We just saw the first real signs that the “vibecession” is becoming something more—and this is our cue to pluck from our portfolios (or avoid adding!) three funds that are way into bubble territory. (Names and tickers below.)

Let’s start with that slowdown signal.

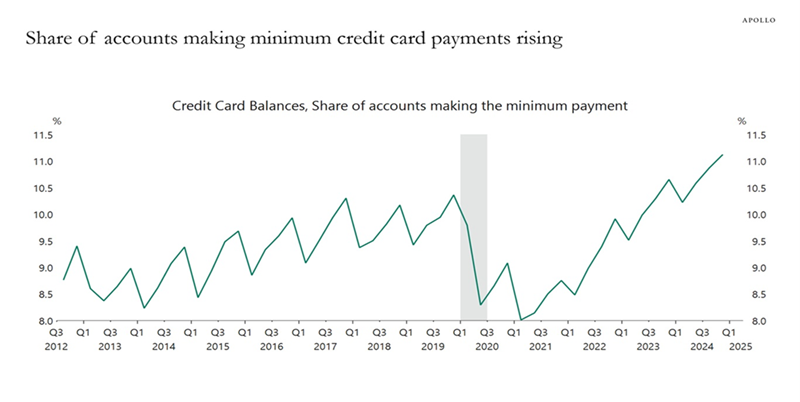

In this chart, from Apollo Global Management, we see that the total number of Americans who are only making the minimum payments on their credit cards is at its highest level in over a decade. This tells us that inflation and a slowdown in the job market are putting direct (and increasing) pressure on household budgets.

There are other signs, too. Like a Lending Tree survey showing that the percentage of Americans who use “buy now, pay later” services to buy groceries has more than doubled. That follows warnings from Walmart (WMT) a couple of months back (before President Trump’s April 2 tariff announcement) that more Americans are cutting back due to high interest rates and persistent inflation.

Recent Market Bounce Lets Us Prune Weaker Holdings

The natural instinct of mainstream investors is to sell and hide out when bad news arrives. But we’re income investors first and foremost, and the last thing we want to do is cut off our income streams.

In fact, times like these are exactly why we buy high-yielding investments such as closed-end funds (CEFs)! These funds’ high payouts (8%+ in the case of many CEFs) let us calmly fund our lives with our payouts when volatility hits.

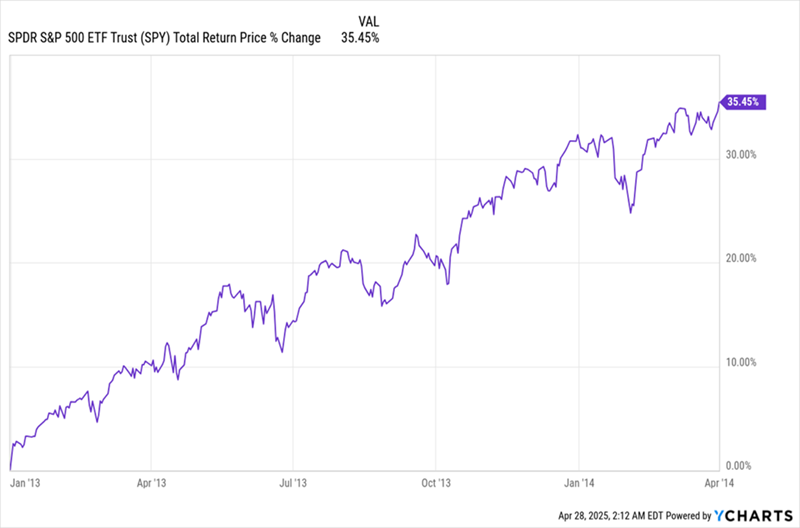

History also serves up example after example of why indiscriminate selling on bad economic news will hurt returns. Consider, for instance, the first peak in the chart above, at the start of 2013. If you’d sold then and waited to buy when the share of people paying the minimum on their debts bottomed out, in the spring of 2013, you would’ve missed out on a quick, steady return:

Panic Selling Would Have Meant Missing a 35% Return

Similar missed gains would’ve happened for someone who did the same at most of the peaks on the chart above.

Which brings me back to those three overbought funds we’re selling. In the CEF world, it’s easy to see if a fund is overbought: Simply look at its discount or premium to net asset value (NAV, or the value of its underlying portfolio). If the fund is trading at a premium to NAV—particularly at an extreme premium like the three funds below—it’s very likely overbought.

CEF Sell Call No. 1: The Destiny Tech100 Fund (DXYZ)

I warned about DXYZ in my February 27 article. Back then, the fund had an absurd 807% premium to NAV (not a typo!). As of this writing, it’s at a more “modest” 490% premium.

In part, that premium has shrunk because of the fund’s 6.6% decline between the time I wrote about it and now. But keep in mind that this fund’s return was actually down 29% until the last week of April. The volatility here is off the charts.

A Wild Ride for Persistent Losses

DXYZ’s focus on high-risk private companies has attracted a lot of attention and hype, but how long can that last if the market becomes more risk-averse and DXYZ is overpriced by nearly 500%? This is a clear sell, unless you want a roller coaster ride.

