Read on to learn more about identifying good dividend REITs and how to use these investment opportunities in a way that limits your risk.

What is a REIT?

A real estate investment trust (REIT) is a company that owns and operates or finances income-producing properties. Most REITs work relatively straightforwardly, managing commercial or residential spaces, renting them out to tenants and returning a portion of rent to shareholders in the form of dividends. Some REITs also offer property finance services, including personal and commercial mortgage loans. Congress established the REIT structure in the 1960s to provide individuals with a method to invest in large-scale property investments.

Why Do REITs Pay High Dividends?

Many investors are attracted to high dividend REIT investment opportunities because REITs are one of the only company structures legally required to pay dividends to investors. To maintain its status as a REIT, a REIT company must pay out at least 90% of its taxable income to shareholders. The highest dividend REITs may even pay a monthly dividend to keep up with government-required investor payments.

A company that qualifies as a REIT must issue dividends to maintain this status as long as it profits. Many REITs aim to pay out more than 90% of its income to investors to compete for the title of the highest dividend REIT and attract new funds for projects. You can tell how much a REIT will pay in a dividend by examining the dividend yield and comparing it to the current share price.

Example of a REIT

A quintessential example of a REIT, Whitestone REIT (NYSE: WSR) specializes in maintaining and operating community-centered properties in major metropolitan areas. Whitestone owns a diversified portfolio of commercial properties in densely populated areas of Texas, Arizona and Illinois. These properties typically cater to local residents and small businesses, offering a mix of retail, office and other commercial spaces.

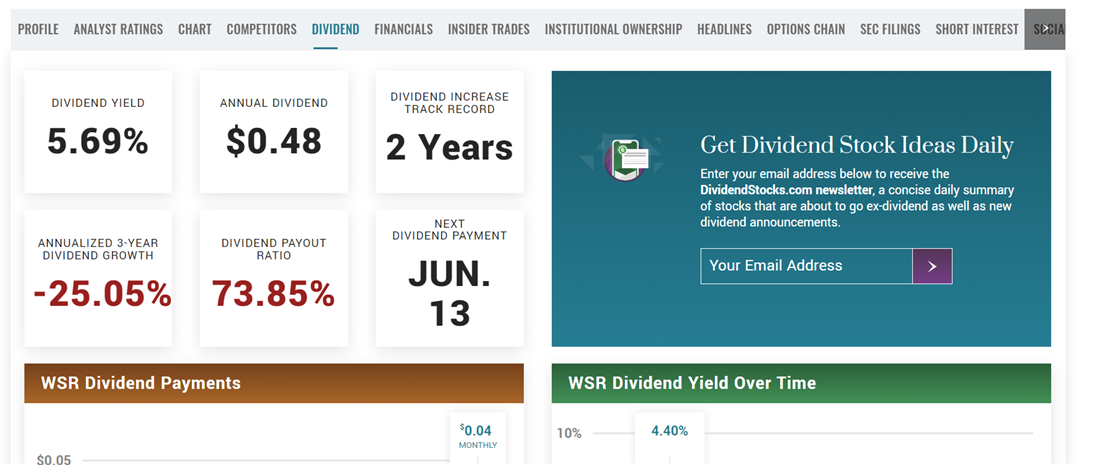

Image: Like other high-dividend REITs, Whitestone aims to increase its dividend for as many consecutive years as possible.

Like many other REITs, Whitestone aims to increase its dividend track record year after year. Whitestone currently has a track record of increasing its dividend for the previous two years, which does not qualify it as a dividend contender or champion. It showcases a healthy dividend yield percentage of 5.69% as of May 2023, which means that it pays out about 5.69% of the stock's share value each year. Its next dividend payment will pay out on June 13, with an estimated value of four cents. Whitestone pays a monthly dividend, which can create a consistent and predictable stream of reinvestment capital for investors.

