Wall Street Zen upgraded shares of Alamos Gold (NYSE:AGI - Free Report) TSE: AGI from a hold rating to a buy rating in a report published on Saturday morning.

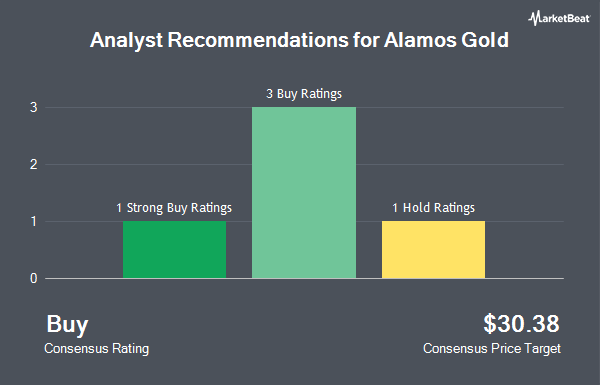

AGI has been the topic of a number of other research reports. Scotiabank reiterated an "outperform" rating on shares of Alamos Gold in a research note on Monday, April 14th. Bank of America decreased their target price on shares of Alamos Gold from $31.00 to $30.50 and set a "neutral" rating on the stock in a research report on Tuesday, April 8th. Stifel Canada upgraded shares of Alamos Gold to a "strong-buy" rating in a research report on Tuesday, July 8th. Stifel Nicolaus initiated coverage on shares of Alamos Gold in a research report on Wednesday, July 9th. They set a "buy" rating on the stock. Finally, Royal Bank Of Canada increased their target price on shares of Alamos Gold from $27.00 to $30.00 and gave the stock an "outperform" rating in a research report on Friday, April 4th. One analyst has rated the stock with a hold rating, six have issued a buy rating and two have assigned a strong buy rating to the company's stock. According to data from MarketBeat, the company presently has an average rating of "Buy" and an average price target of $30.38.

Check Out Our Latest Stock Analysis on Alamos Gold

Alamos Gold Stock Performance

Shares of Alamos Gold stock traded up $0.62 during trading on Friday, hitting $26.20. 1,575,453 shares of the stock were exchanged, compared to its average volume of 3,478,929. The stock has a market capitalization of $11.01 billion, a price-to-earnings ratio of 31.53, a price-to-earnings-growth ratio of 0.55 and a beta of 0.51. The company has a fifty day moving average price of $26.32 and a 200-day moving average price of $25.35. Alamos Gold has a 1-year low of $16.63 and a 1-year high of $31.00. The company has a current ratio of 1.49, a quick ratio of 1.00 and a debt-to-equity ratio of 0.07.

Alamos Gold (NYSE:AGI - Get Free Report) TSE: AGI last announced its quarterly earnings results on Wednesday, July 30th. The basic materials company reported $0.34 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.33 by $0.01. Alamos Gold had a return on equity of 10.67% and a net margin of 22.99%. The business had revenue of $438.20 million during the quarter, compared to the consensus estimate of $400.61 million. During the same quarter last year, the firm posted $0.24 EPS. The company's quarterly revenue was up 31.7% on a year-over-year basis. As a group, equities analysts predict that Alamos Gold will post 1.29 EPS for the current fiscal year.

Alamos Gold Announces Dividend

The company also recently announced a quarterly dividend, which was paid on Thursday, June 26th. Investors of record on Thursday, June 12th were paid a dividend of $0.025 per share. This represents a $0.10 dividend on an annualized basis and a yield of 0.4%. The ex-dividend date of this dividend was Thursday, June 12th. Alamos Gold's dividend payout ratio (DPR) is currently 12.05%.

Hedge Funds Weigh In On Alamos Gold

A number of hedge funds have recently bought and sold shares of the company. Murphy Pohlad Asset Management LLC grew its holdings in shares of Alamos Gold by 0.3% during the first quarter. Murphy Pohlad Asset Management LLC now owns 159,650 shares of the basic materials company's stock valued at $4,269,000 after buying an additional 500 shares during the last quarter. Baird Financial Group Inc. lifted its position in shares of Alamos Gold by 0.3% during the fourth quarter. Baird Financial Group Inc. now owns 181,611 shares of the basic materials company's stock valued at $3,349,000 after purchasing an additional 614 shares in the last quarter. Cheviot Value Management LLC lifted its position in shares of Alamos Gold by 1.2% during the first quarter. Cheviot Value Management LLC now owns 52,377 shares of the basic materials company's stock valued at $1,346,000 after purchasing an additional 635 shares in the last quarter. SBI Securities Co. Ltd. lifted its position in shares of Alamos Gold by 67.0% during the first quarter. SBI Securities Co. Ltd. now owns 1,645 shares of the basic materials company's stock valued at $44,000 after purchasing an additional 660 shares in the last quarter. Finally, NewEdge Advisors LLC lifted its position in shares of Alamos Gold by 1.2% during the fourth quarter. NewEdge Advisors LLC now owns 72,751 shares of the basic materials company's stock valued at $1,342,000 after purchasing an additional 854 shares in the last quarter. Institutional investors own 64.33% of the company's stock.

About Alamos Gold

(

Get Free Report)

Alamos Gold Inc engages in the acquisition, exploration, development, and extraction of precious metals in Canada and Mexico. The company primarily explores for gold deposits. It holds 100% interest in the Young-Davidson mine and Island Gold mine located in the Ontario, Canada; Mulatos mine located in the Sonora, Mexico; and Lynn Lake project situated in the Manitoba, Canada.

See Also

Before you consider Alamos Gold, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Alamos Gold wasn't on the list.

While Alamos Gold currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for September 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.