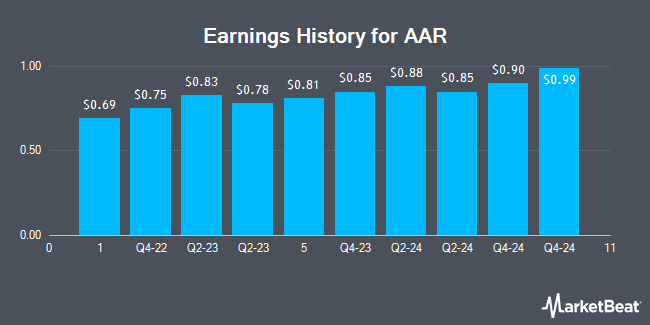

AAR (NYSE:AIR - Get Free Report) is projected to release its Q1 2026 results after the market closes on Tuesday, September 23rd. Analysts expect AAR to post earnings of $0.98 per share and revenue of $692.4680 million for the quarter. Investors may review the information on the company's upcoming Q1 2026 earningreport for the latest details on the call scheduled for Tuesday, September 23, 2025 at 5:00 PM ET.

AAR (NYSE:AIR - Get Free Report) last released its quarterly earnings results on Wednesday, July 16th. The aerospace company reported $1.16 EPS for the quarter, topping the consensus estimate of $1.00 by $0.16. The business had revenue of $754.50 million during the quarter, compared to analyst estimates of $695.81 million. AAR had a net margin of 0.45% and a return on equity of 11.66%. The company's quarterly revenue was up 15.0% on a year-over-year basis. During the same quarter in the prior year, the firm earned $0.88 earnings per share. On average, analysts expect AAR to post $4 EPS for the current fiscal year and $5 EPS for the next fiscal year.

AAR Stock Performance

Shares of AAR stock traded down $0.58 during trading on Friday, hitting $75.36. 851,378 shares of the stock were exchanged, compared to its average volume of 270,609. The stock has a market cap of $2.71 billion, a PE ratio of 228.36 and a beta of 1.50. The company has a debt-to-equity ratio of 0.80, a quick ratio of 1.26 and a current ratio of 2.72. The stock's fifty day moving average is $75.75 and its 200 day moving average is $66.85. AAR has a 12 month low of $46.51 and a 12 month high of $86.43.

Wall Street Analysts Forecast Growth

Several research analysts have commented on the stock. Royal Bank Of Canada raised their target price on shares of AAR from $75.00 to $85.00 and gave the stock an "outperform" rating in a report on Thursday, July 17th. Wall Street Zen lowered shares of AAR from a "buy" rating to a "hold" rating in a research report on Saturday. Truist Financial boosted their target price on shares of AAR from $78.00 to $81.00 and gave the company a "buy" rating in a research note on Friday, July 11th. Finally, KeyCorp upped their price target on shares of AAR from $80.00 to $86.00 and gave the stock an "overweight" rating in a research report on Thursday, July 17th. Four equities research analysts have rated the stock with a Buy rating, According to MarketBeat.com, the company presently has a consensus rating of "Buy" and an average target price of $83.75.

Get Our Latest Stock Analysis on AIR

Insiders Place Their Bets

In other AAR news, CEO John Mcclain Holmes III sold 31,551 shares of AAR stock in a transaction dated Thursday, July 24th. The stock was sold at an average price of $78.03, for a total value of $2,461,924.53. Following the transaction, the chief executive officer owned 360,921 shares in the company, valued at $28,162,665.63. The trade was a 8.04% decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is available at this link. Also, CAO Jessica A. Garascia sold 3,631 shares of the business's stock in a transaction that occurred on Wednesday, July 23rd. The shares were sold at an average price of $77.08, for a total value of $279,877.48. Following the completion of the transaction, the chief accounting officer directly owned 39,117 shares in the company, valued at approximately $3,015,138.36. This trade represents a 8.49% decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last three months, insiders have sold 95,182 shares of company stock worth $7,331,452. Insiders own 3.60% of the company's stock.

Institutional Inflows and Outflows

A number of institutional investors and hedge funds have recently made changes to their positions in the company. Osterweis Capital Management Inc. bought a new stake in shares of AAR in the 2nd quarter worth $26,000. Geneos Wealth Management Inc. lifted its position in shares of AAR by 200.0% in the second quarter. Geneos Wealth Management Inc. now owns 3,105 shares of the aerospace company's stock worth $214,000 after buying an additional 2,070 shares in the last quarter. Captrust Financial Advisors purchased a new stake in AAR during the second quarter valued at approximately $216,000. Tower Research Capital LLC TRC grew its stake in shares of AAR by 277.4% during the second quarter. Tower Research Capital LLC TRC now owns 3,174 shares of the aerospace company's stock valued at $218,000 after buying an additional 2,333 shares during the last quarter. Finally, Rafferty Asset Management LLC lifted its holdings in AAR by 12.8% during the second quarter. Rafferty Asset Management LLC now owns 9,191 shares of the aerospace company's stock worth $632,000 after buying an additional 1,040 shares during the period. Hedge funds and other institutional investors own 90.74% of the company's stock.

AAR Company Profile

(

Get Free Report)

AAR Corp. provides products and services to commercial aviation, government, and defense markets worldwide. The Parts Supply segment leases and sells aircraft components and replacement parts. The Repair & Engineering segment provides airframe maintenance services, such as airframe inspection, painting, line maintenance, airframe modification, structural repair, avionics service and installation, exterior and interior refurbishment, and engineering and support services; component repair services comprising maintenance, repair, and overhaul (MRO) services, engine and airframe accessories, and interior refurbishment; and landing gear overhaul services, including repair services on wheels and brakes.

Recommended Stories

Before you consider AAR, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AAR wasn't on the list.

While AAR currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.