with varying levels of risk. For example, bonds are inherently less risky than stocks because they guarantee a return of the initial amount borrowed, represented by the value of the bond. However, they have less chance of producing high returns.

With this in mind, you can see how the number of years that you have before retirement influences the best types of assets for your portfolio. If you're approaching retirement, devote a larger percentage of assets to bonds to retain value when liquidating your assets. On the other hand, if you're younger, you may want to direct a larger percentage of your assets to purchase more volatile assets to increase your overall returns when viewed on the meta scale.

Asset Allocation Strategies

There are a variety of asset allocation strategies that you can use to manage the maintenance of funds and growth. Some examples of strategies you can use include three of the following common options:

- Strategic asset allocation: Strategic asset allocation is a straightforward way to allocate your assets. In this asset allocation definition, you choose a percentage of individual asset classes to meet your upcoming investment goals. For example, you might allot 80% of your investment funds to stocks and 20% to bonds.

- Constant-weight asset allocation: The constant-weight asset allocation strategy is available when investing in select types of mutual funds and involves automatic rebalancing. As asset concentration changes with market movements, fund managers automatically rebalance your portfolio according to the fund's prospectus and needs.

For example, imagine your portfolio contains 80% stocks and 20% bonds. Suppose the value of your stocks increase, causing them to make up 85% of your portfolio. In that case, the fund will automatically rebalance by selling stocks and purchasing more bonds to restore the desired balance. Many investors favor this feature, as it prevents them from being too slow in responding to significant market shifts. While this method may yield different gains than other more actively involved investors, it provides a protective shield against risk.

- Tactical asset allocation: Tactical asset allocation involves incorporating market timing into your allocation. In this model, investors deliberately deviate from their standard portfolio mix to capitalize on uncommon or exceptional investment prospects. This approach necessitates the discipline to readjust the portfolio back to its desired long-term mix after achieving the desired short-term objective or to cut losses if the opportunity fails to materialize.

How to Determine the Right Asset Allocation for You

The ideal asset allocation will vary depending on several personal factors, including the following: time horizon, risk tolerance and desired retirement income.

Time Horizon

The number of years you have until retirement directly affects the ideal asset mix for your portfolio. If you have many years before you retire, you have more time to ride out market fluctuations and can afford to invest in more volatile assets. If you're close to retirement, you'll want to lock down your accumulated value by scaling down to less volatile assets like government and municipal bonds.

Risk Tolerance

Your investing risk tolerance is related to your time in the market and your goals. Most investors take a relatively more conservative approach when using retirement funds for investing versus personal investments in a taxable brokerage account. Think about the possibility of loss when choosing your asset mix, and err on the side of caution as you get closer to achieving goals like retiring or buying a home.

Desired Retirement Income

As you're actively in retirement, you'll scale down your investments from riskier options like stocks to stable choices like bonds and cash. Depending on your desired retirement income, leave a larger percentage of your investments in income-producing options like dividend stocks.

How Often Should You Change Your Asset Allocation Mix?

The frequency of changing your asset allocation mix depends on various factors, including your investment goals, risk tolerance, market conditions and personal preferences. There is no universally applicable answer, as the best time to reallocate assets is entirely based on where you are in your life and your unique goals. As a general rule, consider looking at your portfolio once annually to be sure that your mix still meets your current needs and vision for your future.

Four Examples of Asset Allocation

The ideal asset allocation for your portfolio will vary depending on your age, investing goals and how close you are to retirement. Let's look at a few examples of investor profiles and how they might divide their portfolio assets.

