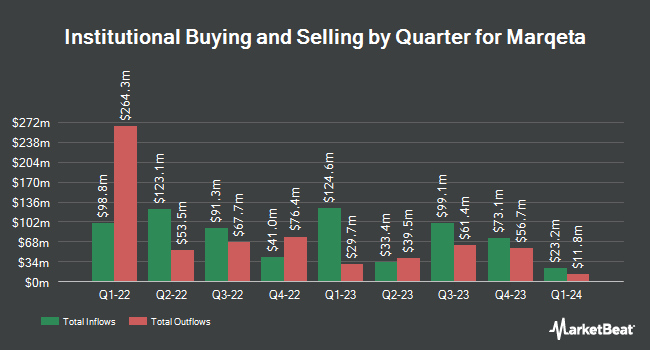

Aquatic Capital Management LLC bought a new position in Marqeta, Inc. (NASDAQ:MQ - Free Report) in the fourth quarter, according to the company in its most recent disclosure with the SEC. The institutional investor bought 357,176 shares of the company's stock, valued at approximately $1,354,000. Aquatic Capital Management LLC owned approximately 0.07% of Marqeta as of its most recent SEC filing.

Other institutional investors and hedge funds have also bought and sold shares of the company. Nordea Investment Management AB raised its position in shares of Marqeta by 107.8% in the 4th quarter. Nordea Investment Management AB now owns 851,278 shares of the company's stock worth $3,265,000 after acquiring an additional 441,617 shares in the last quarter. Congress Asset Management Co. grew its stake in Marqeta by 7.6% during the fourth quarter. Congress Asset Management Co. now owns 1,135,842 shares of the company's stock worth $4,305,000 after purchasing an additional 80,161 shares during the period. Xponance Inc. increased its holdings in Marqeta by 11.5% in the fourth quarter. Xponance Inc. now owns 34,314 shares of the company's stock worth $130,000 after purchasing an additional 3,546 shares in the last quarter. Quantbot Technologies LP acquired a new position in Marqeta in the fourth quarter valued at approximately $235,000. Finally, JPMorgan Chase & Co. boosted its holdings in shares of Marqeta by 263.0% during the 3rd quarter. JPMorgan Chase & Co. now owns 1,320,893 shares of the company's stock worth $6,499,000 after buying an additional 956,992 shares in the last quarter. Institutional investors and hedge funds own 78.64% of the company's stock.

Wall Street Analysts Forecast Growth

A number of research analysts recently issued reports on the stock. The Goldman Sachs Group dropped their target price on shares of Marqeta from $4.50 to $4.00 and set a "neutral" rating on the stock in a research report on Wednesday, April 2nd. Wells Fargo & Company dropped their price objective on shares of Marqeta from $5.00 to $4.00 and set an "equal weight" rating on the stock in a report on Thursday, January 16th. Finally, Keefe, Bruyette & Woods reduced their target price on Marqeta from $5.00 to $4.00 and set a "market perform" rating for the company in a research note on Monday, January 6th. Eleven equities research analysts have rated the stock with a hold rating and three have issued a buy rating to the stock. Based on data from MarketBeat.com, Marqeta has an average rating of "Hold" and a consensus price target of $5.29.

Read Our Latest Report on MQ

Marqeta Stock Performance

Shares of Marqeta stock traded up $0.02 on Monday, hitting $3.87. The company had a trading volume of 1,856,013 shares, compared to its average volume of 6,295,003. The stock has a market capitalization of $1.95 billion, a price-to-earnings ratio of 193.25 and a beta of 1.42. Marqeta, Inc. has a 1 year low of $3.37 and a 1 year high of $6.01. The stock has a 50 day moving average of $4.05 and a 200-day moving average of $4.04.

Marqeta (NASDAQ:MQ - Get Free Report) last released its quarterly earnings results on Wednesday, February 26th. The company reported ($0.05) EPS for the quarter, beating analysts' consensus estimates of ($0.10) by $0.05. The business had revenue of $135.79 million during the quarter, compared to analyst estimates of $132.71 million. Marqeta had a return on equity of 1.20% and a net margin of 2.86%. Equities analysts anticipate that Marqeta, Inc. will post 0.06 earnings per share for the current year.

Marqeta Profile

(

Free Report)

Marqeta, Inc operates a cloud-based open application programming interface platform that delivers card issuing and transaction processing services. It offers its solutions in various verticals, including financial services, on-demand services, expense management, and e-commerce enablement, as well as buy now, pay later.

Further Reading

Before you consider Marqeta, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Marqeta wasn't on the list.

While Marqeta currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.