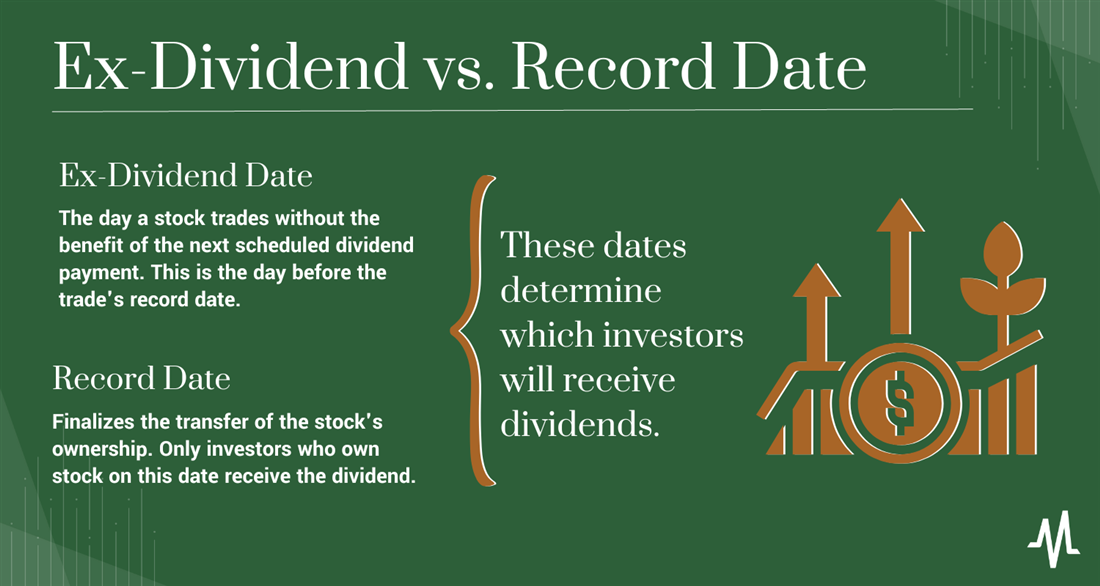

In this article, you'll learn the difference between the two most decisive dates on the dividend calendar: the ex-dividend date vs. the record date. You'll also learn why these dates are set the way they are and how to leverage the calendar for specific dividend investment strategies.

Overview: Ex dividend date and record date

Dividends make up a substantial portion of annual stock returns. Of course, the total dividend contribution varies yearly, and today, companies pay out fewer dividends than they did in the 1960s and 1970s.

But during the decade lasting from 2010 to 2020, dividends still accounted for 17% of the S&P 500's total return. Compound interest is a powerful force — combining it with dividend reinvestment is like feeding performance enhancers to an Olympian.

However, owning a company's stock doesn't necessarily entitle you to its dividend. Instead, you must own the stock at a specific time to earn the dividend, so you'll see a feature like a dividend calendar on your brokerage account. The dividend calendar breaks into a few critical dates — always beware of these if you're frequently trading.

Ex dividend date

What is ex dividend date?

Imagine the ex-dividend date like it's the Super Bowl for dividends. You can attend the game if you purchase a ticket to the Super Bowl before kickoff. It doesn't matter if you bought your tickets two months or two days ago — as long as you have them by the start of the game, you can get in.

The ex-dividend date works similarly, and your shares are the tickets. You'll get the dividend payment if you own shares at least one day before the ex-dividend date. If you buy shares on or after the ex-dividend date, you won't get the dividend from that particular quarter. You don't need to hold your shares through the ex-dividend date. You'd get the dividend if you were on record as a shareholder before the close of the preceding market session. Note that if you sell your shares before the end of the session, the person who acquires and holds them through close will get the dividend.

Record date

The record date is less important than the ex-dividend date. On the record date, the company makes a note of eligible dividend recipients on their books. The record date usually comes two days after the ex-dividend date, so all stock trades can settle and give the company full scope of who owned stock before the cutoff. Investors can note the record date on their calendars, but it's merely a company bookkeeping day for the executives.

Other important dates

Each quarterly dividend calendar will have four particular dates of interest to investors. The ex-dividend date is the big one, but you should also be aware of these two other dates when using dividend investing strategies:

- Declaration date: The first entry on the dividend calendar is the declaration date, which usually occurs at least a week before the ex-dividend date. On the declaration date, the company's board sits down and determines how much its quarterly net profits will return to shareholders. Once the board decides, the company announces it, so shareholders know their dividend payout.

- Payout date: Finally, investors get shown the money. The payout date is when dividend payments arrive in the brokerage accounts of eligible shareholders. Dividends are usually paid out in cash, although many companies have an option for shareholders to reinvest their dividends back into the stock automatically.

Record date vs ex dividend date example

Let’s put dividend investing into practice with an example. One of the most generous dividend payers is industrial supplier W.W. Grainger Inc. (NYSE: GWW), a member of the elite Dividend Kings group with 52 years of dividend payout increases. Grainger has an annual dividend payout of $7.44, split into four quarterly payments.