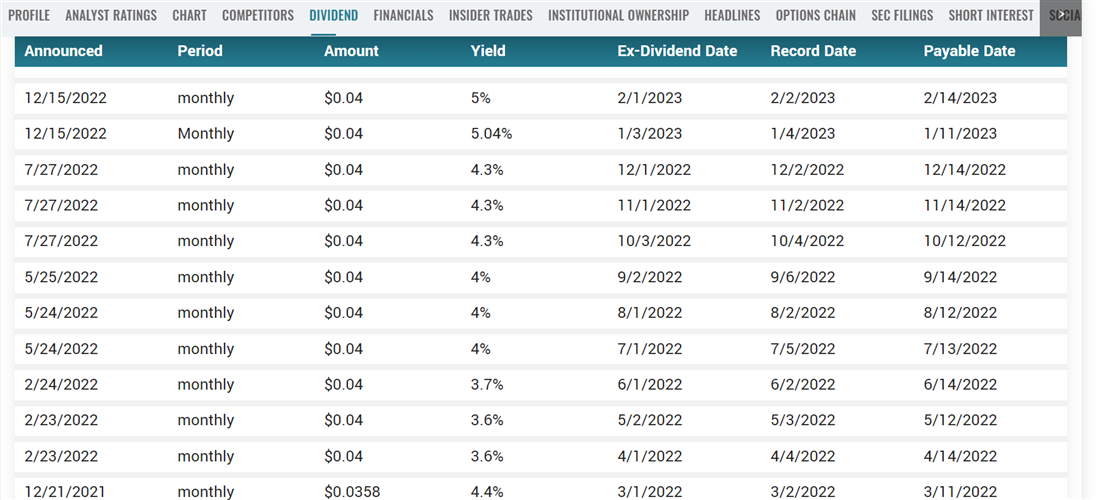

Image text: Whitestone REIT offers a monthly dividend to investors, which may encourage long-term holding among investors.

How to Evaluate High Dividend REITs

When investing for passive income, investing all your funds in the highest dividend REITs can be tempting. While dividend yield is a key factor, it shouldn't be the only thing you consider when choosing the best dividend REITs. The following are a few additional factors to help you maximize the benefits REITs can offer you.

Diversification

REITs expose you to the real estate asset class, which has different risk and return characteristics than traditional stocks and bonds. Including REITs in a portfolio allows investors to diversify beyond traditional asset classes and benefit from real estate's income potential and capital appreciation. If you don't have the funds to invest in real estate directly or you're looking for a more passive way to capitalize on real estate market movements, REITs can provide an ideal solution.

You can further diversify your investment by investing in multiple real estate classes within the real estate sector. Major REITs operate in individual market sectors; these companies usually own properties around a select few states. Including multiple REIT types (for example, commercial property and healthcare property investments) can help diversify your portfolio and limit losses.

Hedge Against Inflation

Multiple characteristics of REITs make them higher-value assets in an environment of high inflation. REITs derive a significant portion of their revenue from rental income generated by their real estate properties. As inflation occurs, the cost of living and operating expenses, including property operating expenses, tends to rise.

In response, landlords often can increase rental rates over time to keep pace with inflation. This potential for rental income adjustments allows REITs to capture increased cash flows from their properties and maintain income growth in an inflationary environment.

Property prices and values also tend to rise when inflation is high. Many REITs own underlying, tangible real estate investments, which leads to increased share prices based on the land ownership or value of the leases issued. While these REITs may see increased capital appreciation in times of inflation, mortgage REITs may be at a higher risk of volatility. Understanding these types of REITs and diversifying the types of REITs you include in your asset mix can make dividend investing less risky.

How to Pick the Best High Dividend REITs

Now that you understand how to evaluate REITs and some of the benefits these companies can add to your portfolio, it's time to start investigating your investment options. Here's how to select a REIT with a high dividend to add to your portfolio.

Step 1: Consider stocks vs. ETFs.

When investing in REITs, you can purchase either individual stocks or exchange-traded funds (ETFs) that include REIT investments. ETFs are collections of stocks that trade together as a single unit throughout the day on major stock markets. Investing in an ETF over individual shares of stocks can limit your risk of loss as an investor, as these assets spread your risk among multiple companies.

