Who’s up for speedy 80% stock gains? Believe it or not, there’s a “split secret” hiding in plain sight for us to apply.

Let’s discuss the details. And appreciate that we can tap this strategy using safe dividend paying stocks, too.

Believe it or not, stock splits can hand us a nice price bump. When a company—especially a top-notch dividend grower—splits its shares, the move draws in folks who’ve been holding off, seeing the pre-split price as too expensive.

Let’s be honest: we’ve all done this. How many times have we avoided a stock because it trades for $300 a share?

I know this stops folks—I hear it from readers of my Hidden Yields dividend-growth advisory regularly—even though we all know a stock’s price on its own doesn’t have much to do with its value. (At best it’s half the equation: for a real sense of value, we need to divide it into earnings per share or, better yet, free cash flow per share, a cleaner measure of a company’s cash generation.)

“Cheap” Shares: More Fun, Not Necessarily More Profitable

There are lots of reasons why folks have this hang-up on price.

Some still think of shares in “lots”—and a lot of 100 was the smallest you could buy years ago (even though you can buy any number now, and even fractions of shares with some brokerages).

And let’s be honest—it’s just more fun to buy more shares! Dropping $10,000 to buy 24 shares of $400-trader UnitedHealth Group (UNH) is underwhelming compared to picking up, say, 255 shares of $39-trader Pfizer Inc. (PFE) for the same $10K.

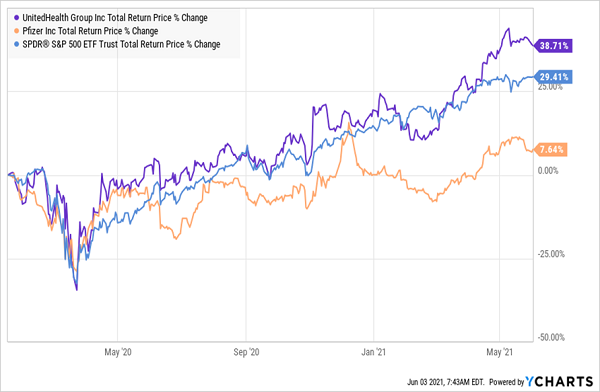

But we need to put this old bias to bed, because higher-priced stocks can, and do, outperform: if you sat out UNH (a potential splitter today, as we’ll see in a moment) in January 2020, when it traded at $300, you’d have missed a stock that’s beaten the “cheap” Pfizer and the S&P 500, too:

UNH Soars Despite Its “High” Price

I’m not pulling this UNH example out of the air—this is the return we bagged in Hidden Yields when we bought the stock in January ’20, “high” price and all. We did it by focusing on UNH’s soaring dividend—a proven gain predictor, as a fast-rising dividend acts like a magnet on a company’s share price.

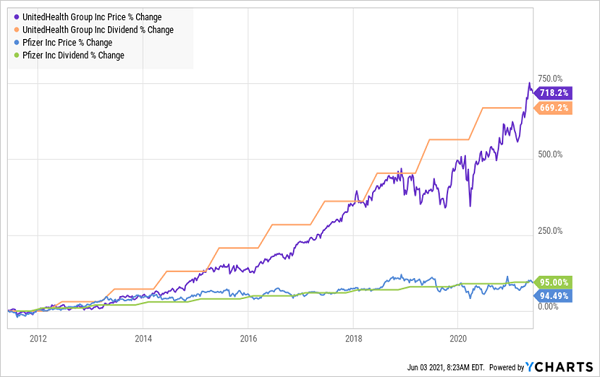

And when it comes to dividend (and share-price) growth, UNH is in a different league. Check out this chart of the last 10 years of both companies’ stock-price and dividend performance. You can clearly see their dividends and share prices tracking each other skyward—and UNH’s “dividend magnet” easily out-powering Pfizer’s.

UNH’s “Dividend Magnet” Outpulls PFE

Despite this history, UNH’s $300 price at the time still made some folks pause. This is where a split can come into play—and unlock a stock’s value as it pulls in hesitant shoppers like these.

How a Share Split Can Unlock Value

More on UNH in a second. First let’s talk more about splits, which, on their surface, are a wash. Management simply takes every share and splits it on a certain basis—three-to-one, say, or five-to-one. Both the value of your stake and your overall dividends stay the same, even though the number of shares you own multiplies.

