Weiss Ratings restated their sell (d-) rating on shares of 89BIO (NASDAQ:ETNB - Free Report) in a research report sent to investors on Saturday,Weiss Ratings reports.

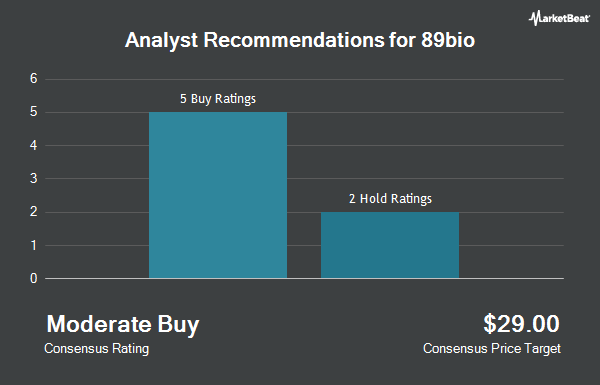

A number of other equities research analysts also recently commented on the company. Cantor Fitzgerald upgraded 89BIO to a "strong-buy" rating in a report on Wednesday, April 30th. The Goldman Sachs Group assumed coverage on 89BIO in a report on Friday, March 14th. They issued a "neutral" rating and a $11.00 price objective for the company. Two research analysts have rated the stock with a hold rating, four have issued a buy rating and two have given a strong buy rating to the company's stock. According to MarketBeat.com, 89BIO has a consensus rating of "Buy" and a consensus price target of $26.43.

View Our Latest Analysis on ETNB

89BIO Trading Up 0.2%

Shares of ETNB stock traded up $0.02 on Friday, reaching $10.65. 955,494 shares of the stock were exchanged, compared to its average volume of 1,530,688. The stock has a market cap of $1.55 billion, a PE ratio of -3.15 and a beta of 1.28. 89BIO has a one year low of $4.16 and a one year high of $11.84. The company has a debt-to-equity ratio of 0.06, a current ratio of 18.03 and a quick ratio of 18.03. The stock has a 50 day moving average price of $9.73 and a 200 day moving average price of $8.62.

89BIO (NASDAQ:ETNB - Get Free Report) last released its quarterly earnings data on Thursday, May 1st. The company reported ($0.49) EPS for the quarter, beating analysts' consensus estimates of ($0.50) by $0.01. During the same period in the prior year, the company posted ($0.54) earnings per share. Equities research analysts forecast that 89BIO will post -3.19 EPS for the current fiscal year.

Insider Activity

In other 89BIO news, insider Quoc Le-Nguyen sold 10,461 shares of the stock in a transaction dated Tuesday, July 15th. The stock was sold at an average price of $11.02, for a total value of $115,280.22. Following the completion of the sale, the insider directly owned 309,364 shares in the company, valued at $3,409,191.28. This represents a 3.27% decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available through the SEC website. 2.60% of the stock is owned by company insiders.

Institutional Investors Weigh In On 89BIO

Several large investors have recently modified their holdings of the business. Assenagon Asset Management S.A. boosted its position in shares of 89BIO by 406.2% during the second quarter. Assenagon Asset Management S.A. now owns 2,171,194 shares of the company's stock worth $21,321,000 after buying an additional 1,742,299 shares during the period. Goldman Sachs Group Inc. boosted its position in shares of 89BIO by 23.3% during the first quarter. Goldman Sachs Group Inc. now owns 995,449 shares of the company's stock worth $7,237,000 after buying an additional 188,367 shares during the period. Voya Investment Management LLC boosted its position in shares of 89BIO by 417.9% during the first quarter. Voya Investment Management LLC now owns 132,791 shares of the company's stock worth $965,000 after buying an additional 107,151 shares during the period. Rhumbline Advisers boosted its position in shares of 89BIO by 17.0% during the first quarter. Rhumbline Advisers now owns 152,138 shares of the company's stock worth $1,106,000 after buying an additional 22,158 shares during the period. Finally, UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC boosted its position in shares of 89BIO by 50.4% during the first quarter. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC now owns 268,798 shares of the company's stock worth $1,954,000 after buying an additional 90,107 shares during the period.

About 89BIO

(

Get Free Report)

89bio, Inc, a clinical-stage biopharmaceutical company, focuses on the development and commercialization of therapies for the treatment of liver and cardio-metabolic diseases. Its lead product candidate is pegozafermin, a glycoPEGylated analog of fibroblast growth factor 21 for the treatment of nonalcoholic steatohepatitis; and for the treatment of severe hypertriglyceridemia.

Featured Articles

Before you consider 89BIO, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and 89BIO wasn't on the list.

While 89BIO currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.