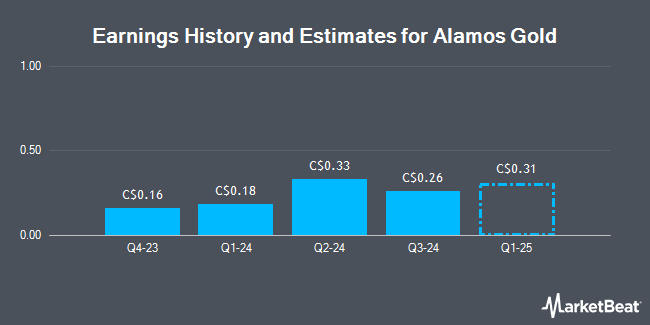

Alamos Gold Inc. (TSE:AGI - Free Report) NYSE: AGI - Research analysts at National Bank Financial upped their FY2025 earnings per share (EPS) estimates for Alamos Gold in a note issued to investors on Tuesday, September 23rd. National Bank Financial analyst D. Demarco now expects that the company will earn $2.15 per share for the year, up from their prior estimate of $2.10. The consensus estimate for Alamos Gold's current full-year earnings is $1.48 per share.

AGI has been the topic of a number of other reports. BMO Capital Markets upped their price target on Alamos Gold from C$48.00 to C$51.00 in a research report on Tuesday, September 16th. Bank of America upped their price target on Alamos Gold from C$50.50 to C$55.00 in a research report on Friday, August 29th. TD Securities lowered their price target on Alamos Gold from C$48.00 to C$47.00 and set a "buy" rating on the stock in a research report on Friday, August 1st. National Bankshares upped their price target on Alamos Gold from C$53.50 to C$56.00 and gave the company an "outperform" rating in a research report on Wednesday. Finally, Stifel Canada upgraded Alamos Gold to a "strong-buy" rating in a research report on Tuesday, July 8th. Two analysts have rated the stock with a Strong Buy rating and three have given a Buy rating to the company. According to MarketBeat.com, Alamos Gold presently has a consensus rating of "Buy" and a consensus price target of C$50.17.

Read Our Latest Analysis on AGI

Alamos Gold Stock Performance

Shares of TSE:AGI opened at C$46.37 on Thursday. The business's fifty day moving average price is C$39.44 and its two-hundred day moving average price is C$37.76. Alamos Gold has a fifty-two week low of C$24.47 and a fifty-two week high of C$47.71. The stock has a market capitalization of C$19.50 billion, a price-to-earnings ratio of 56.55, a price-to-earnings-growth ratio of -2.10 and a beta of 0.59. The company has a debt-to-equity ratio of 8.48, a current ratio of 1.62 and a quick ratio of 1.06.

Alamos Gold Cuts Dividend

The firm also recently announced a quarterly dividend, which was paid on Monday, September 15th. Stockholders of record on Thursday, September 11th were issued a dividend of $0.025 per share. This represents a $0.10 annualized dividend and a dividend yield of 0.2%. Alamos Gold's payout ratio is presently 12.20%.

About Alamos Gold

(

Get Free Report)

Alamos Gold Inc acquires, explores, and produces gold and other precious metals, and operates in two principal geographic areas: Canada and Mexico. The company has three operating mines in North America: the Young-Davidson Mine in Canada and the Mulatos and El Chanate Mines in Sonora, Mexico. The Young-Davidson mine is the group's largest revenue contributor, and the property also holds mineral leases and claims covering approximately 11,000 acres.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Alamos Gold, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Alamos Gold wasn't on the list.

While Alamos Gold currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.