Long-term investors can simply own GWW shares and count the dividends as they add up. But if you're trading based on a dividend capture strategy, you'll need to mark down these four dates:

- Declaration date

- Ex-dividend date

- Record date

- Payout date

The company will announce the dividend on the declaration date and let investors know how much they'll receive. For Grainger, the declaration date is October 25. A week later, the ex-dividend date will occur. If you want to receive the dividend, you'll need to own the stock BEFORE the ex-date, which in this scenario is November 10. Note that the exchanges set the ex-dividend date, not the company itself. The company sets the record date (November 13), and the exchange marks the ex-dividend date for settlement purposes.

To receive the dividend, shares must be owned by the end of the November 9 trading session. The end of the session before the ex-date is like the clock striking midnight on Cinderella’s enchantment. If you don’t have the shares in your brokerage account by the close of the previous session, you won’t be entitled to that period’s dividend.

You don’t even need to hold GWW shares through the ex-dividend date! As soon as the market opens on the ex-date, you can sell your shares and still receive the dividend on the payout date (December 1, in the case of GWW). Even though three weeks will have passed without you owning the shares, the GWW dividend will still hit your brokerage account on December 1. Many brokerages allow clients to reinvest their dividends into the stock through fractional shares, or you can simply receive a cash payment. Note that dividends will be taxed as ordinary income when using trading strategies like dividend capture, so always stay on top of your tax planning process.

Note: Use MarketBeat's dividend screener to search for yields, payouts and dates.

Who sets the ex dividend date?

The stock exchanges, not the individual public companies, give the ex dividend date meaning. The firm issuing the stock manages the declaration date, record date and payout date, but the exchange sets the ex-dividend date.

In the example above, W.W. Grainger had a declaration date of October 25 and a record date of November 13. In this scenario, the New York Stock Exchange (NYSE) would set the ex-dividend date for November 10 to allow time for trade settlement. The NYSE sets most ex-dividend dates, and other exchanges follow in lockstep.

When to buy shares to get dividends

You can sit on your shares and collect your dividends if you're a buy-and-hold investor. As mentioned above, dividend reinvestment contributes significantly to an investor's returns over time. Many investors approaching retirement age choose companies from the Dividend Aristocrats or Dividend Champions lists for their steadily increasing payouts. (Plus, these stocks tend to be less volatile than the overall market.)

But if you want to swing trade stocks for dividends, you'll need to hold through the close of the trading session before the ex-dividend date. This is the only day that matters. If the ex-dividend date is May 7, you must own the shares when the May 6 trading session ends.

As a result, investors only need to hold shares overnight for a single day to get the payout. This rule extends into the after-hours period, which ends at 8 p.m., meaning you can purchase shares at 7:59 p.m., sell them at 9:30 a.m. the following day and still get the dividend.

How many days between the ex dividend and record dates?

Two different entities set the ex-dividend date and record date. First, a public company will announce a dividend and inform investors when the record date and payout date will occur. Once established, the exchange (usually the NYSE) will set an ex-dividend date as a cutoff for dividend eligibility so that all trades can be properly cleared and dividends can be marked for the correct investors.

In most instances, the ex-dividend date will be two days before the record date, providing brokers time to settle stock trades. Of course, the ex-dividend date doesn't necessarily need to be two days before the record date, but this is the preferred timeframe of the NYSE, and most other exchanges follow their lead.

Is the record date or the ex-dividend date more important?

For investors, the ex-dividend date vs. record date battle is no contest — the ex-dividend date is the most important day on the dividend calendar. If you're investing for dividends, you must maintain awareness of the ex-dividend date since investors must own shares before it arrives. On the other hand, the record date is more important for the company issuing the dividend since that's when qualified recipients are documented.

Tips for tracking dividend dates

Public companies pay dividends to investors daily, and tracking dates can get tedious. But with a large portfolio of stocks, you'll need to keep track of your dividends for tax planning purposes. Depending on how long you hold your shares, dividends could be taxed as ordinary income, complicating things when filing taxes.

To keep track of dividend dates, create a calendar with your brokerage app or use tools like MarketBeat’s ex-dividend date tracker. You'll get information on upcoming ex-dividend dates of different public companies, along with the yield, amount, record date and payout date. You can also track stocks like the Dividend Kings, companies that have raised dividend payments for 50 straight years.

Note specific dates when investing for dividends

The dividend calendar has plenty of entries, and novice investors may need clarification as to which dates matter more for their purposes. For example, the record date may sound more important but fairly insignificant to investors. Instead, the ex-dividend date is critical since it marks the cutoff for dividend eligibility.

Buying shares on or after the ex-dividend date won't entitle you to a dividend; you must own stock before the bell rings to close the trading session before the ex-dividend date. However, selling stock before the ex-dividend date can also negate your payout if you fail to hold through the close the day before. So, if you're frequently trading, remember these rules to maximize your dividends and make the most of your returns.