Solel Partners LP acquired a new stake in Paramount Group, Inc. (NYSE:PGRE - Free Report) in the 4th quarter, according to its most recent disclosure with the Securities and Exchange Commission. The firm acquired 1,360,076 shares of the financial services provider's stock, valued at approximately $6,719,000. Paramount Group comprises about 1.3% of Solel Partners LP's investment portfolio, making the stock its 17th biggest position. Solel Partners LP owned about 0.63% of Paramount Group as of its most recent SEC filing.

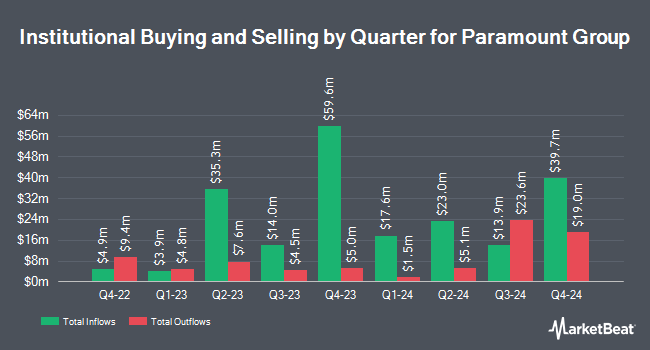

A number of other hedge funds have also bought and sold shares of the stock. Sterling Capital Management LLC raised its position in Paramount Group by 806.3% during the fourth quarter. Sterling Capital Management LLC now owns 5,909 shares of the financial services provider's stock valued at $29,000 after acquiring an additional 5,257 shares in the last quarter. Commerce Bank purchased a new position in shares of Paramount Group during the 4th quarter valued at approximately $54,000. Greenleaf Trust acquired a new stake in shares of Paramount Group in the fourth quarter valued at about $63,000. US Bancorp DE boosted its holdings in shares of Paramount Group by 33.9% during the 4th quarter. US Bancorp DE now owns 14,656 shares of the financial services provider's stock worth $72,000 after purchasing an additional 3,708 shares during the last quarter. Finally, Inspire Investing LLC purchased a new stake in Paramount Group in the 4th quarter valued at $76,000. Institutional investors and hedge funds own 65.64% of the company's stock.

Insider Transactions at Paramount Group

In related news, CEO Albert P. Behler bought 10,000 shares of the company's stock in a transaction dated Friday, March 21st. The shares were acquired at an average price of $4.15 per share, with a total value of $41,500.00. Following the completion of the acquisition, the chief executive officer now owns 751,812 shares in the company, valued at approximately $3,120,019.80. This trade represents a 1.35 % increase in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Insiders own 13.80% of the company's stock.

Analyst Upgrades and Downgrades

Several research analysts have recently commented on PGRE shares. Mizuho reduced their price target on Paramount Group from $6.00 to $5.00 and set an "outperform" rating on the stock in a report on Tuesday, February 25th. StockNews.com lowered shares of Paramount Group from a "hold" rating to a "sell" rating in a report on Wednesday, April 23rd. Finally, Morgan Stanley restated an "underweight" rating and set a $3.25 price target on shares of Paramount Group in a report on Tuesday, April 15th.

Get Our Latest Stock Analysis on Paramount Group

Paramount Group Trading Up 2.1 %

PGRE stock traded up $0.10 during mid-day trading on Wednesday, hitting $4.72. 209,264 shares of the company were exchanged, compared to its average volume of 1,233,881. Paramount Group, Inc. has a 12-month low of $3.75 and a 12-month high of $5.47. The firm has a market capitalization of $1.03 billion, a P/E ratio of -4.82 and a beta of 1.12. The business has a fifty day simple moving average of $4.24 and a 200-day simple moving average of $4.62. The company has a quick ratio of 4.45, a current ratio of 4.45 and a debt-to-equity ratio of 0.91.

Paramount Group (NYSE:PGRE - Get Free Report) last issued its quarterly earnings results on Wednesday, April 30th. The financial services provider reported $0.17 earnings per share (EPS) for the quarter, hitting the consensus estimate of $0.17. Paramount Group had a negative net margin of 27.92% and a negative return on equity of 5.26%. The business had revenue of $187.02 million for the quarter, compared to analysts' expectations of $180.79 million. On average, equities research analysts predict that Paramount Group, Inc. will post 0.78 earnings per share for the current fiscal year.

About Paramount Group

(

Free Report)

Paramount Group, Inc ("Paramount" or the "Company") is a fully-integrated real estate investment trust that owns, operates, manages, acquires and redevelops high-quality, Class A office properties located in select central business district submarkets of New York and San Francisco. Paramount is focused on maximizing the value of its portfolio by leveraging the sought-after locations of its assets and its proven property management capabilities to attract and retain high-quality tenants.

Recommended Stories

Before you consider Paramount Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Paramount Group wasn't on the list.

While Paramount Group currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.