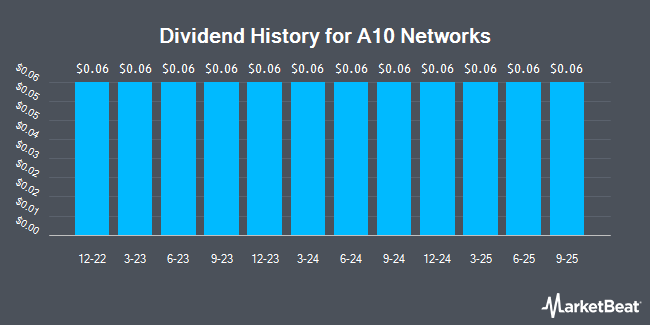

A10 Networks, Inc. (NYSE:ATEN - Get Free Report) announced a quarterly dividend on Wednesday, August 6th, Wall Street Journal reports. Shareholders of record on Friday, August 15th will be paid a dividend of 0.06 per share by the communications equipment provider on Tuesday, September 2nd. This represents a c) annualized dividend and a yield of 1.4%. The ex-dividend date is Friday, August 15th.

A10 Networks has a dividend payout ratio of 24.7% indicating that its dividend is sufficiently covered by earnings. Equities analysts expect A10 Networks to earn $0.79 per share next year, which means the company should continue to be able to cover its $0.24 annual dividend with an expected future payout ratio of 30.4%.

A10 Networks Stock Down 2.5%

NYSE:ATEN traded down $0.44 on Friday, hitting $17.40. 959,920 shares of the company's stock were exchanged, compared to its average volume of 935,249. The firm has a 50-day moving average price of $18.49 and a 200-day moving average price of $18.16. The company has a debt-to-equity ratio of 1.07, a current ratio of 4.23 and a quick ratio of 4.04. A10 Networks has a 52 week low of $12.45 and a 52 week high of $21.90. The company has a market cap of $1.26 billion, a P/E ratio of 25.59 and a beta of 1.35.

A10 Networks (NYSE:ATEN - Get Free Report) last released its quarterly earnings data on Tuesday, August 5th. The communications equipment provider reported $0.21 earnings per share for the quarter, topping the consensus estimate of $0.20 by $0.01. The company had revenue of $69.38 million for the quarter, compared to analyst estimates of $65.99 million. A10 Networks had a net margin of 18.45% and a return on equity of 25.46%. A10 Networks's revenue for the quarter was up 15.5% compared to the same quarter last year. During the same period in the previous year, the business earned $0.18 EPS. As a group, analysts expect that A10 Networks will post 0.69 EPS for the current fiscal year.

Analysts Set New Price Targets

A number of research analysts recently commented on ATEN shares. BWS Financial reiterated a "buy" rating and issued a $24.00 price target on shares of A10 Networks in a research note on Friday, May 2nd. BTIG Research upgraded shares of A10 Networks from a "neutral" rating to a "buy" rating and set a $22.00 target price on the stock in a research report on Wednesday. Wall Street Zen upgraded shares of A10 Networks from a "hold" rating to a "buy" rating in a research report on Sunday. Mizuho assumed coverage on shares of A10 Networks in a research report on Monday, July 14th. They set a "neutral" rating on the stock. Finally, Craig Hallum upgraded shares of A10 Networks from a "hold" rating to a "buy" rating and set a $20.00 target price on the stock in a research report on Friday, May 2nd. Two analysts have rated the stock with a hold rating and five have assigned a buy rating to the company's stock. According to data from MarketBeat, the company presently has an average rating of "Moderate Buy" and a consensus target price of $22.00.

Check Out Our Latest Report on A10 Networks

About A10 Networks

(

Get Free Report)

A10 Networks, Inc provides networking solutions in the Americas, Japan, rest of Asia Pacific, Europe, the Middle East, and Africa. The company offers Thunder Application Delivery Controller that provides advanced server load balancing; Thunder Carrier Grade Networking, which provides standards-compliant address and protocol translation services between varying types of internet protocol addresses; Thunder Secure Sockets Layer (SSL) Insight that decrypts SSL-encrypted traffic and forwards it to a third-party security device for deep packet inspection; and Thunder Convergent Firewall, which addresses multiple critical security capabilities in one package.

See Also

Before you consider A10 Networks, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and A10 Networks wasn't on the list.

While A10 Networks currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.