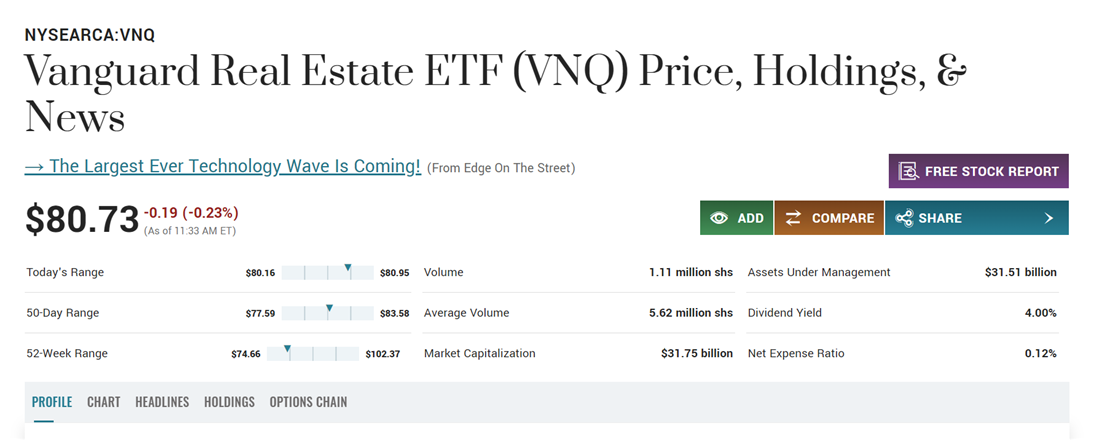

Image: The Vanguard Real Estate ETF (NYSE: VNQ) is an example of a REIT ETF that provides a solid dividend.

Image: The Vanguard Real Estate ETF (NYSE: VNQ) is an example of a REIT ETF that provides a solid dividend.

As you research, consider the benefits ETFs can offer over shares of stock. Both assets can provide consistent, high dividends when concentrated in the REIT sector, but ETFs manage risk by investing in multiple income-generating assets. Consider dividend yields when comparing investments and note each ETF's expense ratio when calculating anticipated returns.

Step 2: Consider industry and sector.

Once you've found a potential investment, learn how the business operates and what types of assets it considers for its portfolio. Assess the overall economic conditions and prospects for the specific industry sector in which the REIT operates. Factors such as population growth in the area where the REIT operates and employment trends can be key factors to research when considering the REIT's growth potential.

Pay special attention to the property types the REIT invests in and their suitability for the current market conditions. Different property types have varying risk profiles. For example, while healthcare facilities have higher operating costs than most commercial shopping centers, cutting into profits for investors, they also have higher consumer demand levels. If you aren't investing in a diversified ETF, you may want to consider investing in multiple REITs operating in different sectors.

Step 3: Look at portfolio assets.

When investing in individual stocks, you must review the company's current portfolio of assets before investing. While examining company financials and overall sector is essential, looking at the individual operations the REIT invests in can provide a more concrete look at what you're investing in. You should be able to access your REIT's portfolio information through its website or investor reports.

Step 4: Place a buy order and monitor your investment.

Once you've created a watchlist of REITs and REIT investments you're considering, choose an entry point and place a buy order through your brokerage account. Monitor your investment and how it changes in value over time. As the REIT produces dividends, you'll see them automatically deposited into the brokerage account that holds your shares.

Long-term investors may want to enable automatic dividend reinvestments, which reinvest dividends back into the issuing stock at the current market rate at the time of payment. You can also choose to take the dividend in cash.

Are High Dividend REITs Safe?

While high dividend REITs may be legally required to offer a dividend distribution, these assets can be more volatile than other options like blue-chip investments. REITs' performances are closely tied to the performance of the real estate markets, which means that investors may be subject to losses if the market takes a negative turn.

You can take steps to limit your risk of losses when investing in high dividend REITs. Reviewing a REIT's debt levels and interest rate exposure is crucial; high levels of debt and variable interest rates can increase the financial risk of the REIT and potentially impact its ability to maintain dividend payments. Also, pay attention to dividend yield and sustainability instead of purchasing the REITs with the highest payouts. Generally, dividend yield rates above 10% are considered riskier and less likely to be sustainable.

Outlook for REITs

In the past year, investors have been subject to historic inflation levels. However, a contracting circulating cash supply may indicate that the worst is behind us as the market moves toward a period of recession. REITs may be poised to perform exceptionally well in the second half of 2023 and beyond, especially as a lack of residential properties for sale further increases the cost of housing.

Investing in Real Estate through REITs

While high dividend REITs can provide an attractive incentive to investors, it's important to remember that these payments may increase the likelihood that an asset is overvalued. Comparing debt levels and choosing investments with sustainable dividends can create a more reliable passive income stream for you as an investor. Use REITs to complement a fully diversified investment portfolio of blue-chip and growth-oriented options.

FAQs

Before continuing your research, learn the answers to a few last-minute questions you might have about high dividend REITs and other income-generating assets.

What is a typical dividend for a REIT?

In March 2023, the average REIT paid a dividend yield of 3.49%. While it's possible to find REITs with yields as high as 10% or more, these payments are less sustainable and can be at a higher risk of cuts.

What is the most profitable REIT to invest in?

Why not invest in REITs?

REIT values are highly tied to the real estate market's performance, which can be more volatile. Changes in tax laws or regulations related to REITs can also impact their ability to distribute dividends or qualify for tax benefits, reducing your returns as an investor.