CEF Sell Call No. 2: Gabelli Utility Trust (GUT)

Our second top sell among CEFs is GUT, which is in many ways the opposite of DXYZ, focusing on utility stocks like NextEra Energy (NEE) and Duke Energy (DUK). But its premium to NAV is a whopping 71%. And for that, investors are getting a fund that has returned less than 2% in the last three years.

GUT: A High Premium for Meager Returns

Unless GUT swings to a lower premium or a discount, it’s best to leave it out of your portfolio, despite its 11.2% dividend yield.

CEF Sell Call No. 3: Barings Corporate Investors (MCI)

Some CEFs offer lower (for a CEF) yields that are considered sustainable and attract prudent income investors. The 7.8%-yielding Barings Corporate Investors (MCI) is an example here: It’s a well-managed fund with a long track record.

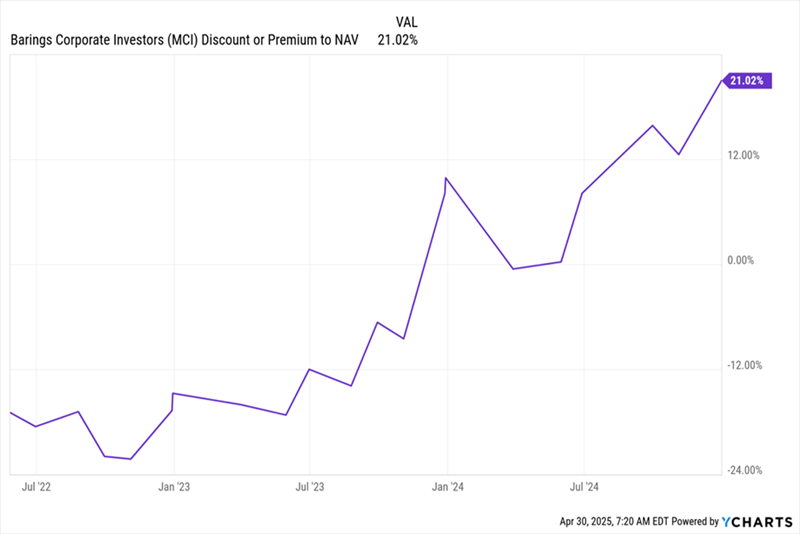

Unfortunately, though, now is not the time to buy MCI, because its premium is 21%, and that premium has been creeping up for years now:

MCI Keeps Getting Pricier …

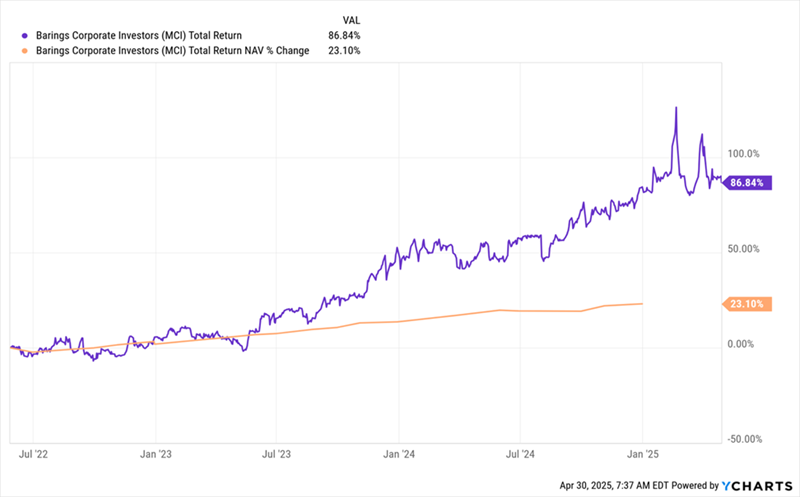

This has made MCI’s total return look impressive: Over the last three years, including dividends, investors have earned 87%, crushing the S&P 500’s still-impressive 41%. But that’s almost entirely due to the rising premium, since its portfolio of privately held debt hasn’t appreciated nearly as quickly—up about 23% as of the end of 2024, the last time it was publicly disclosed:

… But Its Portfolio Can’t Keep Up

On an annualized basis, that NAV return (in orange above), rose just an annualized 7.2%, much less than the stock market and much less than MCI’s payouts, which come to a 9.5% yield, based on the latest quarterly payout and per-share NAV, not the market price.

When MCI shareholders realize MCI is underperforming stocks and that its total profits can’t sustain its dividend, expect that premium to fade and MCI’s market price to fall. If MCI were to cut its payouts, that drop would be worse.

My Advice? Swap These 3 Overvalued Funds for My Top 4 CEFs to Buy Now

The best way to protect ourselves from risky funds like the ones we covered today? Shift into high-yielding CEFs that are trading at rare discounts.

I’ve hand-picked 4 such funds for you. Together, they kick out a reliable 9.8% average yield. And unlike GUT, MCI and DXYZ, they’re cheap now.

That makes these four funds the opposite of the bubble-priced CEFs we just discussed. Backed by strong fundamentals, they’re likely to get a lot of attention as the economy slows, rates fall and investors go looking for high, reliable income streams.

When that happens, their discounts are likely to snap shut fast.

That gives us two ways to win: big income streams and fast price gains when these funds’ discounts inevitably narrow.

Don’t miss your chance to buy these high-yield plays while they’re cheap: Click here and I’ll tell you more about these four 9.8%-paying funds and give you a free Special Report revealing their names and tickers.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report