Moore Capital Management LP acquired a new stake in The AZEK Company Inc. (NYSE:AZEK - Free Report) during the fourth quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The fund acquired 114,441 shares of the company's stock, valued at approximately $5,433,000. Moore Capital Management LP owned approximately 0.08% of AZEK at the end of the most recent quarter.

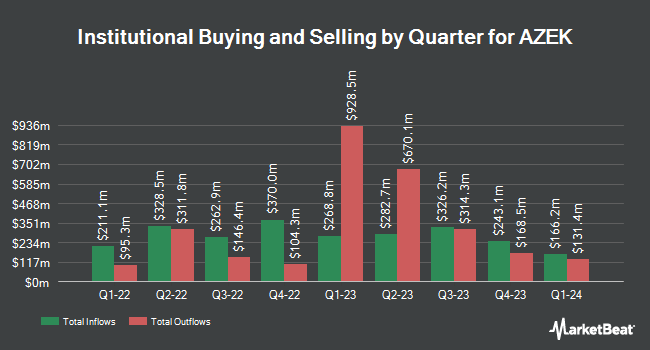

A number of other institutional investors and hedge funds have also recently bought and sold shares of AZEK. Blue Trust Inc. boosted its position in shares of AZEK by 94.2% during the 4th quarter. Blue Trust Inc. now owns 1,808 shares of the company's stock worth $85,000 after purchasing an additional 877 shares in the last quarter. Charles Schwab Investment Management Inc. lifted its stake in shares of AZEK by 2.1% in the fourth quarter. Charles Schwab Investment Management Inc. now owns 1,169,551 shares of the company's stock valued at $55,519,000 after purchasing an additional 24,249 shares during the period. Proficio Capital Partners LLC acquired a new stake in shares of AZEK in the fourth quarter valued at about $717,000. Raymond James Financial Inc. purchased a new position in AZEK in the fourth quarter valued at about $19,436,000. Finally, Sanctuary Advisors LLC lifted its position in shares of AZEK by 6.1% during the 4th quarter. Sanctuary Advisors LLC now owns 11,918 shares of the company's stock valued at $620,000 after acquiring an additional 689 shares during the period. Institutional investors and hedge funds own 97.44% of the company's stock.

AZEK Stock Performance

AZEK traded down $0.14 during trading on Friday, reaching $51.19. 1,565,105 shares of the company were exchanged, compared to its average volume of 2,212,393. The AZEK Company Inc. has a 52 week low of $35.48 and a 52 week high of $54.91. The company has a current ratio of 2.56, a quick ratio of 1.19 and a debt-to-equity ratio of 0.31. The stock has a market cap of $7.35 billion, a P/E ratio of 51.71, a PEG ratio of 1.91 and a beta of 1.86. The firm has a 50 day moving average of $47.07 and a 200 day moving average of $48.29.

AZEK (NYSE:AZEK - Get Free Report) last announced its quarterly earnings results on Tuesday, May 6th. The company reported $0.45 EPS for the quarter, beating the consensus estimate of $0.44 by $0.01. AZEK had a net margin of 9.85% and a return on equity of 13.47%. The company had revenue of $452.23 million for the quarter, compared to analyst estimates of $444.75 million. During the same quarter last year, the business earned $0.39 earnings per share. AZEK's revenue was up 8.1% compared to the same quarter last year. On average, sell-side analysts forecast that The AZEK Company Inc. will post 1.34 EPS for the current fiscal year.

Insider Buying and Selling

In related news, CEO Jesse G. Singh sold 15,000 shares of the business's stock in a transaction that occurred on Monday, March 10th. The shares were sold at an average price of $41.03, for a total value of $615,450.00. Following the sale, the chief executive officer now directly owns 868,765 shares in the company, valued at $35,645,427.95. The trade was a 1.70% decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. 3.20% of the stock is owned by corporate insiders.

Analysts Set New Price Targets

AZEK has been the topic of a number of research reports. Baird R W cut AZEK from a "strong-buy" rating to a "hold" rating in a report on Monday, March 24th. UBS Group dropped their price target on AZEK from $55.00 to $51.00 and set a "neutral" rating for the company in a research report on Wednesday, May 7th. Barclays lifted their target price on shares of AZEK from $53.00 to $57.00 and gave the stock an "overweight" rating in a research report on Thursday, May 8th. Citigroup reaffirmed a "neutral" rating and set a $51.50 price objective (down previously from $61.00) on shares of AZEK in a research note on Tuesday, March 25th. Finally, Wolfe Research reissued a "peer perform" rating on shares of AZEK in a research note on Wednesday, March 26th. Ten equities research analysts have rated the stock with a hold rating and seven have assigned a buy rating to the stock. According to data from MarketBeat.com, the stock presently has a consensus rating of "Hold" and a consensus target price of $53.93.

Get Our Latest Stock Report on AZEK

About AZEK

(

Free Report)

The AZEK Company Inc engages in the design, manufacturing, and selling of building products for residential, commercial, and industrial markets in the United States and Canada. It operates through two segments: Residential and Commercial. The Residential segment designs and manufactures engineered outdoor living products, such as decking, railing, trim and molding, siding and cladding, pergolas and cabanas, and accessories under the TimberTech, AZEK Exteriors, VERSATEX, ULTRALOX, StruXure, and INTEX brands.

Further Reading

Before you consider AZEK, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AZEK wasn't on the list.

While AZEK currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.