Alight Capital Management LP decreased its stake in shares of Dell Technologies Inc. (NYSE:DELL - Free Report) by 57.1% during the fourth quarter, according to the company in its most recent filing with the SEC. The fund owned 15,000 shares of the technology company's stock after selling 20,000 shares during the period. Alight Capital Management LP's holdings in Dell Technologies were worth $1,729,000 as of its most recent filing with the SEC.

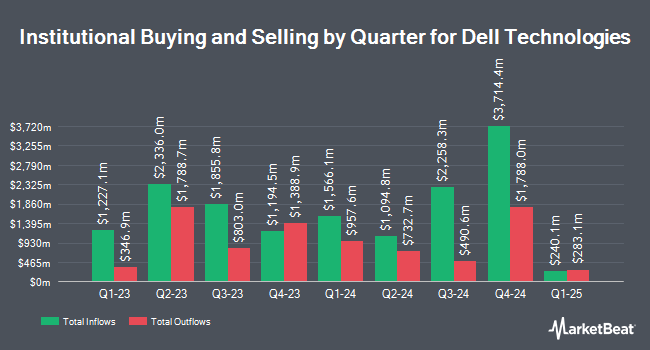

Other institutional investors have also made changes to their positions in the company. Meiji Yasuda Life Insurance Co bought a new position in shares of Dell Technologies in the fourth quarter valued at approximately $415,000. Westbourne Investments Inc. acquired a new position in Dell Technologies during the 4th quarter worth $939,000. Freestone Grove Partners LP bought a new stake in Dell Technologies during the fourth quarter valued at about $25,502,000. One68 Global Capital LLC acquired a new stake in shares of Dell Technologies in the fourth quarter valued at about $691,000. Finally, Comerica Bank increased its stake in shares of Dell Technologies by 10.4% in the fourth quarter. Comerica Bank now owns 71,203 shares of the technology company's stock worth $8,205,000 after purchasing an additional 6,689 shares during the period. 76.37% of the stock is owned by institutional investors.

Dell Technologies Stock Down 0.3 %

DELL stock traded down $0.28 during midday trading on Tuesday, reaching $94.08. 4,988,168 shares of the company's stock traded hands, compared to its average volume of 10,384,654. The company has a 50-day simple moving average of $90.52 and a two-hundred day simple moving average of $109.65. Dell Technologies Inc. has a 1-year low of $66.25 and a 1-year high of $179.70. The company has a market cap of $65.65 billion, a price-to-earnings ratio of 16.62, a PEG ratio of 1.10 and a beta of 0.99.

Dell Technologies Increases Dividend

The firm also recently announced a quarterly dividend, which was paid on Friday, May 2nd. Stockholders of record on Tuesday, April 22nd were paid a $0.525 dividend. The ex-dividend date was Tuesday, April 22nd. This is a positive change from Dell Technologies's previous quarterly dividend of $0.45. This represents a $2.10 dividend on an annualized basis and a dividend yield of 2.23%. Dell Technologies's dividend payout ratio (DPR) is 33.76%.

Wall Street Analysts Forecast Growth

A number of analysts have issued reports on DELL shares. Barclays raised their target price on Dell Technologies from $115.00 to $116.00 and gave the company an "equal weight" rating in a report on Friday, February 28th. Evercore ISI dropped their target price on shares of Dell Technologies from $145.00 to $120.00 and set an "outperform" rating on the stock in a research report on Monday, April 28th. JPMorgan Chase & Co. reduced their price target on shares of Dell Technologies from $150.00 to $108.00 and set an "overweight" rating for the company in a report on Thursday, April 17th. Citigroup reduced their target price on shares of Dell Technologies from $145.00 to $105.00 and set a "buy" rating for the company in a research note on Monday, April 14th. Finally, Morgan Stanley decreased their price objective on Dell Technologies from $154.00 to $128.00 and set an "overweight" rating on the stock in a report on Thursday, February 13th. Three analysts have rated the stock with a hold rating and sixteen have assigned a buy rating to the stock. According to MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and a consensus target price of $134.65.

View Our Latest Research Report on Dell Technologies

Insider Buying and Selling

In other news, CAO Brunilda Rios sold 926 shares of Dell Technologies stock in a transaction on Friday, March 28th. The stock was sold at an average price of $93.29, for a total value of $86,386.54. Following the completion of the sale, the chief accounting officer now directly owns 37,948 shares of the company's stock, valued at approximately $3,540,168.92. This trade represents a 2.38 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. 46.70% of the stock is owned by corporate insiders.

About Dell Technologies

(

Free Report)

Dell Technologies Inc designs, develops, manufactures, markets, sells, and supports various comprehensive and integrated solutions, products, and services in the Americas, Europe, the Middle East, Asia, and internationally. The company operates through two segments, Infrastructure Solutions Group (ISG) and Client Solutions Group (CSG).

See Also

Before you consider Dell Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Dell Technologies wasn't on the list.

While Dell Technologies currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.