J. Stern & Co. LLP bought a new position in Applied Materials, Inc. (NASDAQ:AMAT - Free Report) in the 4th quarter, according to the company in its most recent 13F filing with the SEC. The firm bought 2,800 shares of the manufacturing equipment provider's stock, valued at approximately $455,000.

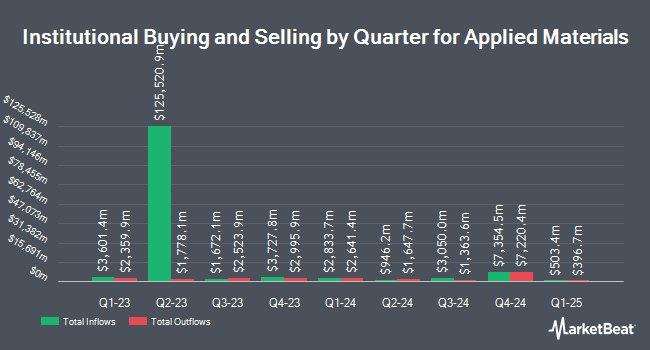

Other large investors have also added to or reduced their stakes in the company. Advisory Resource Group boosted its position in shares of Applied Materials by 22.5% during the 3rd quarter. Advisory Resource Group now owns 24,867 shares of the manufacturing equipment provider's stock valued at $5,024,000 after acquiring an additional 4,561 shares during the last quarter. SkyView Investment Advisors LLC lifted its position in Applied Materials by 3.7% in the 3rd quarter. SkyView Investment Advisors LLC now owns 3,746 shares of the manufacturing equipment provider's stock worth $757,000 after buying an additional 133 shares during the last quarter. Pine Valley Investments Ltd Liability Co lifted its position in Applied Materials by 26.4% in the 3rd quarter. Pine Valley Investments Ltd Liability Co now owns 47,649 shares of the manufacturing equipment provider's stock worth $9,627,000 after buying an additional 9,941 shares during the last quarter. World Investment Advisors LLC lifted its position in Applied Materials by 70.6% in the 3rd quarter. World Investment Advisors LLC now owns 9,845 shares of the manufacturing equipment provider's stock worth $1,989,000 after buying an additional 4,073 shares during the last quarter. Finally, Sfmg LLC lifted its position in Applied Materials by 0.4% in the 3rd quarter. Sfmg LLC now owns 54,967 shares of the manufacturing equipment provider's stock worth $11,106,000 after buying an additional 219 shares during the last quarter. Institutional investors own 80.56% of the company's stock.

Wall Street Analysts Forecast Growth

AMAT has been the subject of a number of recent research reports. Wells Fargo & Company dropped their target price on Applied Materials from $210.00 to $200.00 and set an "overweight" rating for the company in a research report on Monday, January 13th. Jefferies Financial Group raised Applied Materials from a "hold" rating to a "buy" rating and set a $195.00 price target on the stock in a research note on Friday, March 28th. Edward Jones raised Applied Materials from a "hold" rating to a "buy" rating in a research note on Wednesday, March 12th. Bank of America decreased their price target on Applied Materials from $205.00 to $190.00 and set a "buy" rating on the stock in a research note on Wednesday, April 16th. Finally, Mizuho decreased their price target on Applied Materials from $220.00 to $210.00 and set an "outperform" rating on the stock in a research note on Friday, January 10th. One research analyst has rated the stock with a sell rating, six have issued a hold rating and seventeen have given a buy rating to the company's stock. According to data from MarketBeat.com, Applied Materials has a consensus rating of "Moderate Buy" and a consensus target price of $208.86.

Read Our Latest Analysis on AMAT

Insider Transactions at Applied Materials

In related news, CAO Adam Sanders sold 450 shares of the business's stock in a transaction that occurred on Tuesday, April 1st. The shares were sold at an average price of $144.83, for a total transaction of $65,173.50. Following the completion of the sale, the chief accounting officer now directly owns 6,077 shares in the company, valued at approximately $880,131.91. The trade was a 6.89 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which can be accessed through the SEC website. Also, CEO Gary E. Dickerson bought 50,000 shares of the business's stock in a transaction that occurred on Thursday, April 3rd. The shares were acquired at an average price of $137.30 per share, with a total value of $6,865,000.00. Following the completion of the transaction, the chief executive officer now directly owns 1,716,058 shares of the company's stock, valued at $235,614,763.40. This trade represents a 3.00 % increase in their position. The disclosure for this purchase can be found here. Company insiders own 0.24% of the company's stock.

Applied Materials Stock Performance

Shares of AMAT stock traded down $1.45 during trading hours on Tuesday, reaching $149.34. The company had a trading volume of 2,136,693 shares, compared to its average volume of 6,667,264. The business has a fifty day moving average price of $149.08 and a 200-day moving average price of $167.94. Applied Materials, Inc. has a one year low of $123.74 and a one year high of $255.89. The firm has a market cap of $121.33 billion, a PE ratio of 19.53, a price-to-earnings-growth ratio of 1.81 and a beta of 1.61. The company has a debt-to-equity ratio of 0.29, a quick ratio of 1.96 and a current ratio of 2.67.

Applied Materials (NASDAQ:AMAT - Get Free Report) last announced its quarterly earnings results on Thursday, February 13th. The manufacturing equipment provider reported $2.38 EPS for the quarter, topping analysts' consensus estimates of $2.28 by $0.10. Applied Materials had a net margin of 22.95% and a return on equity of 39.50%. Sell-side analysts predict that Applied Materials, Inc. will post 9.38 earnings per share for the current fiscal year.

Applied Materials Increases Dividend

The business also recently declared a quarterly dividend, which will be paid on Thursday, June 12th. Stockholders of record on Thursday, May 22nd will be paid a $0.46 dividend. The ex-dividend date is Thursday, May 22nd. This is a positive change from Applied Materials's previous quarterly dividend of $0.40. This represents a $1.84 dividend on an annualized basis and a dividend yield of 1.23%. Applied Materials's payout ratio is currently 24.05%.

Applied Materials declared that its board has authorized a share buyback program on Monday, March 10th that permits the company to repurchase $10.00 billion in shares. This repurchase authorization permits the manufacturing equipment provider to repurchase up to 8.2% of its stock through open market purchases. Stock repurchase programs are usually an indication that the company's board of directors believes its stock is undervalued.

About Applied Materials

(

Free Report)

Applied Materials, Inc engages in the provision of manufacturing equipment, services, and software to the semiconductor, display, and related industries. The company operates through three segments: Semiconductor Systems, Applied Global Services, and Display and Adjacent Markets. The Semiconductor Systems segment develops, manufactures, and sells various manufacturing equipment that is used to fabricate semiconductor chips or integrated circuits.

See Also

Before you consider Applied Materials, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Applied Materials wasn't on the list.

While Applied Materials currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report