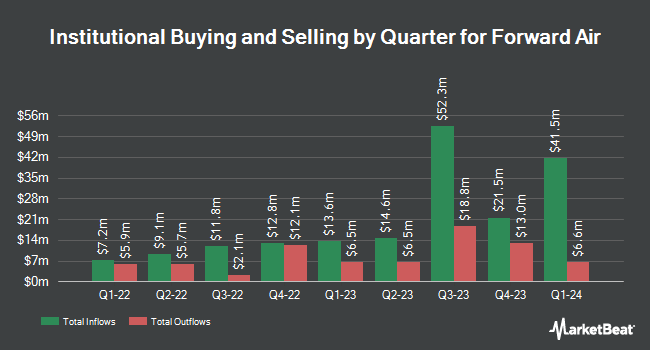

Marshall Wace LLP purchased a new position in shares of Forward Air Co. (NASDAQ:FWRD - Free Report) in the 4th quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor purchased 38,519 shares of the transportation company's stock, valued at approximately $1,242,000. Marshall Wace LLP owned approximately 0.13% of Forward Air at the end of the most recent quarter.

Other institutional investors and hedge funds have also bought and sold shares of the company. Sterling Capital Management LLC lifted its stake in Forward Air by 812.5% during the fourth quarter. Sterling Capital Management LLC now owns 803 shares of the transportation company's stock worth $26,000 after purchasing an additional 715 shares during the last quarter. Byrne Asset Management LLC lifted its position in Forward Air by 122.9% in the 4th quarter. Byrne Asset Management LLC now owns 1,070 shares of the transportation company's stock worth $35,000 after buying an additional 590 shares during the last quarter. AlphaQuest LLC grew its position in Forward Air by 155.9% during the fourth quarter. AlphaQuest LLC now owns 2,925 shares of the transportation company's stock valued at $94,000 after acquiring an additional 1,782 shares during the last quarter. KLP Kapitalforvaltning AS purchased a new position in shares of Forward Air during the fourth quarter worth approximately $235,000. Finally, Polymer Capital Management US LLC bought a new stake in shares of Forward Air in the 4th quarter worth approximately $254,000. 97.03% of the stock is owned by hedge funds and other institutional investors.

Forward Air Stock Performance

Forward Air stock traded down $0.32 during mid-day trading on Monday, reaching $17.41. 110,189 shares of the stock traded hands, compared to its average volume of 883,028. Forward Air Co. has a 12-month low of $9.79 and a 12-month high of $40.92. The business's 50-day moving average is $17.72 and its 200-day moving average is $27.94. The company has a debt-to-equity ratio of 5.07, a current ratio of 1.21 and a quick ratio of 1.21. The stock has a market capitalization of $529.27 million, a PE ratio of -0.73 and a beta of 1.24.

Wall Street Analysts Forecast Growth

A number of analysts have recently weighed in on FWRD shares. Susquehanna dropped their price objective on Forward Air from $35.00 to $32.00 and set a "positive" rating for the company in a research note on Monday, March 31st. Stifel Nicolaus dropped their price target on shares of Forward Air from $29.00 to $22.00 and set a "hold" rating for the company in a research report on Thursday, April 10th. Robert W. Baird decreased their price objective on shares of Forward Air from $32.00 to $28.00 and set a "neutral" rating on the stock in a research report on Thursday, February 27th. Finally, Benchmark reiterated a "hold" rating on shares of Forward Air in a report on Tuesday, January 7th. One investment analyst has rated the stock with a sell rating, four have issued a hold rating and two have issued a buy rating to the company. According to data from MarketBeat.com, the stock has an average rating of "Hold" and an average price target of $32.25.

Read Our Latest Stock Analysis on Forward Air

About Forward Air

(

Free Report)

Forward Air Corporation, together with its subsidiaries, operates as an asset-light freight and logistics company in the United States and Canada. It operates in two segments, Expedited Freight and Intermodal. The Expedited Freight segment provides expedited regional, inter-regional, and national less-than-truckload services; local pick-up and delivery services; and other services, which include shipment consolidation and deconsolidation, warehousing, customs brokerage, and other handling.

Read More

Before you consider Forward Air, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Forward Air wasn't on the list.

While Forward Air currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are hedge funds and endowments buying in today's market? Enter your email address and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying now.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.