Raymond James Financial Inc. purchased a new position in Trinity Capital Inc. (NASDAQ:TRIN - Free Report) during the 4th quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The fund purchased 48,896 shares of the company's stock, valued at approximately $708,000. Raymond James Financial Inc. owned about 0.08% of Trinity Capital as of its most recent filing with the Securities & Exchange Commission.

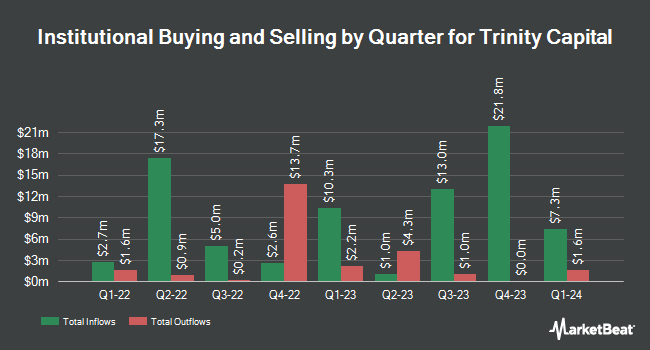

Several other hedge funds have also recently added to or reduced their stakes in the business. Wells Fargo & Company MN boosted its stake in Trinity Capital by 652.3% in the 4th quarter. Wells Fargo & Company MN now owns 243,414 shares of the company's stock worth $3,522,000 after purchasing an additional 211,060 shares during the period. Round Rock Advisors LLC acquired a new position in Trinity Capital in the 4th quarter worth approximately $2,772,000. Trexquant Investment LP boosted its stake in Trinity Capital by 421.3% in the 4th quarter. Trexquant Investment LP now owns 225,710 shares of the company's stock worth $3,266,000 after purchasing an additional 182,414 shares during the period. GraniteShares Advisors LLC purchased a new position in Trinity Capital during the 4th quarter valued at about $2,469,000. Finally, Van ECK Associates Corp grew its stake in Trinity Capital by 6.8% during the 4th quarter. Van ECK Associates Corp now owns 1,389,788 shares of the company's stock valued at $20,110,000 after acquiring an additional 88,698 shares in the last quarter. Institutional investors and hedge funds own 24.62% of the company's stock.

Analyst Upgrades and Downgrades

TRIN has been the topic of several research analyst reports. UBS Group lowered their price target on shares of Trinity Capital from $18.00 to $16.50 and set a "buy" rating on the stock in a report on Thursday, April 17th. Keefe, Bruyette & Woods lowered their price target on shares of Trinity Capital from $16.00 to $15.00 and set a "market perform" rating on the stock in a report on Thursday. Finally, Wells Fargo & Company lowered their price target on shares of Trinity Capital from $14.00 to $13.00 and set an "underweight" rating on the stock in a report on Monday, April 28th.

View Our Latest Report on Trinity Capital

Trinity Capital Stock Performance

TRIN traded up $0.34 on Monday, hitting $14.59. The company had a trading volume of 79,002 shares, compared to its average volume of 524,604. The company's fifty day moving average price is $14.93 and its 200 day moving average price is $14.82. Trinity Capital Inc. has a 1-year low of $12.50 and a 1-year high of $16.82. The company has a debt-to-equity ratio of 0.07, a current ratio of 0.05 and a quick ratio of 0.05. The stock has a market cap of $943.37 million, a price-to-earnings ratio of 8.53 and a beta of 0.57.

Trinity Capital (NASDAQ:TRIN - Get Free Report) last released its quarterly earnings data on Wednesday, May 7th. The company reported $0.52 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.53 by ($0.01). Trinity Capital had a net margin of 40.73% and a return on equity of 15.90%. The firm had revenue of $65.39 million for the quarter, compared to the consensus estimate of $67.67 million. Equities analysts predict that Trinity Capital Inc. will post 2.06 earnings per share for the current fiscal year.

Trinity Capital Announces Dividend

The company also recently declared a quarterly dividend, which was paid on Tuesday, April 15th. Stockholders of record on Monday, March 31st were given a dividend of $0.51 per share. The ex-dividend date was Monday, March 31st. This represents a $2.04 dividend on an annualized basis and a dividend yield of 13.98%. Trinity Capital's dividend payout ratio is 93.15%.

Trinity Capital Profile

(

Free Report)

Trinity Capital Inc is a business development company. It is a venture capital firm specializing in venture debt to growth stage companies looking for loans and/or equipment financing. Trinity Capital Inc was founded in 2019 is based in Phoenix, Arizona with additional offices in the United States.

See Also

Before you consider Trinity Capital, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Trinity Capital wasn't on the list.

While Trinity Capital currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.