Drew, Age 23

As an investor in her early 20s, Drew is likely just getting started in her career. She will likely only be able to contribute a small amount to her retirement savings, but thankfully, she has many years to ride out market fluctuations. An ideal asset mix for someone at this age may look like:

- Stocks: 80% to 100%

- Bonds: 0% to 20%

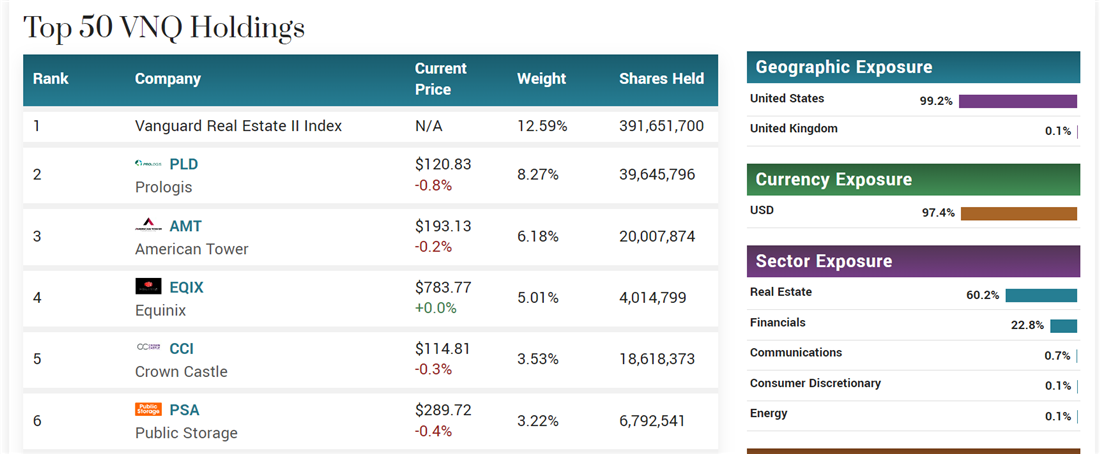

Drew may only be able to invest a small percentage of her income in retirement, as she is likely to be paying off student loans or earning a lower salary at the same time. She may want to devote some funds to higher-risk, higher-reward assets, like individual stocks or real estate-based mutual funds like the Vanguard Real Estate ETF NYSE: VNQ.

Image: Holding most assets in income-producing real estate, the Vanguard Real Estate ETF NYSE: VNQ is a high-risk, high-reward option for investors who can shoulder more risk.

Image: Holding most assets in income-producing real estate, the Vanguard Real Estate ETF NYSE: VNQ is a high-risk, high-reward option for investors who can shoulder more risk.

Jackson, Age 36

A career-focused professional, Jackson is likelier to earn more income as he becomes more established in his chosen field of work. While he might not have student loans to pay down, he likely has other ongoing financial obligations to take care of — like a mortgage loan or child's upcoming college education to fund. Considering these obligations, a suitable asset mix for Jackson could look like the following:

- Stocks: 70% to 90%

- Bonds: 10% to 30%

Jackson is more likely to invest through his employer's 401(k) or other sponsored retirement accounts, which means that the best asset allocation strategy might vary depending on the brokerage firm his company uses to invest. If you're in your 30s, ask about any employer-sponsored 401(k) match programs to help you compound your savings without making additional cuts to your household budget.

Abdullah, Age 48

Abdullah is approaching retirement age but still working and contributing to his retirement accounts. As he gets closer to his golden years, Abdullah will want to start scaling back his risk exposure to maintain his target retirement date. An example of an asset mix that might work for Abdullah could be the following:

- Stocks: 60% to 70%

- Bonds: 30% to 40%

- Cash: 0% to 10%

Depending on when you plan to retire and your goals, consider scaling down a portion of your investments to cash, as is recommended for Abdullah. Scaling down a portion of investments to cash creates a risk that you'll lose money to inflation over time. Still, it may be safer for those with ongoing medical needs or another necessity requiring enhanced liquidity.

Kimiko, Age 67

Kimiko is a retiree who has recently said "good-bye" to the working world and "hello" to relaxing days on the beach. As she has spent her younger years putting money into more volatile assets, Kimiko should now focus on retaining value and using her assets effectively as she enjoys retirement. Sample allocations for retirees like Kimiko might include the following percentage fund allocation:

- Stocks: 30% to 50%

- Bonds: 50% to 70%

- Cash: 30% to 50%

As you can see, there is some variation in the types of assets you may want to hold in retirement. The best assets to invest in while actively in retirement will vary depending on your income and spending needs. For example, if you want to maintain a passive income stream in retirement, you may choose a higher percentage of bonds. If you have more recurring expenses, cash could be a better choice.

