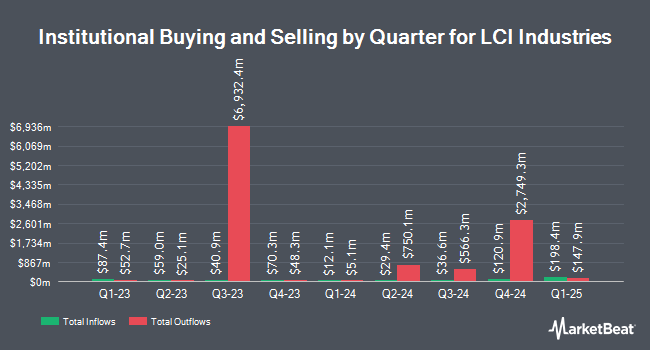

Integrated Quantitative Investments LLC acquired a new stake in shares of LCI Industries (NYSE:LCII - Free Report) during the 4th quarter, according to its most recent filing with the SEC. The institutional investor acquired 11,700 shares of the company's stock, valued at approximately $1,210,000.

Other large investors also recently modified their holdings of the company. Centiva Capital LP bought a new stake in shares of LCI Industries in the 3rd quarter worth approximately $628,000. Readystate Asset Management LP bought a new position in LCI Industries during the 3rd quarter valued at approximately $500,000. Stifel Financial Corp lifted its holdings in LCI Industries by 0.3% in the 3rd quarter. Stifel Financial Corp now owns 82,563 shares of the company's stock worth $9,952,000 after buying an additional 242 shares during the period. Stadium Capital Management LLC bought a new stake in shares of LCI Industries in the 3rd quarter worth approximately $2,412,000. Finally, XTX Topco Ltd purchased a new position in shares of LCI Industries during the third quarter valued at approximately $770,000. 99.71% of the stock is owned by hedge funds and other institutional investors.

Analyst Ratings Changes

LCII has been the topic of several recent analyst reports. StockNews.com cut shares of LCI Industries from a "buy" rating to a "hold" rating in a report on Monday, March 31st. Baird R W lowered shares of LCI Industries from a "strong-buy" rating to a "hold" rating in a report on Friday, April 4th. CJS Securities upgraded LCI Industries from a "market perform" rating to an "outperform" rating and set a $145.00 target price on the stock in a report on Wednesday, February 12th. Robert W. Baird reaffirmed a "neutral" rating and issued a $100.00 price target (down from $130.00) on shares of LCI Industries in a research note on Friday, April 4th. Finally, Truist Financial boosted their target price on shares of LCI Industries from $102.00 to $108.00 and gave the company a "hold" rating in a report on Monday, February 10th. Six investment analysts have rated the stock with a hold rating and two have given a buy rating to the company. According to data from MarketBeat.com, the stock has a consensus rating of "Hold" and a consensus target price of $117.20.

Check Out Our Latest Report on LCII

LCI Industries Stock Down 1.6 %

Shares of NYSE:LCII traded down $1.21 on Wednesday, hitting $73.86. 268,157 shares of the company traded hands, compared to its average volume of 268,216. The stock has a 50 day simple moving average of $96.55 and a 200-day simple moving average of $107.29. The company has a quick ratio of 1.03, a current ratio of 2.82 and a debt-to-equity ratio of 0.55. The company has a market cap of $1.86 billion, a PE ratio of 13.15 and a beta of 1.36. LCI Industries has a 52 week low of $72.36 and a 52 week high of $129.38.

LCI Industries (NYSE:LCII - Get Free Report) last released its quarterly earnings data on Tuesday, February 11th. The company reported $0.37 earnings per share for the quarter, beating analysts' consensus estimates of $0.31 by $0.06. LCI Industries had a net margin of 3.82% and a return on equity of 10.28%. As a group, research analysts expect that LCI Industries will post 6.76 earnings per share for the current year.

LCI Industries Dividend Announcement

The firm also recently announced a quarterly dividend, which was paid on Friday, March 21st. Shareholders of record on Friday, March 7th were paid a dividend of $1.15 per share. The ex-dividend date was Friday, March 7th. This represents a $4.60 annualized dividend and a yield of 6.23%. LCI Industries's dividend payout ratio is 82.14%.

LCI Industries Company Profile

(

Free Report)

LCI Industries, together with its subsidiaries, manufactures and supplies engineered components for the manufacturers of recreational vehicles (RVs) and adjacent industries in the United States and internationally. It operates through two segments: Original Equipment Manufacturers (OEM) and Aftermarket.

Read More

Before you consider LCI Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and LCI Industries wasn't on the list.

While LCI Industries currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.