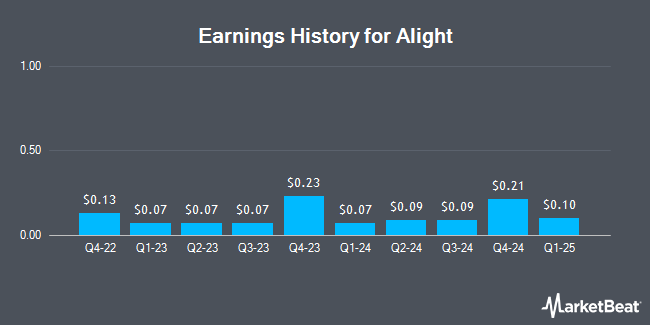

Alight (NYSE:ALIT - Get Free Report) announced its earnings results on Tuesday. The company reported $0.10 EPS for the quarter, meeting analysts' consensus estimates of $0.10, Zacks reports. Alight had a positive return on equity of 6.26% and a negative net margin of 50.37%. The company had revenue of $528.00 million during the quarter, compared to the consensus estimate of $525.26 million. During the same quarter in the prior year, the company earned $0.05 earnings per share. The firm's revenue for the quarter was down 1.9% on a year-over-year basis. Alight updated its FY 2025 guidance to 0.580-0.640 EPS.

Alight Trading Down 4.3%

Alight stock traded down $0.17 during midday trading on Friday, reaching $3.82. The stock had a trading volume of 16,804,401 shares, compared to its average volume of 7,559,512. The company has a quick ratio of 1.18, a current ratio of 1.16 and a debt-to-equity ratio of 0.64. The firm has a market cap of $2.06 billion, a price-to-earnings ratio of -1.73 and a beta of 1.00. Alight has a 52-week low of $3.80 and a 52-week high of $8.93. The company has a fifty day moving average of $5.42 and a 200 day moving average of $5.75.

Alight Announces Dividend

The company also recently declared a quarterly dividend, which will be paid on Monday, September 15th. Investors of record on Tuesday, September 2nd will be issued a dividend of $0.04 per share. This represents a $0.16 annualized dividend and a yield of 4.2%. The ex-dividend date is Tuesday, September 2nd. Alight's dividend payout ratio is presently -7.24%.

Insider Activity

In related news, Director David D. Guilmette purchased 50,000 shares of the business's stock in a transaction dated Tuesday, May 20th. The shares were purchased at an average cost of $5.69 per share, for a total transaction of $284,500.00. Following the completion of the acquisition, the director owned 600,750 shares in the company, valued at approximately $3,418,267.50. This trade represents a 9.08% increase in their position. The purchase was disclosed in a legal filing with the SEC, which is available at the SEC website. Insiders purchased a total of 55,216 shares of company stock worth $307,636 in the last ninety days. 1.93% of the stock is owned by insiders.

Institutional Inflows and Outflows

Hedge funds and other institutional investors have recently bought and sold shares of the company. Strs Ohio purchased a new stake in Alight during the first quarter worth $25,000. Royal Bank of Canada increased its position in shares of Alight by 3.6% in the 1st quarter. Royal Bank of Canada now owns 159,901 shares of the company's stock valued at $948,000 after acquiring an additional 5,525 shares during the period. Cetera Investment Advisers increased its position in shares of Alight by 17.5% in the 2nd quarter. Cetera Investment Advisers now owns 67,094 shares of the company's stock valued at $380,000 after acquiring an additional 9,983 shares during the period. Jones Financial Companies Lllp increased its position in shares of Alight by 1,776.2% in the 1st quarter. Jones Financial Companies Lllp now owns 11,257 shares of the company's stock valued at $67,000 after acquiring an additional 10,657 shares during the period. Finally, MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. increased its position in shares of Alight by 4.6% in the 1st quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 249,753 shares of the company's stock valued at $1,481,000 after acquiring an additional 10,893 shares during the period. Institutional investors own 96.74% of the company's stock.

Wall Street Analysts Forecast Growth

ALIT has been the topic of several recent analyst reports. Wedbush dropped their price objective on Alight from $9.00 to $7.00 and set an "outperform" rating on the stock in a research report on Wednesday. UBS Group decreased their price objective on Alight from $10.00 to $6.50 and set a "buy" rating on the stock in a research note on Wednesday. Finally, Needham & Company LLC decreased their price objective on Alight from $8.00 to $6.00 and set a "buy" rating on the stock in a research note on Wednesday. One investment analyst has rated the stock with a hold rating and seven have issued a buy rating to the stock. According to data from MarketBeat, the company presently has an average rating of "Moderate Buy" and an average price target of $8.94.

Get Our Latest Stock Analysis on Alight

Alight Company Profile

(

Get Free Report)

Alight, Inc provides cloud-based integrated digital human capital and business solutions worldwide. The company operates through two segments, Employer Solutions and Professional Services. The Employer Solutions segment offers employee wellbeing, integrated benefits administration, healthcare navigation, financial wellbeing, leave of absence management, retiree healthcare and payroll; and operates AI-led capabilities software.

Featured Articles

Before you consider Alight, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Alight wasn't on the list.

While Alight currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.