What is an Asset Allocation Fund?

An asset allocation fund is a type of investment fund that aims to provide investors with an instantly diversified portfolio by allocating investments across different asset classes. Instead of putting the onus of asset allocation on the individual investor, allocation funds hire professionals to diversify the fund for you. When you buy the fund, you receive exposure to all asset allocation assets, offering diversification without the need to research and select individual stocks, bonds and ETFs.

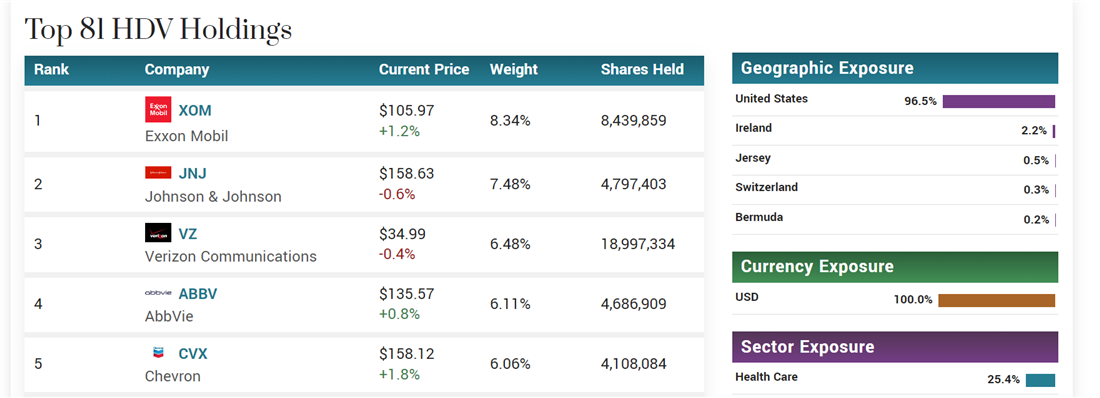

Asset allocation funds strategically distribute the fund's assets among various investments, such as stocks, bonds, cash and occasionally alternative investments like real estate or commodities. The allocation percentages may vary based on the fund's investment objectives and strategy. Well-known asset allocation funds include the BlackRock Global Allocation Fund and the iShares Core High Dividend ETF NYSE: HDV.

Image text: The iShares Core High Dividend ETF NYSE: HDV is an example of an asset allocation fund. Many asset allocation funds are structured as mutual funds for easy retirement investing.

Accounting for Changing Investment Needs

As you age, your financial situation and needs will change — your investment needs will also change, requiring a dynamic approach to your finances. Reassess your portfolio once a year to ensure your assets align with your goals and needs. If you aren't sure if you're on the right track toward retirement, MarketBeat's realistic retirement calculator can be a great place to start learning more.

FAQs

Now that you understand what is meant by asset allocation and the diversification definition that fits your needs, you can begin exploring the top asset allocation funds. The following are some last-minute questions you might have about investment and fund allocation.

What is the best asset allocation for a 401(k)?

The best 401(k) allocation will vary depending on your age and risk tolerance. For example, if you're a younger investor, you'll want to choose an investment mix mostly of stocks, as you have time to ride out market fluctuations. If you're approaching retirement, choose an investment mix primarily of lower-risk options like bonds and diversified mutual funds.

What is a good asset allocation?

A good asset allocation isn't overly concentrated in a single sector and fits your unique needs. The best allocation of funds mixes incorporate investments from various classes, risk levels and markets to reduce risk and expose you to a wider range of market opportunities.

What are the four types of asset allocation?

The four most common types of asset allocation are strategic, dynamic, tactical and core-satellite. Each asset allocation strategy varies in its aggressiveness and how assets are selected in the overall portfolio.

Before you consider BlackRock, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BlackRock wasn't on the list.

While BlackRock currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.