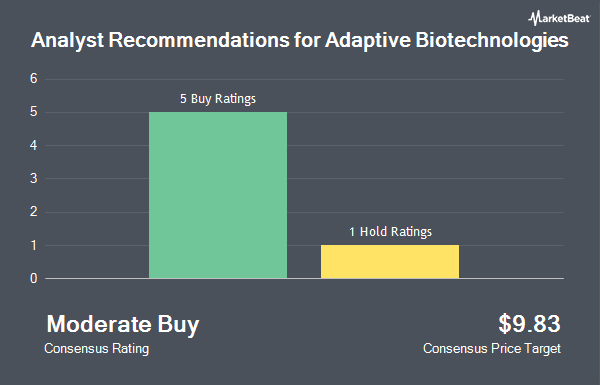

Adaptive Biotechnologies Co. (NASDAQ:ADPT - Get Free Report) has earned a consensus rating of "Moderate Buy" from the six ratings firms that are currently covering the firm, Marketbeat Ratings reports. One research analyst has rated the stock with a hold recommendation and five have issued a buy recommendation on the company. The average 1 year price objective among brokerages that have covered the stock in the last year is $9.83.

ADPT has been the topic of a number of recent research reports. Morgan Stanley raised their price objective on shares of Adaptive Biotechnologies from $7.00 to $9.00 and gave the company an "equal weight" rating in a research note on Monday, May 5th. The Goldman Sachs Group upped their price target on Adaptive Biotechnologies from $9.00 to $10.00 and gave the company a "buy" rating in a research note on Friday, May 2nd. Piper Sandler reaffirmed an "overweight" rating and issued a $13.00 target price (up previously from $11.00) on shares of Adaptive Biotechnologies in a research note on Tuesday, May 6th. Finally, Scotiabank raised their price target on Adaptive Biotechnologies from $10.00 to $12.00 and gave the stock a "sector outperform" rating in a research report on Thursday, February 13th.

Read Our Latest Report on ADPT

Adaptive Biotechnologies Price Performance

Shares of ADPT stock traded up $0.39 during trading hours on Friday, hitting $9.94. 1,490,852 shares of the company's stock were exchanged, compared to its average volume of 1,569,200. Adaptive Biotechnologies has a 52 week low of $2.99 and a 52 week high of $10.28. The stock has a market cap of $1.51 billion, a price-to-earnings ratio of -9.12 and a beta of 1.75. The stock's 50-day moving average is $8.36 and its 200-day moving average is $7.52.

Adaptive Biotechnologies (NASDAQ:ADPT - Get Free Report) last issued its quarterly earnings data on Thursday, May 1st. The company reported ($0.20) EPS for the quarter, topping analysts' consensus estimates of ($0.28) by $0.08. The firm had revenue of $52.44 million for the quarter, compared to analyst estimates of $42.13 million. Adaptive Biotechnologies had a negative net margin of 89.12% and a negative return on equity of 64.65%. The company's revenue was up 25.2% on a year-over-year basis. During the same quarter in the prior year, the firm earned ($0.33) EPS. Equities research analysts forecast that Adaptive Biotechnologies will post -0.92 earnings per share for the current fiscal year.

Insider Buying and Selling at Adaptive Biotechnologies

In other Adaptive Biotechnologies news, insider Harlan S. Robins sold 68,412 shares of the company's stock in a transaction that occurred on Thursday, May 1st. The shares were sold at an average price of $7.35, for a total value of $502,828.20. Following the completion of the transaction, the insider now directly owns 1,279,524 shares in the company, valued at approximately $9,404,501.40. This represents a 5.08% decrease in their position. The sale was disclosed in a legal filing with the SEC, which can be accessed through this link. Also, Director Michelle Renee Griffin sold 15,664 shares of the stock in a transaction on Thursday, March 6th. The shares were sold at an average price of $7.94, for a total value of $124,372.16. Following the completion of the sale, the director now owns 51,685 shares of the company's stock, valued at $410,378.90. The trade was a 23.26% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 358,754 shares of company stock worth $2,584,806 over the last 90 days. Insiders own 6.40% of the company's stock.

Hedge Funds Weigh In On Adaptive Biotechnologies

A number of hedge funds and other institutional investors have recently made changes to their positions in ADPT. KBC Group NV acquired a new stake in Adaptive Biotechnologies during the 4th quarter valued at approximately $50,000. Cibc World Markets Corp bought a new stake in shares of Adaptive Biotechnologies in the 4th quarter valued at $65,000. Bridgefront Capital LLC acquired a new stake in shares of Adaptive Biotechnologies during the fourth quarter worth $80,000. Personal CFO Solutions LLC bought a new position in Adaptive Biotechnologies during the first quarter worth $84,000. Finally, Blair William & Co. IL bought a new position in Adaptive Biotechnologies during the first quarter worth $84,000. 99.17% of the stock is owned by institutional investors and hedge funds.

About Adaptive Biotechnologies

(

Get Free ReportAdaptive Biotechnologies Corporation, a commercial-stage company, develops an immune medicine platform for the diagnosis and treatment of various diseases. The company offers immunosequencing platform which combines a suite of proprietary chemistry, computational biology, and machine learning to generate clinical immunomics data to decode the adaptive immune system.

Further Reading

Before you consider Adaptive Biotechnologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Adaptive Biotechnologies wasn't on the list.

While Adaptive Biotechnologies currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.