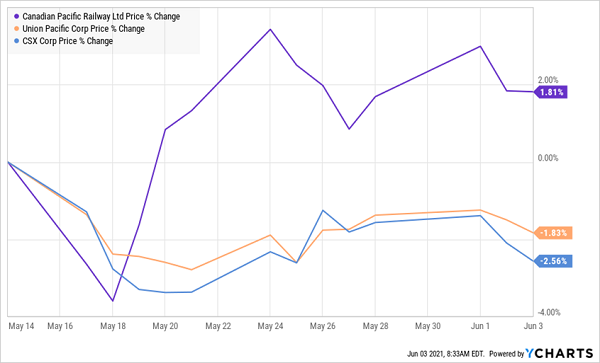

We just saw this happen with another of our Hidden Yields holdings: Canadian Pacific Railway (CP), which split its shares five-to-one on May 14. When the markets closed on May 13, our CP shares traded at $400—and when the markets opened the next day, they traded around $80, but we had five times more shares in our account.

And we do have some evidence of a post-split bounce with CP, which has outrun major railroads Union Pacific (UNP) and CSX Corp. (CSX) since every one of shareholders’ old CP shares turned into five new ones:

CP Gets a Post-Split Lift

(Thanks to this split “icing” on our train-trade cake, we are now up 80% on this position in just 14 months in my Hidden Yields service.)

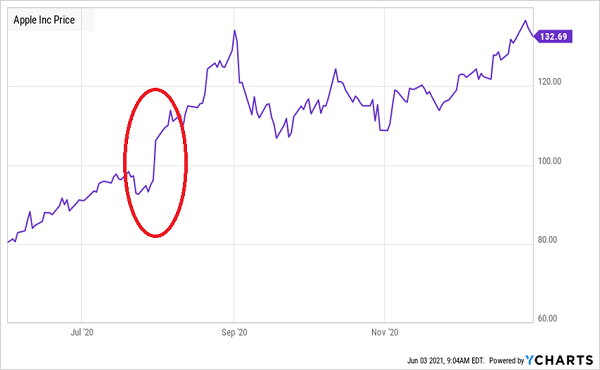

This is far from the first post-split bounce we’ve seen. Apple (AAPL), which has split its stock five times over its history, announced its latest split on July 30, 2020, and saw a quick pop from then till after the shares actually split a month later:

Apple Split Pulls in Reluctant Buyers

And look what happened to shares of chipmaker NVIDIA (NVDA), which announced on May 21 that it will split its shares four-for-one, with current shareholders slated to receive their new shares as a stock dividend on July 19, 2021:

NVIDIA Soars After Share-Split Announcement

Note that this gain came while the broader tech sector slumped. And it didn’t hurt that NVIDIA reported record revenue and earnings per share on May 26, something management was surely aware of when it made the share-split announcement. That highlights another reason why companies announce splits—to grab attention ahead of good news.

So what’s the takeaway here? Share splits can boost your returns—history proves it. And you can do even better when your share-splitter throws off a fast-growing dividend (which pulls up its price), too.

UNH Could Be the Next Stock to Split

That brings us back to UNH, which, as we saw earlier, boosted its dividend 699% in the last decade, driving its share price up in lockstep. Today, it trades near all-time highs. That’s one sign that some split-generated gains could be in the offing.

Here’s another: the company has split its stock five times in the past, with the most recent in 2005—so it’s definitely due to slice up its shares again.

7 “Hidden” Dividends Set to Soar 15%—Year in and Year Out (Forever)

Dividend growth is the driving force behind the 7 stocks I’m urging investors to buy NOW. These 7 firms are primed to ride their surging payouts (and potential share splits!) to steady 15%+ returns—year in and year out, like clockwork.

I call these companies “hidden yield” stocks because most investors don’t appreciate the many ways they pay us—through a current dividend, dividend growth and price upside, thanks to both their surging payouts and their bargain valuations.

But that’s set to change fast as today’s zero-point-nothing interest rates linger, driving income seekers into these sterling income-and-growth plays.

Now is the time for us to front-run them and grab a position. Click here and I’ll give you full details on these 7 outstanding dividend payers (and growers!), including their names, tickers, dividend histories and everything else you need to know.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report