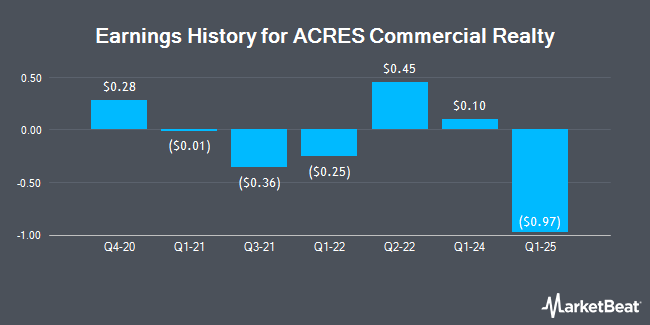

ACRES Commercial Realty (NYSE:ACR - Get Free Report) announced its quarterly earnings results on Wednesday. The company reported ($0.04) EPS for the quarter, missing analysts' consensus estimates of $0.18 by ($0.22), Zacks reports. ACRES Commercial Realty had a net margin of 26.22% and a return on equity of 3.35%. The business had revenue of $21.87 million during the quarter, compared to the consensus estimate of $20.32 million.

ACRES Commercial Realty Trading Down 2.2%

ACRES Commercial Realty stock traded down $0.44 during midday trading on Friday, reaching $19.24. The stock had a trading volume of 22,405 shares, compared to its average volume of 29,269. The company has a quick ratio of 88.11, a current ratio of 88.11 and a debt-to-equity ratio of 2.89. ACRES Commercial Realty has a 52-week low of $14.63 and a 52-week high of $23.81. The firm has a market cap of $142.18 million, a price-to-earnings ratio of -961.52 and a beta of 1.78. The company has a fifty day moving average of $18.13 and a 200 day moving average of $18.88.

Insiders Place Their Bets

In related news, major shareholder Eagle Point Credit Management sold 13,008 shares of the stock in a transaction dated Thursday, July 31st. The shares were sold at an average price of $22.30, for a total value of $290,078.40. Following the sale, the insider directly owned 804,974 shares of the company's stock, valued at $17,950,920.20. This represents a 1.59% decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available through this hyperlink. Over the last 90 days, insiders have sold 54,551 shares of company stock valued at $1,217,229. Corporate insiders own 3.92% of the company's stock.

Institutional Trading of ACRES Commercial Realty

A number of hedge funds and other institutional investors have recently added to or reduced their stakes in the company. Jane Street Group LLC raised its position in ACRES Commercial Realty by 190.8% in the 1st quarter. Jane Street Group LLC now owns 38,434 shares of the company's stock worth $833,000 after purchasing an additional 25,216 shares during the period. Goldman Sachs Group Inc. purchased a new position in shares of ACRES Commercial Realty during the first quarter worth approximately $488,000. Finally, Cubist Systematic Strategies LLC purchased a new position in shares of ACRES Commercial Realty during the first quarter worth approximately $133,000. 40.03% of the stock is owned by hedge funds and other institutional investors.

ACRES Commercial Realty Company Profile

(

Get Free Report)

ACRES Commercial Realty Corp., a real estate investment trust (REIT), focuses on the origination, holding, and management of commercial real estate mortgage loans and equity investments in commercial real estate property in the United States. It invests in commercial real estate-related assets, including floating-rate first mortgage loans, first priority interests in first mortgage loans, subordinated interests in first mortgage loans, mezzanine financing, preferred equity investments, and commercial mortgage-backed securities.

See Also

Before you consider ACRES Commercial Realty, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ACRES Commercial Realty wasn't on the list.

While ACRES Commercial Realty currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.