Alden Global Capital LLC reduced its stake in Sinclair, Inc. (NASDAQ:SBGI - Free Report) by 89.8% during the fourth quarter, according to its most recent filing with the SEC. The fund owned 83,947 shares of the company's stock after selling 740,021 shares during the quarter. Sinclair accounts for approximately 1.3% of Alden Global Capital LLC's portfolio, making the stock its 21st largest holding. Alden Global Capital LLC owned 0.13% of Sinclair worth $1,355,000 as of its most recent SEC filing.

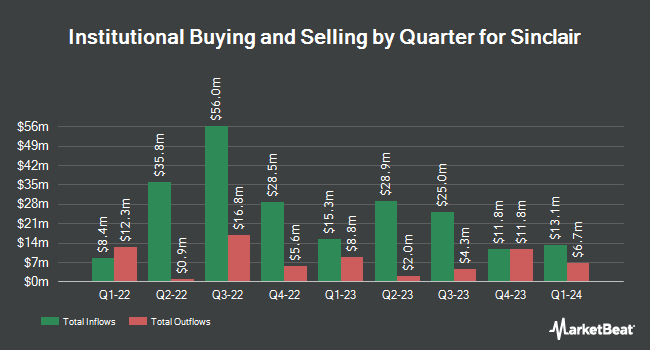

A number of other institutional investors and hedge funds have also recently modified their holdings of the stock. GAMMA Investing LLC lifted its position in shares of Sinclair by 26.9% during the 4th quarter. GAMMA Investing LLC now owns 2,896 shares of the company's stock valued at $47,000 after buying an additional 613 shares during the last quarter. Federated Hermes Inc. bought a new stake in shares of Sinclair during the 4th quarter valued at $47,000. New York State Common Retirement Fund boosted its position in shares of Sinclair by 29.4% in the fourth quarter. New York State Common Retirement Fund now owns 7,480 shares of the company's stock valued at $121,000 after acquiring an additional 1,700 shares during the period. KLP Kapitalforvaltning AS purchased a new position in Sinclair in the 4th quarter worth approximately $123,000. Finally, EntryPoint Capital LLC purchased a new stake in Sinclair in the fourth quarter worth approximately $194,000. 41.71% of the stock is owned by institutional investors.

Sinclair Price Performance

Shares of NASDAQ:SBGI traded up $0.30 during trading on Wednesday, hitting $15.84. 188,679 shares of the company's stock were exchanged, compared to its average volume of 359,402. The business's 50-day simple moving average is $14.78 and its 200 day simple moving average is $15.64. The company has a debt-to-equity ratio of 11.73, a current ratio of 1.91 and a quick ratio of 1.91. Sinclair, Inc. has a 52-week low of $11.13 and a 52-week high of $18.46. The company has a market cap of $1.05 billion, a price-to-earnings ratio of -4.80 and a beta of 1.36.

Sinclair (NASDAQ:SBGI - Get Free Report) last posted its earnings results on Wednesday, February 26th. The company reported $2.61 EPS for the quarter, beating analysts' consensus estimates of $1.99 by $0.62. The firm had revenue of $1 billion during the quarter, compared to the consensus estimate of $1.01 billion. Sinclair had a positive return on equity of 63.89% and a negative net margin of 6.14%. As a group, equities analysts predict that Sinclair, Inc. will post 4.24 EPS for the current year.

Sinclair Dividend Announcement

The firm also recently declared a quarterly dividend, which was paid on Monday, March 24th. Investors of record on Monday, March 10th were paid a dividend of $0.25 per share. This represents a $1.00 dividend on an annualized basis and a dividend yield of 6.32%. The ex-dividend date was Monday, March 10th. Sinclair's dividend payout ratio is currently 21.46%.

Insider Activity at Sinclair

In other Sinclair news, Chairman David D. Smith purchased 4,616 shares of the firm's stock in a transaction on Thursday, March 20th. The stock was bought at an average cost of $16.44 per share, for a total transaction of $75,887.04. Following the completion of the purchase, the chairman now owns 972,205 shares in the company, valued at $15,983,050.20. This represents a 0.48 % increase in their position. The purchase was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link. Insiders purchased 458,530 shares of company stock worth $6,636,392 in the last 90 days. 46.60% of the stock is owned by corporate insiders.

Wall Street Analyst Weigh In

Several brokerages have commented on SBGI. Wells Fargo & Company lowered their price objective on shares of Sinclair from $19.00 to $17.00 and set an "equal weight" rating for the company in a report on Thursday, February 27th. Guggenheim lowered their price target on Sinclair from $19.00 to $17.00 and set a "buy" rating on the stock in a report on Monday, March 10th. Benchmark lowered their price objective on shares of Sinclair from $30.00 to $29.00 and set a "buy" rating on the stock in a research note on Tuesday. Finally, StockNews.com downgraded shares of Sinclair from a "buy" rating to a "hold" rating in a research report on Thursday, March 6th. One analyst has rated the stock with a sell rating, three have assigned a hold rating and two have issued a buy rating to the company. According to data from MarketBeat.com, the stock has an average rating of "Hold" and an average target price of $19.10.

Read Our Latest Stock Report on SBGI

Sinclair Profile

(

Free Report)

Sinclair, Inc, a media company, provides content on local television stations and digital platforms in the United States. It operates through two segments, Local Media and Tennis. The Local Media segment operates broadcast television stations, original networks, and content; provides free-over-the-air programming and live local sporting events on its stations; distributes its content to multi-channel video programming distributors in exchange for contractual fees; and produces local and original news programs.

See Also

Before you consider Sinclair, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sinclair wasn't on the list.

While Sinclair currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.