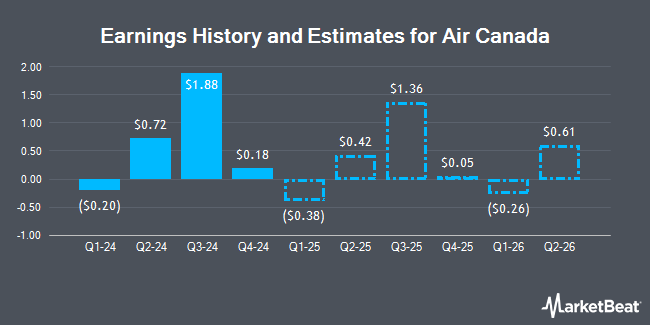

Air Canada (OTCMKTS:ACDVF - Free Report) - Equities researchers at National Bank Financial increased their Q2 2025 earnings per share (EPS) estimates for Air Canada in a research report issued on Tuesday, July 15th. National Bank Financial analyst C. Doerksen now expects that the company will post earnings per share of $0.51 for the quarter, up from their prior forecast of $0.49. The consensus estimate for Air Canada's current full-year earnings is $1.66 per share. National Bank Financial also issued estimates for Air Canada's FY2025 earnings at $1.39 EPS and FY2026 earnings at $1.77 EPS.

Air Canada (OTCMKTS:ACDVF - Get Free Report) last issued its earnings results on Thursday, May 8th. The company reported ($0.31) EPS for the quarter, topping the consensus estimate of ($0.38) by $0.07. Air Canada had a return on equity of 60.31% and a net margin of 7.88%. The company had revenue of $3.61 billion during the quarter, compared to the consensus estimate of $5.35 billion.

Several other research firms have also recently weighed in on ACDVF. Jefferies Financial Group cut Air Canada to an "underperform" rating in a report on Tuesday, April 1st. Royal Bank Of Canada raised Air Canada from a "hold" rating to a "moderate buy" rating in a report on Monday, May 12th.

Check Out Our Latest Research Report on Air Canada

Air Canada Stock Performance

Shares of OTCMKTS ACDVF traded down $0.38 during midday trading on Thursday, hitting $15.27. 516,990 shares of the company's stock were exchanged, compared to its average volume of 162,784. The company has a quick ratio of 0.67, a current ratio of 0.70 and a debt-to-equity ratio of 5.38. Air Canada has a 12 month low of $8.56 and a 12 month high of $18.56. The company's 50 day moving average price is $14.46 and its 200 day moving average price is $12.70. The firm has a market capitalization of $4.93 billion, a PE ratio of 4.88 and a beta of 1.93.

About Air Canada

(

Get Free Report)

Air Canada provides domestic, U.S. transborder, and international airline services. The company provides scheduled passenger services under the Air Canada Vacations and Air Canada Rouge brand names in the Canadian market, the Canada-U.S. transborder market, and in the international market to and from Canada, as well as through capacity purchase agreements on other regional carriers.

Further Reading

Before you consider Air Canada, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Air Canada wasn't on the list.

While Air Canada currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.